The world's largest crypto exchange, Binance, has released its freshly printed proof-of-reserves report, which shows the ratio between customers' net balances and the exchange's. One of the highlights is the performance of XRP reserves on Binance, as they have suddenly seen a notable increase.

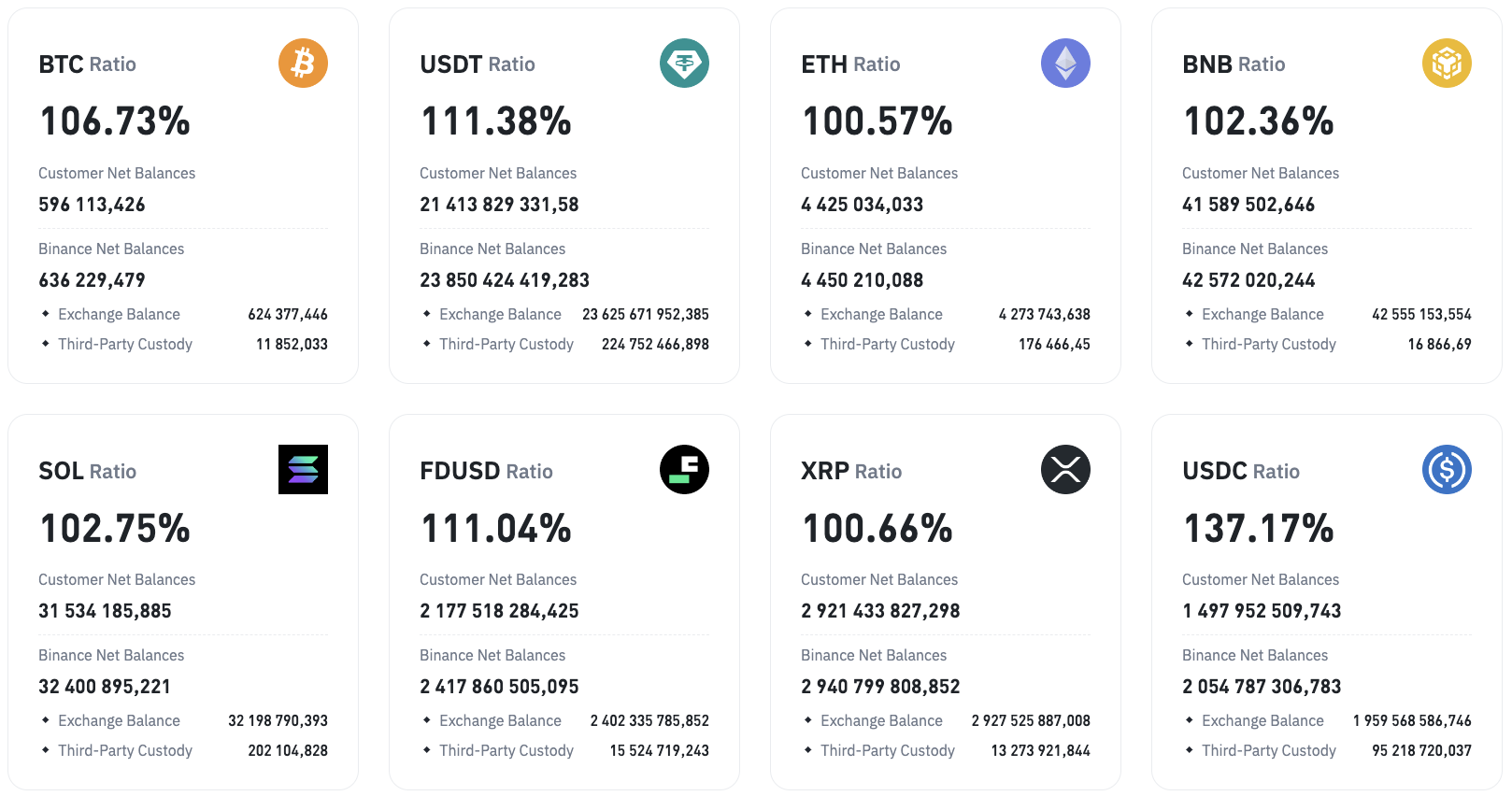

Thus, in one month, the cumulative net balance of Binance customers in XRP has increased by 6%, or 165,386,790.313 XRP, and reached a total of 2.92 million XRP. Binance, on its behalf, increased its net balance to match the increasing balance of its customers, and it can be said that over 330 million XRP, which is equivalent to about $175 million in current prices, were added to net balances. The coverage ratio for XRP on Binance is now 100.66%. In terms of net balances, XRP is currently the seventh largest asset.

Without using complex words, such an increase shows that Binance customers have been buying more XRP over the past month, which itself eloquently describes the sentiment of traders and investors as bullish.

This is also proven by the development of stablecoin reserves on Binance. Over the course of September, the most popular and widely traded "digital buck," USDT, saw a decline from $22.11 million to $21.41 million. The other two less popular options, FDUSD and USDC, also saw a decrease, worth 2.15% and 1.32%, respectively.

The past few months have been all about stablecoin inflows, as crypto market participants, and Binance users in particular, moved to the sidelines for "crypto cash." Now the paradigm has changed, but whether it is a full-fledged trend remains to be seen.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin