On February 26, the Bitcoin price plummeted below the $9,000 mark. The market seems to have taken the turn of events optimistically with many seeing it as another chance to buy the dip.

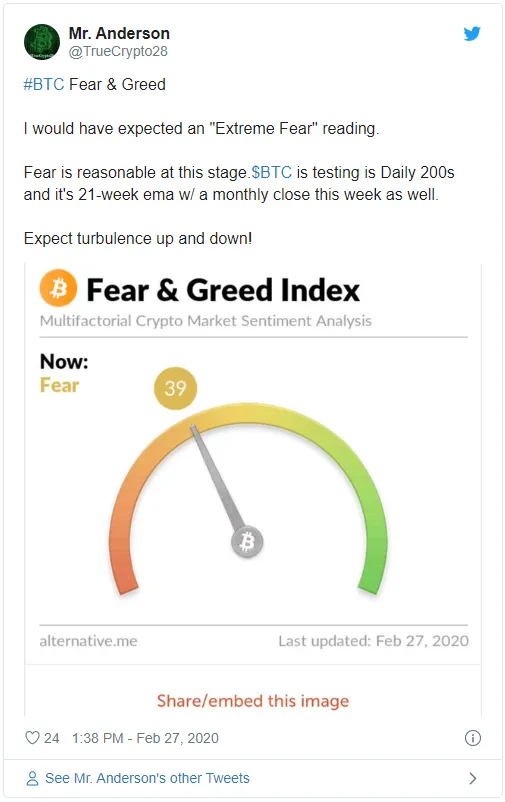

If you look at the BTC Fear & Greed index, as suggested by trader Mr. Anderson with 50,800 followers, it reads 39, which means ‘Fear’. Therefore, the trader says the community should fasten their seat belts.

‘Expect turbulence up and down!’

Crypto trader ‘Mr. Anderson’ suggests the community take a look at the Fear & Greed Index, pointing out that currently the market is going through a fear stage – the index reads 39.

As the creators of the index explain – extreme fear could mean a buying opportunity since investors are very worried at this point. When it comes to extreme greed – it sometimes means an upcoming Bitcoin price correction.

Currently, it is not ‘extreme fear’ but 'reasonable fear'. So ‘Mr. Anderson’ warns that the price may start showing high volatility. The trader admits, though, that he would have expected it to be ‘extreme fear’.

The data from the Index website shows that fear was stronger earlier – between December 2019 and January 2020, when the Index pointed to 21.

‘Buying BTC below $10k is a golden opportunity.’

Bitcoin enthusiast and crypto trader Carl Eric Martin has tweeted that now is a perfect time to accumulate Bitcoin, while the price is below $10,000. Calling this a golden opportunity, he believes that buying BTC below $20,000 and even below $100,000 is still a good decision – since, he emphasizes, we are so early in this market.

Accumulating #Bitcoin below $10,000 is a golden opportunity.

— The Moon (@TheMoonCarl) February 27, 2020

Actually, accumulating below $20,000 is also an opportunity.

In fact, we are so early that even accumulating below $100,000 is an opportunity.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov