Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Since its launch in 2021, novel DeFi ecosystem Reimagined Finance (REFI) advances the user experience of “yield farming” and makes it more profitable, even for “degens” with basic skills in crypto.

Reimagined Finance (REFI) explodes onto the DeFi segment: What is FaaS?

Reimagined Finance is an on-chain protocol that farms yield on its treasury across various smart contracts platforms. Profits are redistributed between “farmers” in Ethers, which is a core native utility asset of Reimagined Finance.

What is special about Reimagined Finance’s offering for “yield farmers” in 2022?

- One product, many chains: Reimagined Finance offers “farming” on Ethereum, Binance Smart Chain with more EVM-compatible and non-EVM platforms to come;

- Out-of-the-box “yield farming” solution: to start farming, crypto holders need nothing but Reimagined Finance’s user-friendly dashboard;

- Various strategies of risk management: treasury is rebalanced between low-, medium-, and high-risk farming strategies;

- Native token REFI is available on Binance (BNB), a world’s top crypto ecosystem, and on Uniswap (UNI), the largest Ethereum-based decentralized cryptocurrencies exchange;

- Fully on-chain structure: Reimagined Finance’s smart contracts addresses are public and traceable.

For the maximum comfort of its customers, Reimagined Finance (REFI) releases light and dark modes of its interface.

What is DeFi?

Despite being invented in 2017-2018 with the inception of Etherdelta, IDEX and Kyber Network, decentralized finance protocols, commonly referred to as DeFi, went mainstream in 2020. DeFi is a class of software programs designed to perform basic financial operations (deposits, lending/borrowing, assets minting, tokenization of property rights and so on). What is special about DeFi is that all operations of these protocols are carried out fully on-chain with no centralized server or money storage.

DeFi protocols work on smart contracts with no need for middlemen to interact with them. This approach made the creation of sophisticated financial ecosystems possible.

Decentralized crypto exchanges Uniswap (on Ethereum), PancakeSwap (on Binance Smart Chain) and SushiSwap (on all blockchains compatible with Ethereum Virtual Machine), and lending protocols Maker, Compound and Aave Finance, and assets minting platform Synthetix are the most popular ecosystems of the ongoing DeFi euphoria.

What is “yield farming?”

The concept of “yield farming” cannot be compared to anything in the world of traditional finance. As DeFi protocols do not rely on their own money for operations, they need to get them from crypto holders. These donors are called “liquidity providers,” or LPs, as they inject liquidity into DeFi mechanisms.

In order to incentivize this process, DeFi protocols distribute the share of their revenues with liquidity providers in the form of “yield,” i.e., periodic payouts proportional to the amount of crypto “locked” by this or that liquidity provider.

This process is known as “yield farming” as LPs can just “farm” revenue from their idle crypto bags. “Farmers” need to just build a proper strategy of rebalancing liquidity between the most profitable pools maintained by different protocols - and even on different blockchains.

Reimagined Finance (REFI) introduces DeFi 3.0

Reimagined Finance (REFI) is set to address all major bottlenecks of the DeFi segment. It attempts to introduce ready-made solutions for “yield farming” to lower an “entry barrier” for crypto newbies.

Tools

With Reimagined Finance (REFI), users can just lock their assets in favor of the protocol: it will do all the heavy lifting to rebalance it for maximum yield. On Reimagined Finance, crypto holders inject liquidity in a 100% novel way, i.e., by buying REFI tokens.

Once REFI tokens are bought, Ethers are transferred to the protocol’s treasury. Then, the protocol utilizes these funds to farm yield across different chains in a peer-to-peer manner. Payouts can be redistributed between farmers in either Ethers or REFI tokens.

To earn distributions, users should buy 10,000 REFI minimum or roughly $543 on Uniswap or 1 REFI on Binance (BNB).

Strategies

On Reimagined Finance, users no longer have to choose between various risk management strategies. The protocol automatically rebalances the treasury between three “buckets” with various levels of implied risks.

The Low-Risk bucket includes pools with <5% volatility, Medium-Risk pools work with volatility between 5–40%, while High-Risk pools are exposed to volatility over 40%.

Key metrics and statistics

As of early February 2022, the protocol amassed 950 Ethers from more than 3,000 holders. In total, it distributed 1,420 Ethers among liquidity providers; they withdrew 1,138 Ethers out of this sum.

Estimated farm growth APY is close to 1,587%, which is far more impressive than that of major competitors.

The REFI supply is capped at one billion tokens; to prevent it from ending whale-dominated, the team imposed a 2% limit for every single wallet. In all, the operations of REFI holders are charged with a 12% tax required to fuel the progress of the Reimagined Finance protocol.

Team

The team of Reimagined Finance is led by Muhammad Mustadi, an Indonesian blockchain veteran and white-hat hacker, known as Mathrdro.id in the community.

Mr. Huf (@hufhaus9) is a coordinator of liquidity farming strategies for the Reimagined Finance (REFI) treasury. The team also has some high-profile advisors and investors onboard to ensure Reimagined Finance’s recognition in the global Web3 community.

Roadmap

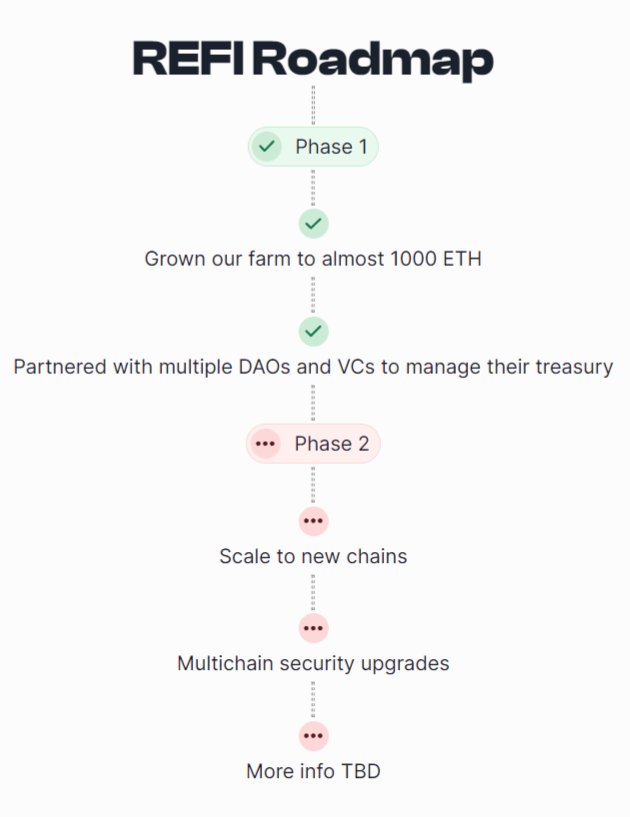

By Q1, 2022, the protocol has released a two-phase roadmap; all missions of the first phase are already completed. Reimagined Finance (REFI) almost managed to grow a farm to 1,000 Ethers and score an array of partnerships with decentralized autonomous organizations (DAOs) and venture capitalists.

During the next phase of its progress, Reimagined Finance (REFI) is going to expand to new blockchains to reaffirm its focus on building multi-chain farming aggregators. Also, its security design across different blockchain platforms will be advanced to ensure 100% security and safety of all funds invested.

Bottom line

Reimagined Finance (REFI) is on a mission to build a one-stop dashboard for newbies and crypto professionals interested in multi-blockchain yield farming. In a couple of clicks, its users can inject liquidity into Reimagined Finance’s treasury; an automated algorithm will rebalance it between three buckets with different levels of risk management.

Reimagined Finance (REFI) has already increased its treasury to almost 1,000 Ethers with more than 1,500% in estimated APY for 3,000 investors. In 2022, the protocol is going to strengthen its position in the multi-chain segment by integrating a number of new chains and giving its security design a significant facelift.

While the diversity of DeFi protocols across multiple blockchains grows day by day, a go-to endpoint of this segment will be of paramount importance for the Web3 segment as a whole.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin