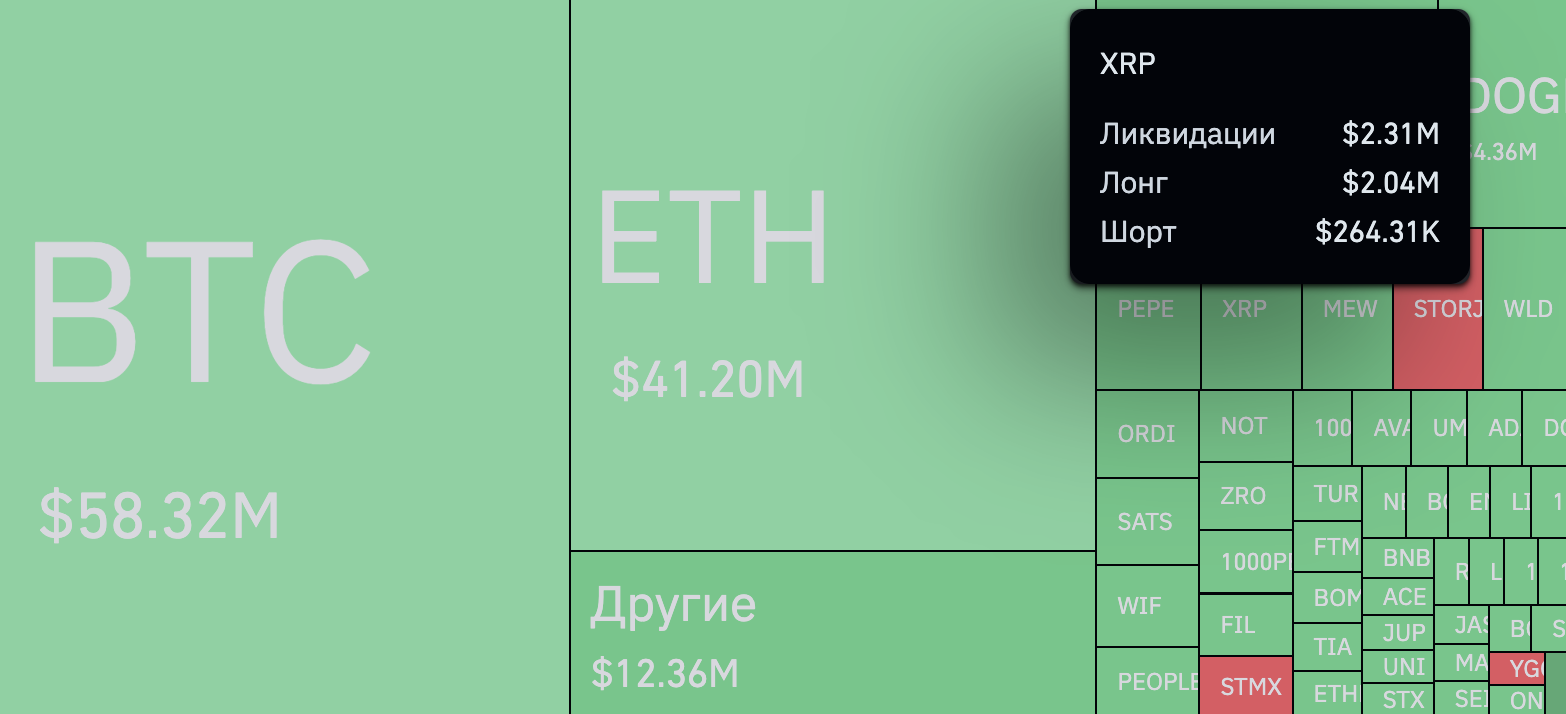

There's been a big shift in the market recently as XRP has seen a lot of bullish liquidations, while bearish activity has been much lower. The latest data from CoinGlass shows that $2.04 million was liquidated from long positions over the past 24 hours, compared to just $264,310 from short positions.

This is a huge 757% imbalance between the two, which shows a big change in how the market is working right now.

This is happening at the same time as XRP is going through what you might call a "crab market," which is when there's no clear trend and the price just goes sideways. Meanwhile, there's been a 44% jump in XRP derivative trading volumes, which suggests the market is more active and there is more speculation going on.

Those trading bearishly have been quick to make a profit during the price decline, while bullish investors are facing substantial losses due to the downturn. The unusual pattern of liquidations makes us wonder if this could be the start of a period of stability and reduced activity for XRP.

There are a few reasons why we are seeing so many bullish liquidations. Some positions have been squeezed out because they were over-leveraged or the risk was mismanaged. Apart from this, there has been a "sell the news" effect following recent announcements at the Bitcoin 2024 conference.

It will be interesting to see how these developments affect XRP's market trajectory in the near term, and whether this liquidation imbalance will lead to a stabilization in prices or if further fluctuations are on the horizon.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov