Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Billionaires, funds, and celebrities are starting to buy Bitcoin as the dominant cryptocurrency becomes more appealing as a portfolio asset.

Speaking to Bloomberg, financial advisors and billionaire investors said Bitcoin is becoming a part of a “larger conversation.”

Supply is Declining But Bitcoinis Becoming More Popular

The demand for Bitcoin is noticeably increasing among institutional investors. Apart from various metrics, such as the CME BTC futures open interest and the inflow into the Grayscale Bitcoin Trust, show a spike in institutional interest.

What has made Bitcoin so attractive for institutional investors and high-net-worth investors during this rally is its effectiveness as a portfolio asset.

Bitcoin is able to protect a portfolio from rising inflation, similar to traditional safe-haven assets like gold. But, because BTC is still technically a store of value in a nascent phase of growth, the potential for an exponential increase in value exists.

In an interview with Bloomberg, Beckett Collective founder Theresa Morrison said that Bitcoin could work practically as an inflation hedge. Morrison noted that a 1% allocation of a portfolio could be ideal for investors.

Similarly, Elemental Wealth’s Dan Herron said that Bitcoin is becoming more compelling for younger investors. He said a 5% allocation into Bitcoincould work in a low-interest rate environment. Herron explained:

“You might consider it if you have the ability to maybe put 5% of your portfolio in there and just let it rise and see what happens."

Why BTC Works as a Portfolio Asset

Bitcoin is efficient as a portfolio asset for high-net-worth investors because of its unique safe-haven characteristics.

The dominant cryptocurrency has a fixed supply, so naturally it protects investors from massive central bank liquidity injections globally.

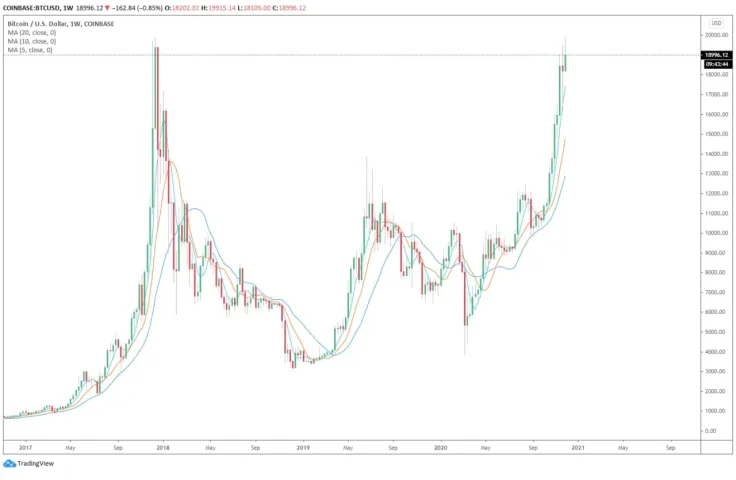

But, compared to gold and other stores of value, the market capitalization of Bitcoin still remains relatively small. At the price of $19,000, the valuation of Bitcoin stands at around $352 billion. In comparison, gold’s market capitalization hovers above $9 trillion, which leaves a large valuation gap.

As the supply of Bitcoin continues to decrease due to block reward halvings, the growing demand would continue to propel the price of BTC.

Atop the positive fundamentals surrounding Bitcoin, the narrative that institutional investors are increasingly purchasing Bitcoin is intensifying. This has considerably caused the confidence around BTC and the cryptocurrency market, as a whole, to significantly improve.

In the near term, it remains to be seen whether the go-to institutional Bitcoin investment vehicles, like Grayscale, would continue to see high volume and inflows.

So far, the demand has far outweighed the new supply of Bitcoin, as investors have purchased more BTC than mined on Grayscale alone in recent weeks.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin