Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

A huge XRP long just got slammed with a $4.12 million liquidation, which is one of the biggest forced exits in the market over the past hour — and yet, somehow, the position was not fully wiped, according to Hyperliquid data. It seems that whoever is behind this size is not just leveraged up; they are refusing to leave the table.

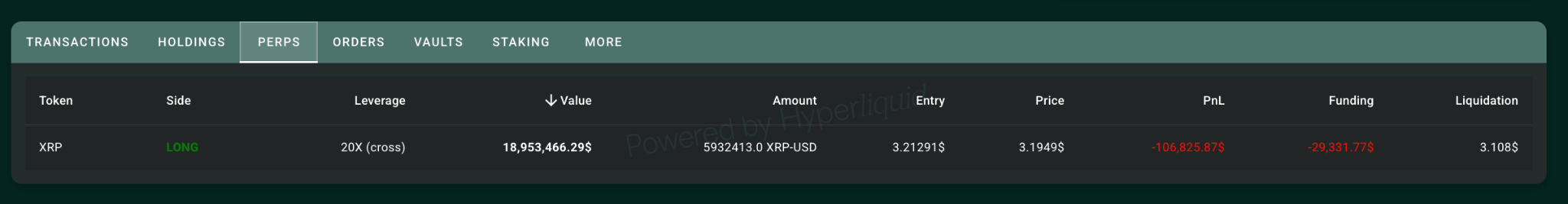

The wallet in question is still holding 593 million XRP on a 20x cross, with a total position value just under $19 million. The entry is at $3.21291, but the price briefly dropped below $3.18, which triggered partial liquidation.

Even so, the position is still open, and it is now pretty close to the $3.108 liquidation price.

While most users would have either pulled out or given up, the transaction history tells a different story. In just a few minutes, the same wallet went up and down a few times — first at $3.1931, then $3.4046, then again at $3.19 — and took on over 1.4 million XRP worth of exposure even as the chart went down.

XRP rockets 13,817% in abnormal liquidation imbalance

In the last hour, there has been over $45.8 million in long liquidations across the board, with XRP accounting for more than $4 million of that — almost all of it from longs. Shorts barely registered, with just $29,660 closed out.

So, what's the plan here? It is tricky to say what the whale is thinking; is it a calculated risk, fading retail panic or just hoping for a bounce? But walking into a loss of over $100,000, plus $29,000 in fees, and then doubling down minutes later, is the kind of move that leaves little room for hesitation — or even for error.

The position is still exposed, the liquidation level is slowly getting closer and the price action is not giving any guarantees. It is not over yet, but the trade is running out of time.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov