Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

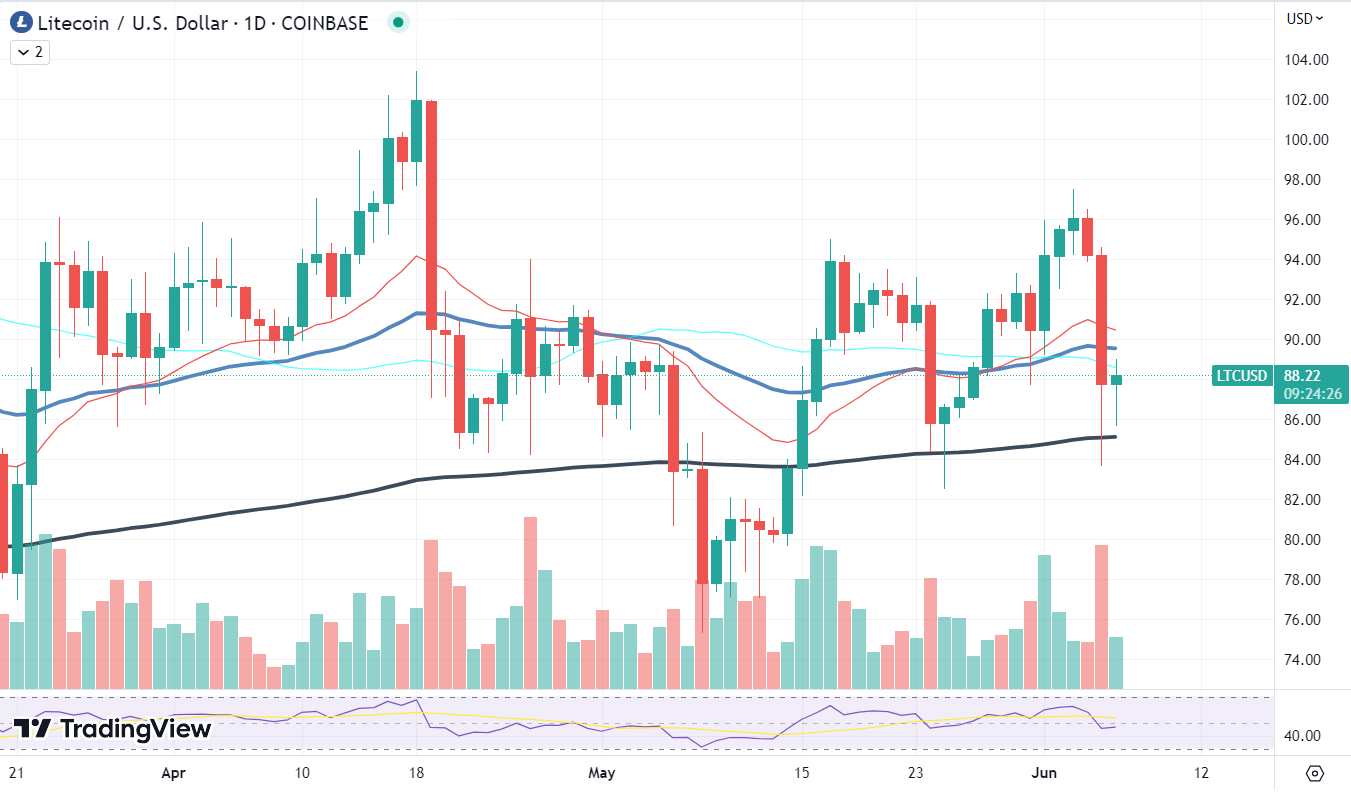

Over the past month, Litecoin (LTC) has been showing a steady upward trajectory; however, recent data suggests that Litecoin miners are massively taking profits, leading to a drop in its price. Despite overall market conditions, Litecoin's growth trajectory has remained noticeable, but these recent developments may shift the dynamics.

Litecoin's Relative Strength Index (RSI), an indicator that tracks the speed and change of price movements, has dropped below 50, suggesting a potential trend reversal. While RSI is just one measure among many, this dip below the midline indicates that bears might be gaining control.

The slow but steady climb of LTC over the last 29 days had traders watching the coin closely. Although the uptrend was neither exponential nor sharp, the consistent increase was a positive signal for many investors. However, with miners taking profits en masse, this trend has been disrupted.

What makes this situation intriguing is the steady volume of Litecoin trading. Despite price fluctuations and profit-taking activities, the trading volume has remained at around 150K. This stability in trading volume could mean that, despite the current downturn, there is still a steady interest in Litecoin among traders.

With the upcoming halving event and the LTC20 assets picking up, the nearly 12-year-old blockchain shows clear growth potential in a challenging market. However, the recent profit-taking by miners and its impact on the coin's price underscore the complex and sometimes unpredictable nature of cryptocurrency markets.

Arbitrum's exceptional revenue

With a stunning $100 million in annualized revenue and a promising outlook, Arbitrum, one of the most popular Layer 2 scaling solutions for Ethereum, presents a robust growth case for its native ARB token. Its profitability is currently estimated at a net 30-40% margin, a number that is set to increase to 90-95% after the implementation of EIP-4844, a proposal aimed at optimizing data costs.

By comparison, Ethereum currently generates $3-5 billion in annualized fees, placing Arbitrum on an impressively competitive track, given the nascent stage of Layer 2 solutions. In fact, Layer 2 chains are on a clear trajectory toward substantial profitability. This is evidenced not only by Arbitrum's performance but also by Optimism's projected annualized fees of approximately $60 million.

A point worth noting, however, is that both chains, Arbitrum and Optimism, currently operate on a single sequencer model. Neither uses their native tokens for gas payments, nor do these tokens have explicit utility, such as protocol fees or burns.

ChainLink continues its mission

Chainlink (LINK) continues to bridge the gap between traditional financial institutions and blockchain technology, standing as a critical connectivity layer for the emerging on-chain finance landscape.

A recent report reveals that Chainlink is currently collaborating with the Society for Worldwide Interbank Financial Telecommunication (SWIFT) and over a dozen leading financial institutions. The aim is to explore and facilitate interoperability and connectivity across public and private blockchains.

SWIFT's exploration into blockchain interoperability seeks to remove friction from tokenized asset settlements. This experimental phase signifies a significant step forward for global financial powerhouses. It underlines their commitment to bridging the world of conventional finance with blockchain technology.

Chainlink's co-founder Sergey Nazarov underscores the importance of this ongoing collaboration. He pointed out that a common connectivity layer across various chains would be a vital building block as banks strive to access multiple blockchains. It will propel their adoption of on-chain finance and potentially revolutionize the way financial transactions are conducted worldwide.

Meanwhile, Chainlink's token (LINK) has experienced a significant price adjustment. The price has seen an almost 30% drop from the recent local high, reaching a cycle low of $6. Despite this downturn, the project's commitment to interlinking the world of traditional finance and blockchain, along with its collaboration with SWIFT and other institutions, highlights the potential for Chainlink's future.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov