Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Toncoin, the native cryptocurrency of The Open Network (TON) blockchain, has seen a surge in exchange netflows, catching the attention of the market and prompting discussions about the implications for TON.

According to IntoTheBlock, Toncoin has seen a 357% increase in exchange netflows. The intriguing part is that this negative netflow has positive implications for Toncoin.

The netflow indicator highlights the trend of traders sending money in and out of exchanges. Negative netflows indicate a greater volume is being withdrawn from exchanges. This could be seen as a sign of accumulation or addresses buying back following major drops. That said, the 357% increase in exchange netflows can be seen as a bullish signal for Toncoin.

TON has steadily declined since reaching highs of $7.20 on Dec. 4. This drop led to lows of $4.67, where buyers quickly bought the dip. At the time of writing, TON was down 2.06% in the last 24 hours, mirroring the declines on the crypto market as investors await the Federal Reserve's first interest rate decision of 2025. TON remains down 8.81% weekly amid mixed price activity since the past week.

Meanwhile, netflows are positive when more funds are entering than leaving exchanges.

Indicator points to retail activity

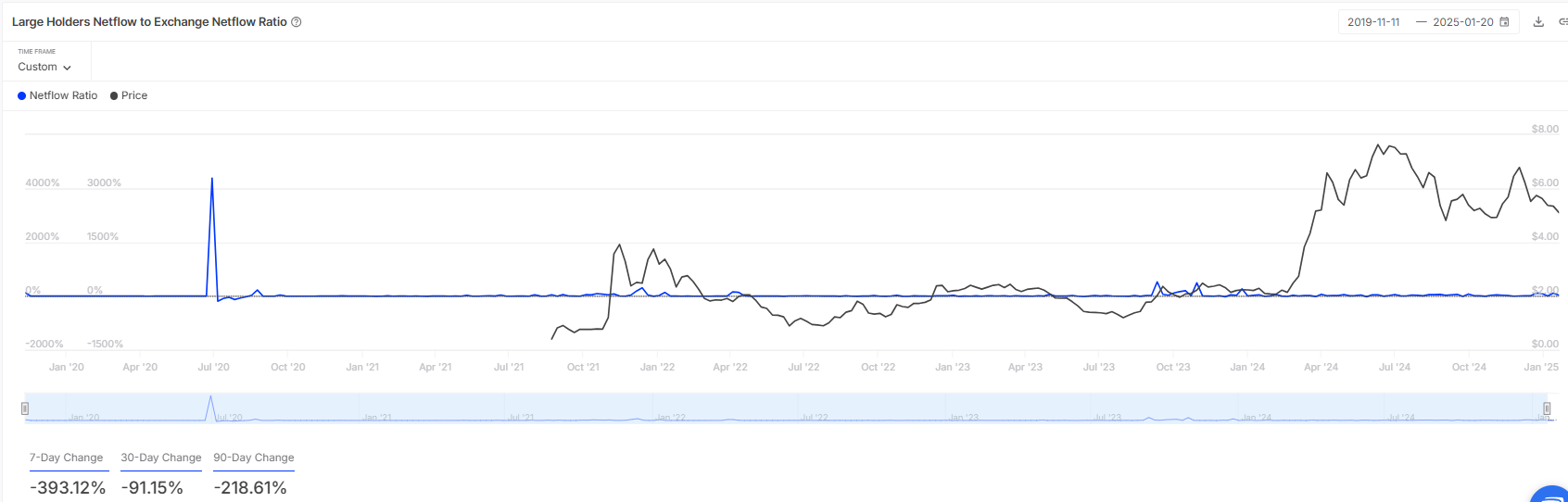

A key indicator from IntoTheBlock, large holders' netflow to exchange netflows, suggests the predominance of retail activity.

The large holders' netflow to exchange net flows indicator computes the ratio of large holders' netflows (inflows minus outflows) to those of centralized exchanges. It provides insights into retail and large-holder activities, indicating potential market patterns such as cashing out or asset accumulation.

This indicator compares the behaviors of large holders referred to as whales and retail traders. A high ratio could imply that whales are more active than retail traders, indicating a trend toward accumulation. In contrast, a low ratio may indicate more activity by retail investors.

For Toncoin, this key metric has surged 393% in the last seven days, suggesting increased activity by retail traders.

Arman Shirinyan

Arman Shirinyan Dan Burgin

Dan Burgin Alex Dovbnya

Alex Dovbnya