Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

MidasDAO, a new-gen passive income ecosystem based on high-performance smart contracts platform Avalanche (AVAX), inches closer to an important rebranding and upgrades its yield model.

Introducing Midas.Finance, a treasury growth protocol on Avalanche

Initially launched as MidasDAO, Midas.Finance protocol scheduled a rebranding to stress its evolution into a full-stack decentralized finance (DeFi) passive income protocol.

Midas.Finance is a yield protocol with an integrated interest-bearing NFT module. Thus, unique non-fungible tokens are the core elements of its tokenomic design.

What is special about its business model, and what opportunities are unlocked by Midas.Finance for retail investors?

- Novel interest-bearing model: interest is accrued on NFTs, not by staking native tokens;

- Different tiers of participation are suitable for investors with various strategies;

- Low barriers to participation; Midas.Finance’s ecosystem is an inclusive and newbie-friendly one;

- Multi-level yield generation scheme: net APY depends on both the amount of crypto invested and its period of lock-up;

- Powerful and resource-efficient blockchain: Avalanche (AVAX) is not exposed to Ethereum-style fee upsurges.

Generating yield in Web3: What are passive income protocols?

In crypto, passive income protocols are used to obtain periodic rewards to provide liquidity to protocols for a predetermined period of time. Unlike "yield farming" on liquidity pools, investing in passive income protocols does not require advanced blockchain or crypto skills.

In order to raise profits (to distribute them between investors), passive income protocols leverage different strategies of liquidity utilization. They can reinvest deposits in prospective assets or use them in automated high-frequency trading. From 2018-2019, passive income protocols started to provide crypto to DeFi protocols from their treasuries.

Passive income protocols are newbie-friendly instruments designed to put idle cryptocurrency bags to use. In some situations, they can even be useful to hedge against the volatility of cryptocurrency markets. However, it is not so easy to find legit passive income protocols in crypto.

Some of them are used to cover Ponzi schemes in which old users are rewarded by the deposits of new ones. Typically, these protocols offer super-high yields and operate for 2-3 months maximum. They have no communities and their social media channels are flooded with bots.

Also, some passive income protocols are blatant exit scams: teams raise funds from gullible investors and run away with their earnings. Since DeFi Summer (2020), such protocols are launched as "DeFi yield schemes," "yield farming interfaces" and so on. For 20-30 days of activity, the teams of such protocols can raise $1-2 million, as estimated by experts.

As such, there are some red flags that can indicate a possible scam that promotes itself as a passive income protocol:

- Too high APY rates.

- Short proven history of operations.

- No KYC.

- Minimal presence on social media channels and crypto news outlets.

Midas.Finance (formerly MidasDAO): Protocol design, tiers, rewards scheme

The Midas.Finance team combines the best practices of all major passive income protocols of the global DeFi ecosystem. Also, it pioneers the concept of interest-bearing NFTs on Avalanche (AVAX) blockchain.

Midas.Finance: The protocol

At its core, Midas.Finance protocol works on easy-to-understand schemes of profit generation. Users can buy CROWN tokens to access THRONE, an in-protocol asset for NFT minting. Once THRONE tokens are claimed, users can freely mint non-fungible tokens to utilize them as interest-bearing items.

All THRONE tokens used to generate NFTs are destroyed: this reduces the supply and shields THRONE from inflation.

Immediately upon mining, NFTs become available for secondary sales, i.e., its owners can trade them among each other. Ten percent of royalties are excluded from the circulating THRONE supply for potential buybacks, token burn events and investment programs.

Currently, THRONE NFTs are available on Tofu marketplace for digital collectibles.

THRONE tokens ("NFT node tokens") provide Midas.Finance participants with access to a variety of DeFi protocols across many blockchains. Investments in THRONE liquidity are managed by the Midas.Finance team and its advisory board.

THRONE investors, therefore, are exposed to investing in the presale and "early bird" rounds of projects by reputable DeFi teams. For instance, it has already injected THRONE investors’ money into new-gen DeFi protocols Reimagined Finance and Dream Chain.

Midas.Finance: Which tier is better?

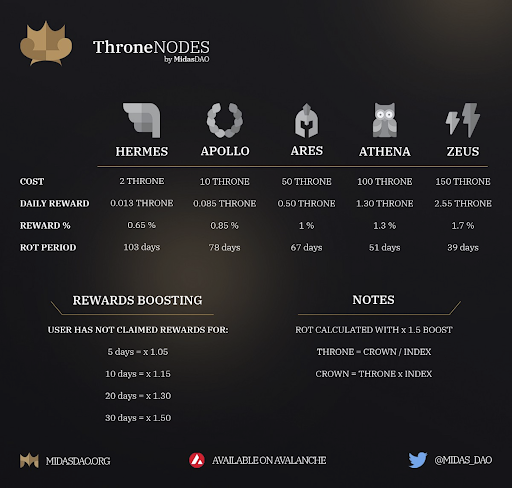

As we have already mentioned, Midas.Finance offers various levels of participation, i.e., the "tiers" of its client. The amount of controlled THRONE assets is the only criterion for being eligible for this or that tier.

Higher tiers boast a faster rate of return than lower tiers, but they also require its participants to obtain more THRONE tokens for their CROWN coins.

As of Q1, 2022, the protocol has five tiers opened for DeFi enthusiasts, namely Hermes, Apollo, Ares, Athena and Zeus.

|

Name of tier |

THRONE stake |

Reward per day (THRONE) |

Reward per day (APY) |

|

Zeus |

150 |

2.55 |

1.7 |

|

Athena |

100 |

1.30 |

1.3 |

|

Ares |

50 |

0.50 |

1 |

|

Apollo |

10 |

0.085 |

0.85 |

|

Hermes |

2 |

0.013 |

0.65 |

The tier status of every account can be upgraded in accordance with the following rules:

- 5 Hermes = 1 Apollo

- 5 Apollo = 1 Ares

- 2 Ares = 1 Athena

- 1 Ares + 1 Athena = 1 Zeus

Midas.Finance: Rewards

The Midas.Finance ecosystem created an additional layer of utility for loyal supporters. In order to boost their revenue, users can reinvest their yield by not only claiming it for a certain period.

A "Liquidity Boost" program is available for those customers who have not claimed their THRONE rewards for five days or more.

|

Days of lock-up |

Boost |

|

5 |

x1.05 |

|

10 |

x1.15 |

|

20 |

x1.30 |

|

30 |

x1.50 |

This rewards program is designed to strengthen the sustainability of Midas.Finance, advance its flexibility and prevent liquidity volume spikes.

Its five-tier system makes Midas.Finance a predictable and secure passive income ecosystem.

Ecosystem and community progress

The Midas.Finance protocol has created a strong, vibrant and passionate community around its instruments. The protocol was endorsed by a clutch of high-profile cryptocurrency influencers active on Twitter and other social media platforms.

Although the core members of the Midas.Finance team have not made their contributions public, its chief financial officer (CFO) passed all necessary KYC checks through cutting-edge providers of digital identities.

For 2022, Midas.Finance prepared a number of upgrades. In particular, it will launch its own decentralized finance mechanism, DeFi X. The launch of DeFi X will make the process of investing more seamless and profitable.

Also, the Midas.Finance team will expand on other mainstream smart contracts platforms such as Ethereum (ETH) and Fantom (FTM). Thus, it will establish itself as the first-ever multi-blockchain passive income protocol on EVM-compatible chains.

Bottom line

Midas.Finance is a unique multi-product ecosystem for passive income on Avalanche (AVAX) blockchain. It allows investors to generate yield on non-fungible tokens minted with THRONE, a native in-app asset. THRONE, in turn, can be purchased with CROWN cryptocurrency.

Its participants can join one of five tiers of Midas.Finance investors proportionally to their contribution and THRONE stakes. Also, rewards can be boosted by lock-ups of THRONE after five days.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin