Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

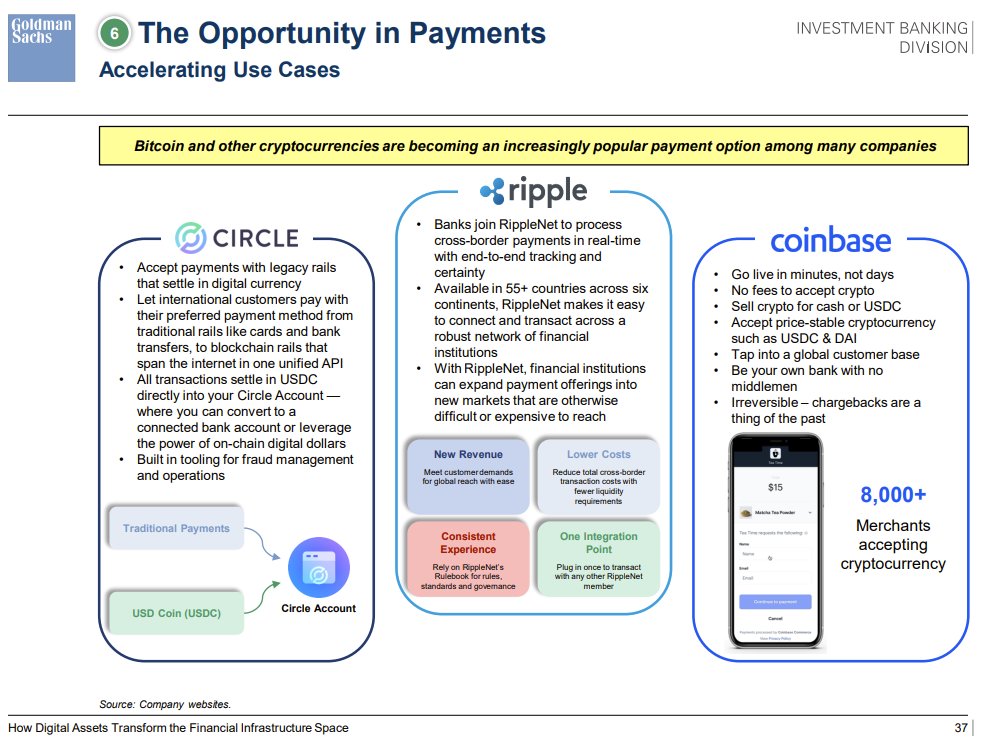

A recent report by Goldman Sachs' Investment Banking Division, "Overview of Digital Assets and Blockchain," identifies Ripple as an "opportunity in payments," alongside Circle, a peer-to-peer payment technology, and Coinbase. The report highlights RippleNet, a network of institutional payment providers like banks and money remittance services that use solutions built by Ripple.

As crypto's presence in the consumer mainstream grows more conspicuous, the financial industry continues its march toward crypto. Previously, Warren Buffett, a well-known crypto critic, invested $1 billion in Nubank, a Brazilian digital bank specializing in cryptocurrency. Binance also announced plans for a new payment processor that will allow customers to use digital assets to make retail purchases.

Advertisements by crypto companies such as Coinbase and FTX can now be spotted all over sports venues and, earlier this year, the industry staged a virtual takeover of the Super Bowl.

As previously reported by U.Today, legendary footballer David Beckham has entered the Metaverse as a blockchain ambassador. One thread runs through it all: growing consumer interest in cryptocurrency.

An increasing shift toward blockchain-based payments

A recent Ripple insight report notes that ''a Cornerstone Advisors survey found that of consumers who already hold crypto, 60% of them would 'definitely' use their bank to invest in cryptocurrencies. Further, a PYMNTS.com report found that 78% of millennials and 82% of Gen Z crypto owners are interested in using it to make contactless purchases.''

Countries in Asia and the Pacific have risen to the top of the world in offering instant payments using digital banking systems. APAC has risen to dominate the digital banking business in recent years, accounting for 20% of the world's approximately 250 digital banks.

Instant payments are digital transactions between participating banks that use an instant messaging/payment layer to enable real-time settlements and great end-user experiences. To make a real-time transfer, several non-crypto instant payment networks need pre-funding beneficiary accounts. Ripple's On-Demand Liquidity (ODL), on the other hand, does away with the necessity for pre-funding.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov