Recently, a heated discussion unfolded between Charles Hoskinson, co-founder of Ethereum and creator of Cardano, and Adam Back, a prominent Bitcoin advocate, on the X social media platform.

The core of their debate centered around the classification of cryptocurrencies as either commodities or securities.

Back schooling Hoskinson

During a live stream, Hoskinson challenged the cryptocurrency community to tell the difference between major players like Bitcoin and Cardano. "Explain to me the f****ng difference between Ethereum, Bitcoin, and Cardano, and the rest of the gang. Explain it to me. Like I'm five years old. Right now. Run the goddamn Howey test on it. Show me the difference between the two. Tell me," he ranted.

He pointed out the presence of an "expectation of return" in Bitcoin and questioned its decentralization.

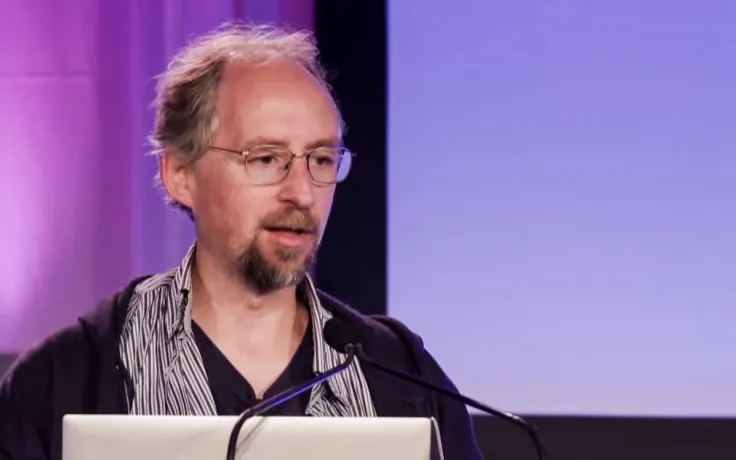

Back, known for his significant contributions to Bitcoin, argued that the flagship coin's origins as a mined currency with no initial coin offering (ICO) set it apart from Ethereum and Cardano.

He classified Bitcoin as a commodity, in line with gold and diamonds. At the same time, he views Ethereum and Cardano as unregistered securities.

Hoskinson's counterargument

In a counter-response, Hoskinson defended Cardano by stating that there was no ICO for Cardano.

However, some members of the Bitcoin community have accused Hoskinson of misrepresenting the facts, citing Cardano's ICO price of $0.0024 per token and the ability for investors to purchase ADA with Bitcoin.

The Cardano ICO was conducted through a voucher sale of a different asset, priced in Yen and settled in Bitcoin.

This approach, tailored specifically for Japanese citizens and excluding U.S. participants, raises questions about the classification of Cardano under U.S. securities law. Hoskinson insists that the voucher sale in Japan did not constitute an ICO.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov