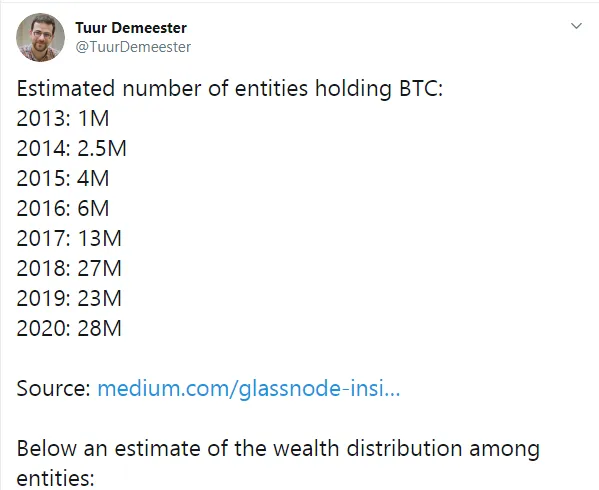

Yesterday, the Glassnode analytical think-tank well-known for its cutting-edge blockchain research strategies, published a new report, How many entities hold Bitcoin. Crypto investor and trading veteran Tuur Demeester payed his tribute to the analysts' conclusions.

Entities, not addresses

A report published by Glassnode utilizes a game-changing methodology in attempting to determe the real number of Bitcoin (BTC) holders. Typically, the on-chain reports tell us about 'wallets' and 'addresses' while the existence of single entities owning multiple Bitcoin (BTC) addresses remains behind the scenes.

Glassnode researchers reconsidered this approach by merging 'industry–standard heuristics, proprietary clustering algorithms and advanced data science methods' to figure out the upper limit for entities holding Bitcoin (BTC).

As a result, they have traced the evolution of the number of Bitcoin (BTC) holders since the very early days of its mass adoption. These figures are fascinating:

Thus, we can see that it took only seven years for the number of Bitcoin (BTC) holders to grow by 28 times.

Is Bitcoin (BTC) decentralized?

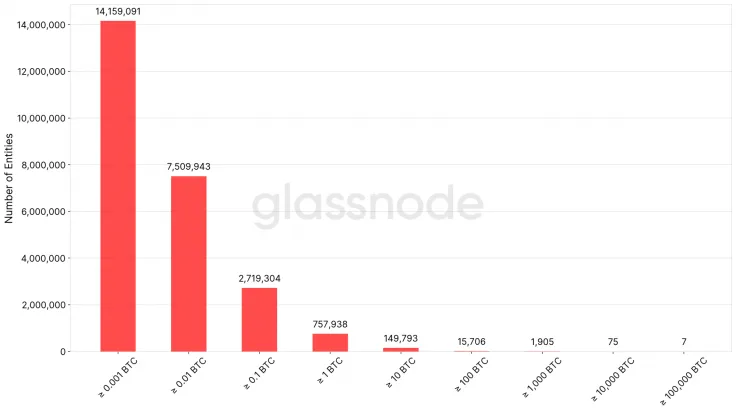

Another interesting part of the research unveils the allocation of Bitcoin (BTC) funds to users' entities. According to the provided data, one in two entities holding Bitcoin (BTC) operates less than 0,001 BTC. On the other hand, almost 2000 Bitcoin (BTC) owners are soon-to-be multimillionaires at printing time.

The seven mysterious 'whales of all whales' mentioned in the far right column are exchanges, namely Coinbase (983,800 BTC), Huobi (369,100 BTC), Binance (240,700 BTC), Bitfinex (214,600 BTC), Bitstamp (165,400 BTC), Kraken (132,100 BTC), and Bittrex (118,100 BTC).

Combined, they hold 2,35M Bitcoins (BTC) or 13% of its circulating supply.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov