Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

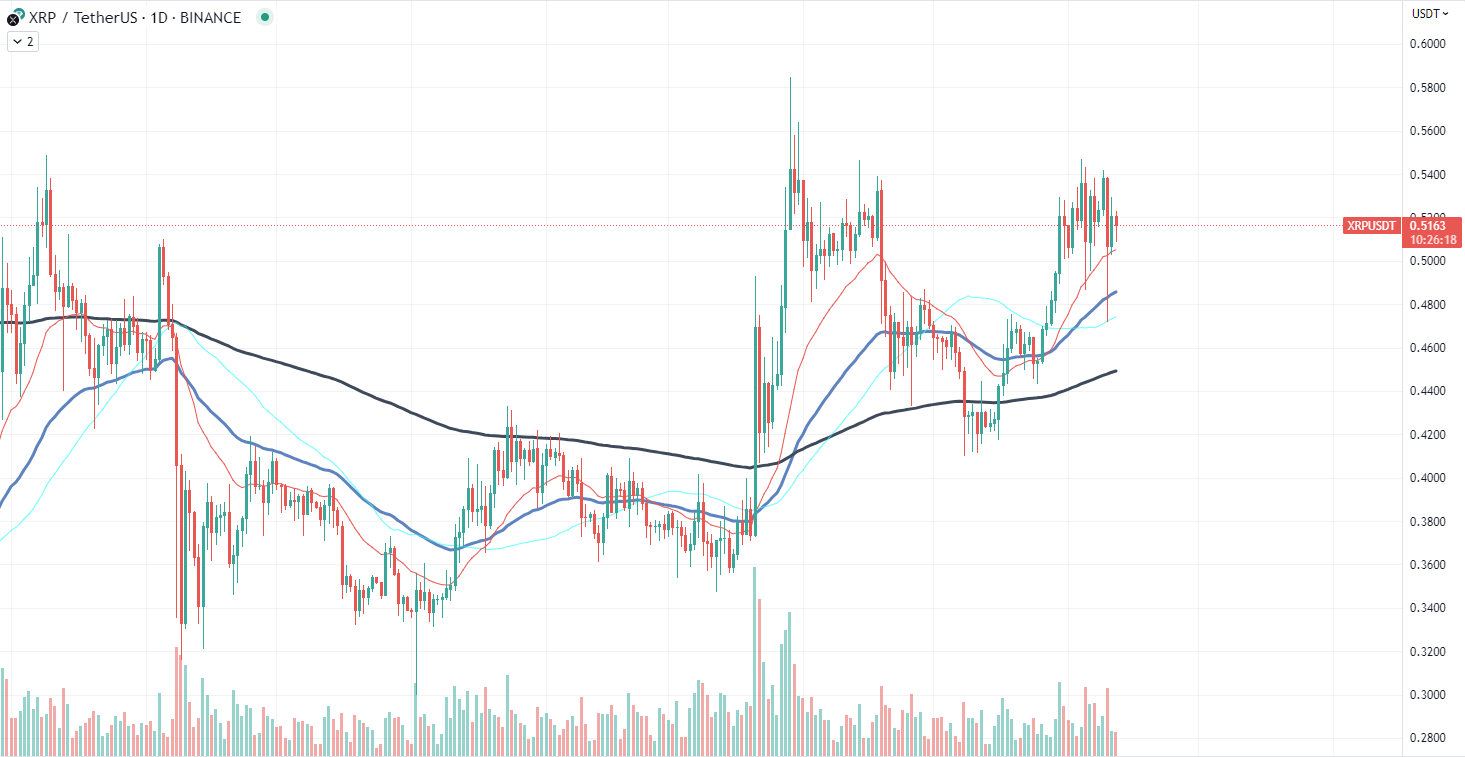

Amid a major market downturn, Ripple's XRP cryptocurrency has exhibited commendable resilience, sidestepping the major sell-off that has ensnared numerous other leading digital assets. Remarkably, XRP only experienced a 5.7% price decline in the recent market upheaval, a mere blip when juxtaposed with the precipitous 30% to 40% drops experienced by coins such as Cardano (ADA) and Binance Coin (BNB).

This downturn, triggered by a multitude of factors, including the ongoing legal tussle between the SEC and key crypto players like Binance and Coinbase, has swept across the crypto markets. The turmoil prompted most cryptocurrencies to surrender significant portions of their value. However, amid this scenario, XRP's firm standing has become an outlier.

Ripple's native currency has managed to maintain its foothold in the $0.5 price corridor, a testament to its strength given the wider market conditions. This resilience is not only remarkable but also suggestive of the growing faith in XRP's long-term value proposition and the robustness of its underlying technology.

The defiance shown by XRP points to an underlying belief in Ripple's commitment to revolutionizing cross-border payments, in spite of the ongoing legal battles. It appears that investors are keeping their faith in XRP's potential to revolutionize the traditional financial infrastructure, a sentiment that has been bolstered by Ripple's ongoing developments and partnerships.

ADA awakening

Cardano (ADA) has finally seen a small but significant uptick, gaining around 2% of its value for the first time since the storm of SEC lawsuits against Binance and Coinbase began. This positive movement raises the question: could this be the start of a recovery for ADA?

For context, Cardano was caught in a turbulent market after being named a security in legal documents related to the lawsuits, sparking a massive sell-off. The shockwaves were felt significantly among institutional investors who rapidly withdrew their stakes, leading ADA to lose around 30% of its value. Surprisingly, this drop occurred despite Cardano initially appearing to maintain stability when the news first broke into the space.

Analyzing the current situation, it appears that this bounce might signal a tentative shift in investor sentiment. While a 2% increase might not seem like much, in the volatile world of cryptocurrencies, it could potentially indicate a positive trend. The recent upward movement could be a sign of returning investor confidence, a crucial factor for ADA's price action.

Several external factors can still affect ADA's recovery, including the ongoing SEC lawsuits and market sentiment toward cryptocurrencies in general. In this regard, the real litmus test will be how Cardano fares in the coming weeks.

Ethereum finds support

After weeks of price correction, Ethereum (ETH) has landed on the 200-day Exponential Moving Average (EMA), which may suggest some critical opportunities for traders and investors alike. As we examine the current ETH landscape, three potential targets appear to emerge: price levels $1,900, $2,145 and the 50 EMA line.

A drop toward the 200 EMA often signals a critical juncture. When the 50 EMA hovers above the asset's price level, it typically indicates a bearish trend. This scenario often suggests that the asset may be oversold and that a price rebound could be imminent.

The first key target, set at $1,900, corresponds to the local top of ETH reached in May. This price level served as significant resistance in the past and may do so again. If ETH manages to breach this threshold, it would be a strong indication of a potential shift in the trend.

Next, the 50 EMA line represents another significant hurdle. Traders often view the 50 EMA as a dynamic resistance level during bear markets. Ethereum would need to push through this line to fully enter a bullish phase again.

Lastly, the cycle high of $2,145 appears as a crucial target. This level has been acting as the top recently, and breaking above it could potentially signal the start of a new bullish cycle for Ethereum.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin