Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

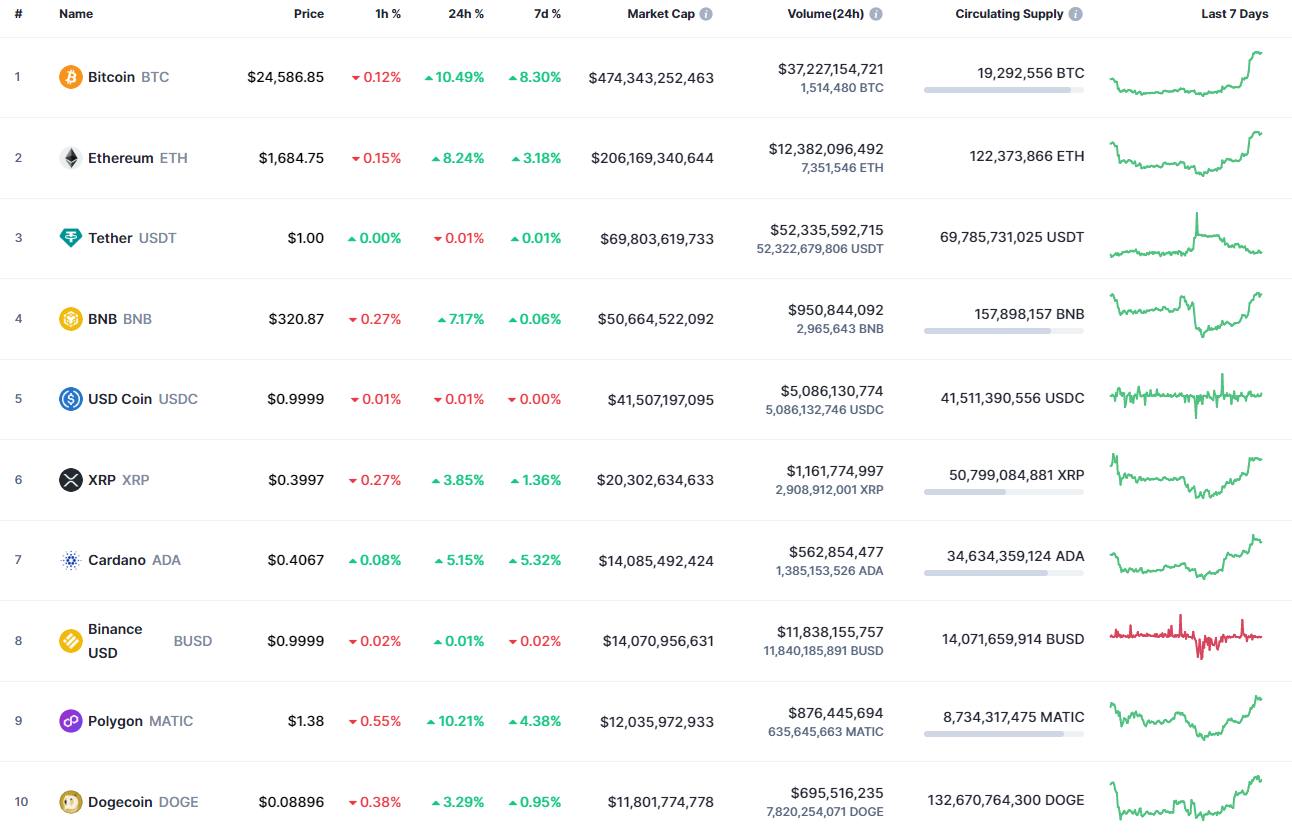

Bulls continue their dominance, according to the CoinMarketCap ranking.

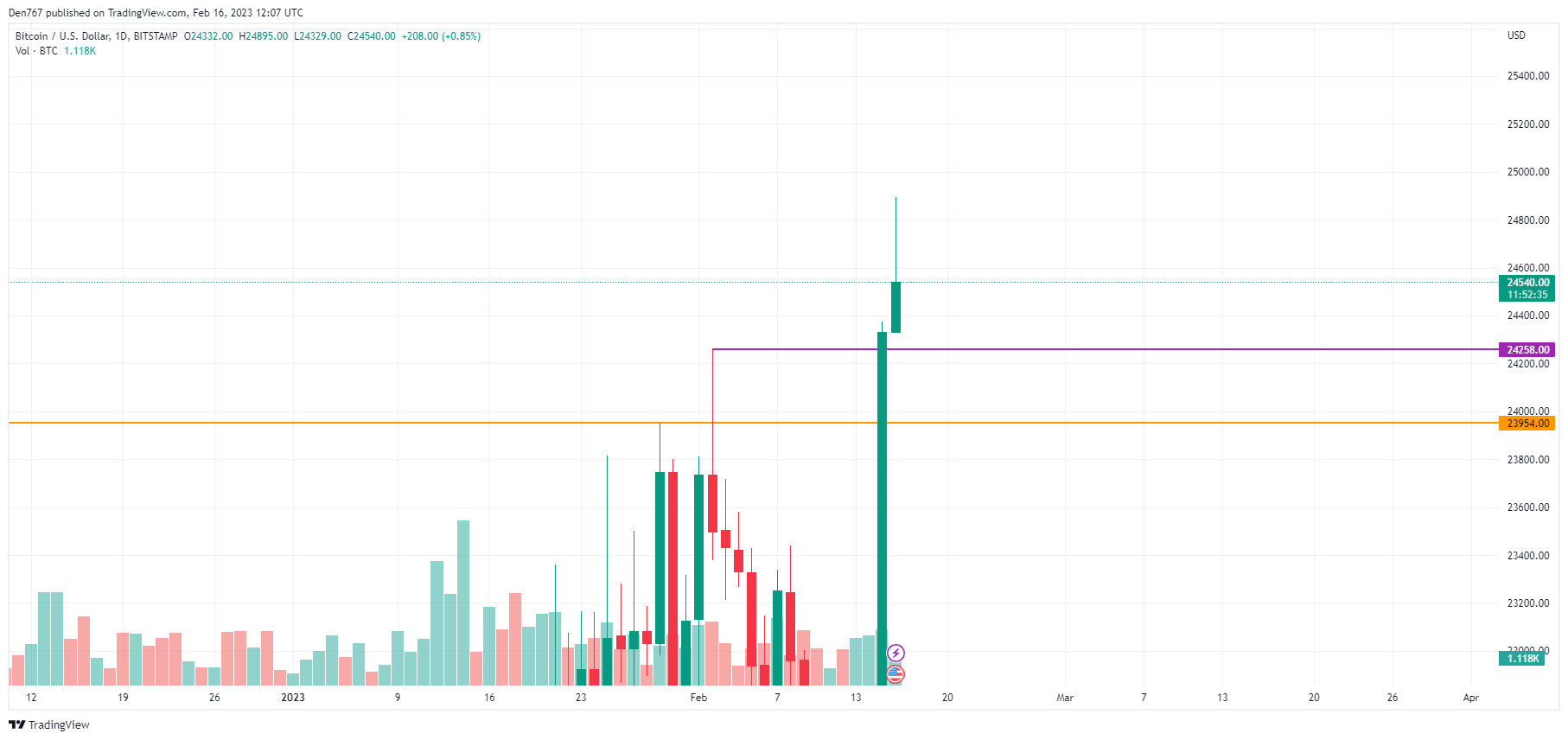

BTC/USD

Bitcoin (BTC) is the biggest gainer among the top 10 coins, rocketing by more than 10% over the last 24 hours.

Despite the sharp growth, Bitcoin (BTC) is looking locally bearish on the hourly chart as the price has returned to the support level of $24,571. If the rate fixes below it, the drop may continue to the next zone around $24,400. Such a scenario is relevant until the end of the day.

On the daily time frame, the situation is rather more bearish than bullish as the price could not fix above the important zone of around $25,000.

If the rate returns to the support at $24,258, it might be a prerequisite for a further drop to the $23,954 level.

From the midterm point of view, Bitcoin (BTC) is looking bullish; however, one needs to wait for the candle closure. If it happens above the $23,954 level, there are chances to see a further rise. In this case, the growth can continue to the nearest resistance level of $26,845.

Bitcoin is trading at $24,535 at press time.

Arman Shirinyan

Arman Shirinyan Yuri Molchan

Yuri Molchan Alex Dovbnya

Alex Dovbnya