Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

"Just when I thought I was out, they pulled me back in." This iconic line from such a cinematic masterpiece as "The Godfather" seems to perfectly describe what is happening on the price chart of Bitcoin (BTC) right now.

When the sell-off that market participants witnessed earlier this week ended with the liquidation of $1.5 billion in perpetual futures, many hoped that the worst was over.

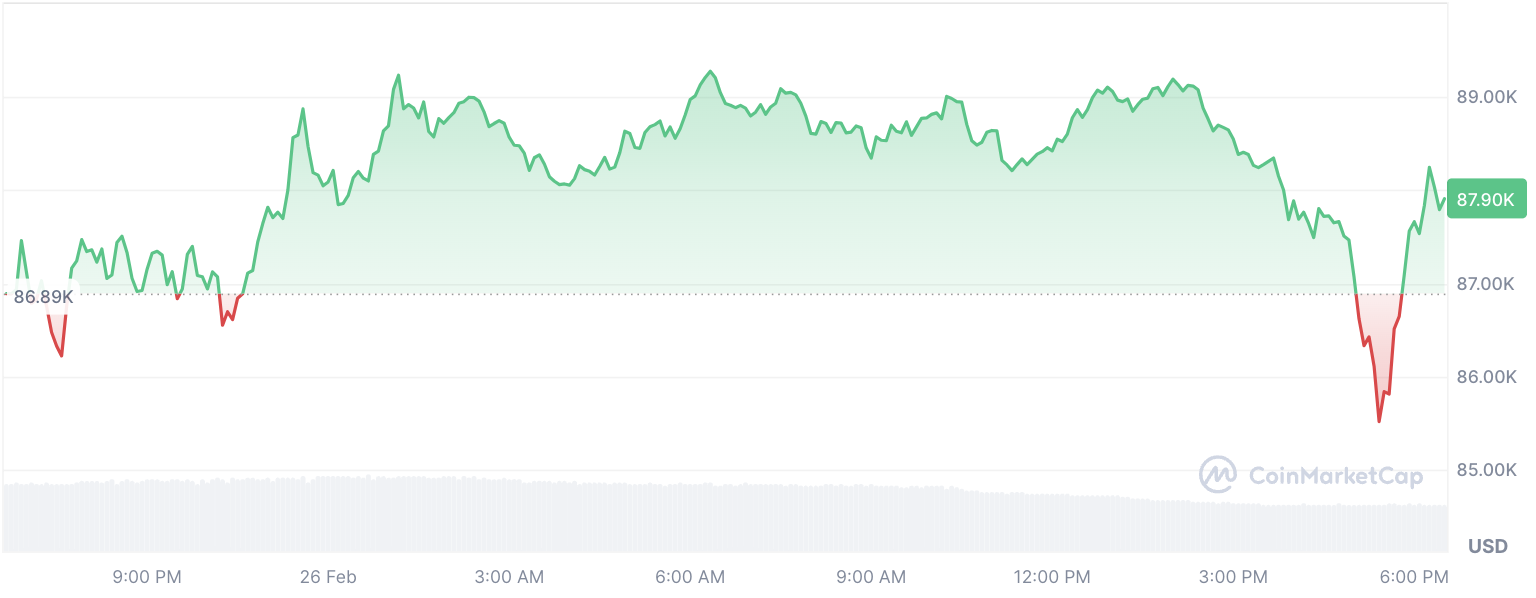

However, today's trading session shows that this may not be the case. As the U.S. stock market opened in the green, up 0.52%, the price of Bitcoin suddenly plunged 1.48% to as low as $85,400.

To put it in perspective, this is the lowest the leading cryptocurrency has traded in three months, since November. This means that all the gains, especially the pump that took Bitcoin to a new all-time high of $109,588, have been "successfully" erased.

Worst February

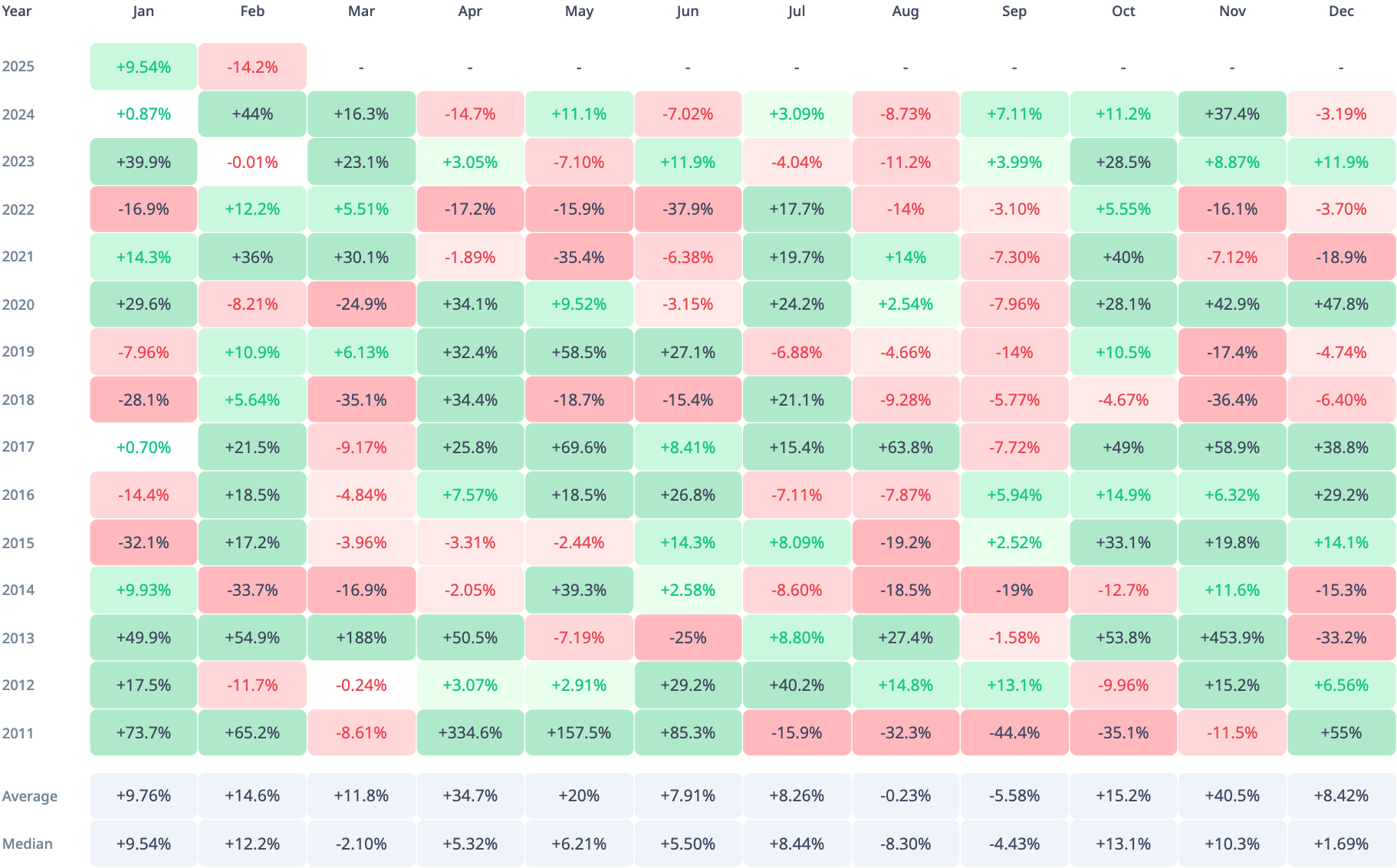

Adding to the sentiment is that this February is actually the worst for BTC in almost 11 years. According to data from CryptoRank, the last time the situation with the major cryptocurrency was this ugly in February was in 2014, when Bitcoin recorded a 33.7% correction. After that, there have not been such bad second months of the year, until the current year.

With March next on the menu, the average return for the first month of spring is 11.8%, according to price history. The median, however, differs significantly and is -2.10%.

Drawing a conclusion from all of these numbers might mean that historical trends do not predict the future of the cryptocurrency market. But using them as one of the benchmarks might not be a bad idea, and they can also provide some interesting insights.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov