Charles Edwards, head of Capriole Investments digital assets management fund and blockchain researcher, published a detailed forecast of the correlation between energy value usage of the Bitcoin (BTC) network and the crypto king price dynamics.

Which price is fair?

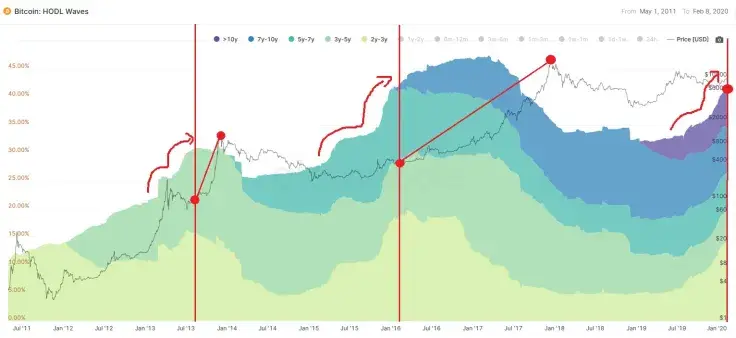

Mr. Edwards' forecast is based on the assertion that Bitcoin (BTC) Energy Value has tracked the Bitcoin (BTC) price for the last ten years. His calculations are based on two main inputs, hash-rate and mining hardware efficiency.

Thus, he expects that Bitcoin's (BTC) hash-rate growth will slow and fall to ~20% p.a. in 2025 similar to a mining hardware efficiency improvement (ca 16% in 2025). Mr. Edwards is sure, that

combining these estimates for HR and Efficiency, Bitcoin’s Energy Value should reach $100K by 2025.

Additionally, the author of the forecast also tries to account for other factors the Bitcoin (BTC) price is affected by. Obviously, he calculates supply fall and demand growth.

Critical Risks

Mr. Edwards remembers the role of 'black swans' in Bitcoin Energy Value estimations. The 'step-change improvement in Energy Efficiency in 2013/14' took place when ASIC-chips dropped Bitcoin (BTC) energy value as a textbook example of such a 'swan'.

The two groups of risks are crucial for the Bitcoin (BTC) price. The first one is quantum computing which can break the SHA-256 algorithm to access the lost coins. The second group is about governmental restrictions that can curtail Bitcoin (BTC) mass adoption.

Nevertheless, the analyst predicts the Bitcoin (BTC) price to be catapulted towards the $100,000 level in 5 years:

Bitcoin was the best performing asset of the last 10yrs. There are plenty of reasons to think the next 5 will be no different

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov