GSR recently released its ETF Possibility Score, which evaluates the potential for ETFs on various cryptocurrencies based on decentralization and demand metrics. The research involves calculating decentralization and demand scores by converting various category metrics into z-scores, combining them and averaging each category's z-score.

Decentralization, a complex and nuanced concept, considers issues such as permissionless participation, development control, token distribution and hardware diversity.

Key decentralization metrics include the Nakamoto Coefficient, which measures the smallest number of entities that can collude to attack a network, and staking requirements, which assesses the ease of participation as a node operator or validator.

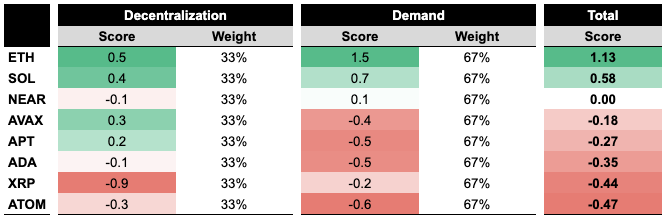

According to GSR's analysis, XRP and Cardano have decentralization scores of -0.9 and -0.1, ranking last and fifth, respectively. It should be noted that Nakaflow does not provide a rate for Cardano and XRP, so GSR used estimates based on other sources.

Demand potential is another key factor, taking into account metrics such as market cap, trading volume and community activity levels. Higher scores in these metrics generally indicate stronger future demand. XRP and Cardano have demand scores of -0.2 and -0.5, placing them fourth and sixth, respectively.

Combining these scores, GSR's ETF Possibility Score weights decentralization at 33% and demand at 67%. Ethereum emerged as the leader, with Solana and NEAR also performing well. In contrast, XRP and Cardano's lower scores suggest a lower likelihood of ETFs for these assets in the near future.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov