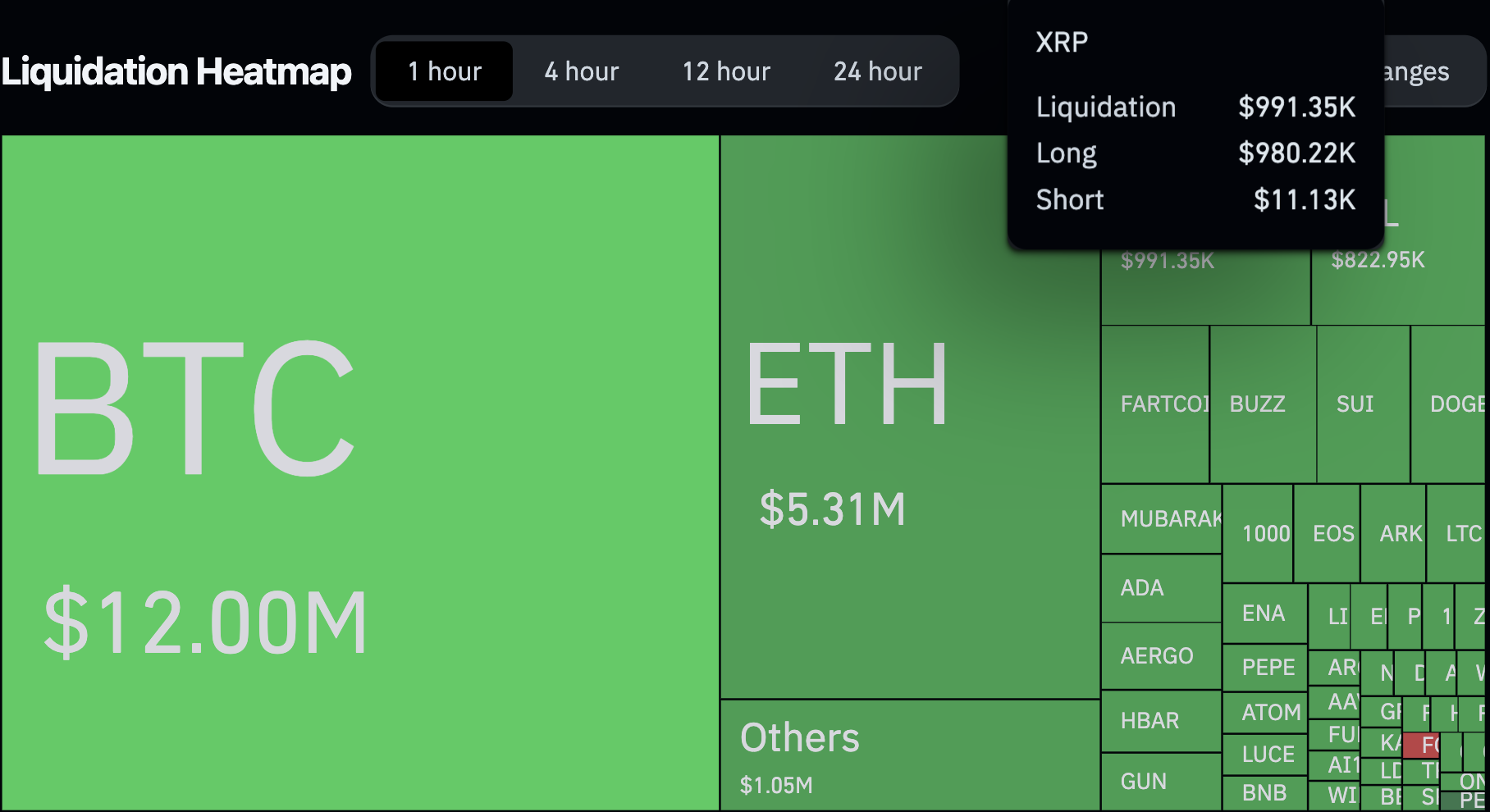

In just one hour, XRP futures had a liquidation imbalance that would stand out even in more volatile conditions: an 8,909% difference between liquidated long positions and shorts.

It was not that the asset collapsed in price; XRP's price fell around 2.7%, which is a noticeable move, but not the sort of drop that would usually be associated with nearly a million dollars in liquidated longs.

Even so, $980,220 were wiped from bullish hands, compared to just $11,130 from shorts.

And this imbalance was not just a one-time thing. In fact, total liquidations across the crypto futures market over the past 24 hours reached $240.15 million, with long positions making up more than half — $126.34 million, according to CoinGlass.

The biggest single liquidation was from Bitcoin, at $4.76 million, but XRP's concentration of losses in such a short time pushed it into the top three assets by liquidation volume today.

It is not just the size of the losses but also how off they are from what traders are doing and what is actually happening on the market. The bulls on XRP were clearly betting heavily on upside scenarios, perhaps reading stability or rebound potential in earlier price levels that did not hold.

It is not clear if this kind of washout is just a short-term correction or if it signals a bigger shift in sentiment. But when a single hour sees this kind of liquidation imbalance, it tends to reflect less about XRP itself and more about sentiment and leverage on the market.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov