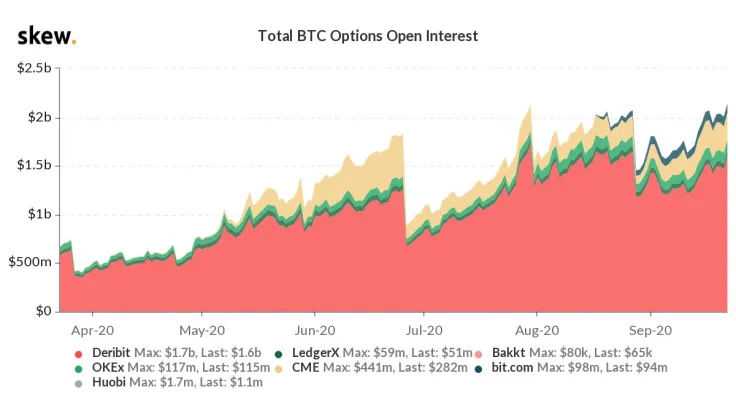

Open interest for Bitcoin options has reached a fresh all-time high of more than $2.2 bln on Sept. 23, according to derivatives analytics platform Skew.

The market is heating up ahead of the "blockbuster" $1 bln expiry on Friday that is widely expected to bring more volatility.

Mark this day on your calendar

Bitcoin options allow traders to make bullish and bearish bets on the trend without actually holding the underlying asset.

They are not obliged to execute their call or put contracts into maturity, but they have to fork out the premium that tends to constantly fluctuate.

On Sept. 25, more than 88,300 options contracts are slated to expire, which is the lion's share of all calendar options that are set to mature this year.

Notably, there is an eerily high concentration of short-term options, and there is no clear reason behind this phenomenon.

The Panama-based derivatives exchange remains the undisputed leader of the options market, with 77 percent of all contracts expected to expire on its platform alone.

Deribit is responsible for $1.6 bln of the record-shattering open interest figure. CME Group comes in second place with $282 mln.

Bitcoin's volatility tapers off

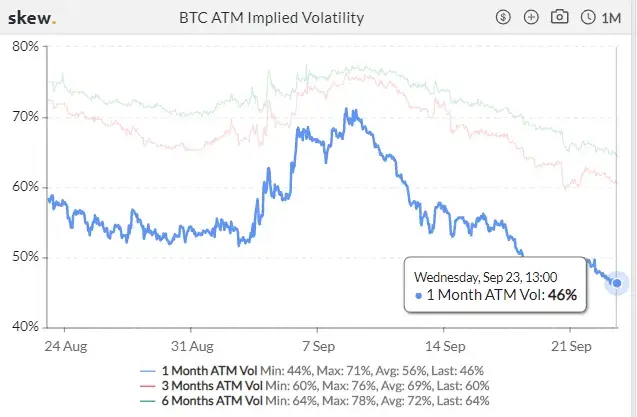

Bitcoin's one-month implied volatility, which reflects the expectations of options traders about future price moves, has nose-dived to 46 percent following a spike to a local high of 71 percent on Sept. 8.

The bellwether cryptocurrency once again touched $12,000 on Sept. 1, but the short-lived rally was followed by a violent crash below $10,000 in the following days.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov