Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

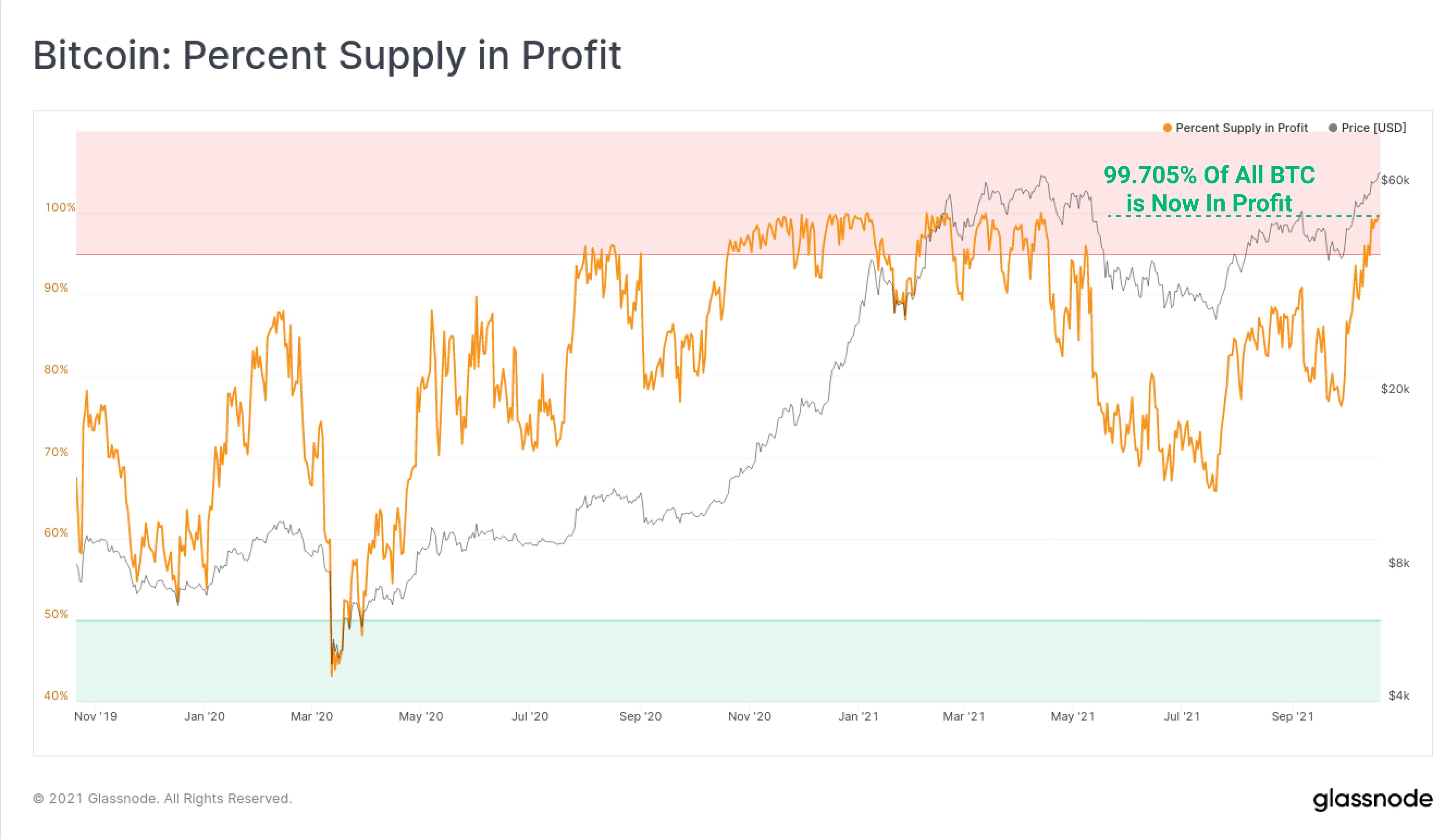

The most recent data from Glassnode suggests that almost 100% of all Bitcoin traders and investors are now in profit. With Bitcoin coming closer to the previous all-time high, there are now almost no entities that have taken a high price.

According to the data provided data, 99.75% of the Bitcoin supply is now in profit. The same value was previously reached back in April-May when Bitcoin reached $64,899, which remains the ATH.

As of now, Bitcoin is trading at $63,900, which means that it remains short $1,000 from the previous high. The main fuel for the current growth is the start of Bitcoin futures ETF trading in addition to the global risk-on on the financial markets. The main market indexes, like S&P500 and DAX, are also facing strong rallies with an average 5% growth.

The mentioned on-chain metric can also be used to determine whether the market is overbought or oversold. With the value coming closer to 100%, the market might face the first profit realizations that can start the chain of liquidations and correction.

Previously, with metrics moving in the 95-99% range, the correction on the market appeared shortly after over the course of a week. While the metric can be used as an indicator, it does not utilize any technical analysis and only shows raw data.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov