In a recent note, JPMorgan analysts claim that Ethereum is seeing “much healthier” institutional demand compared to archrival Bitcoin.

The American megabank points to the fact that Bitcoin futures offered by Chicago-based giant CME Group have returned to backwardation.

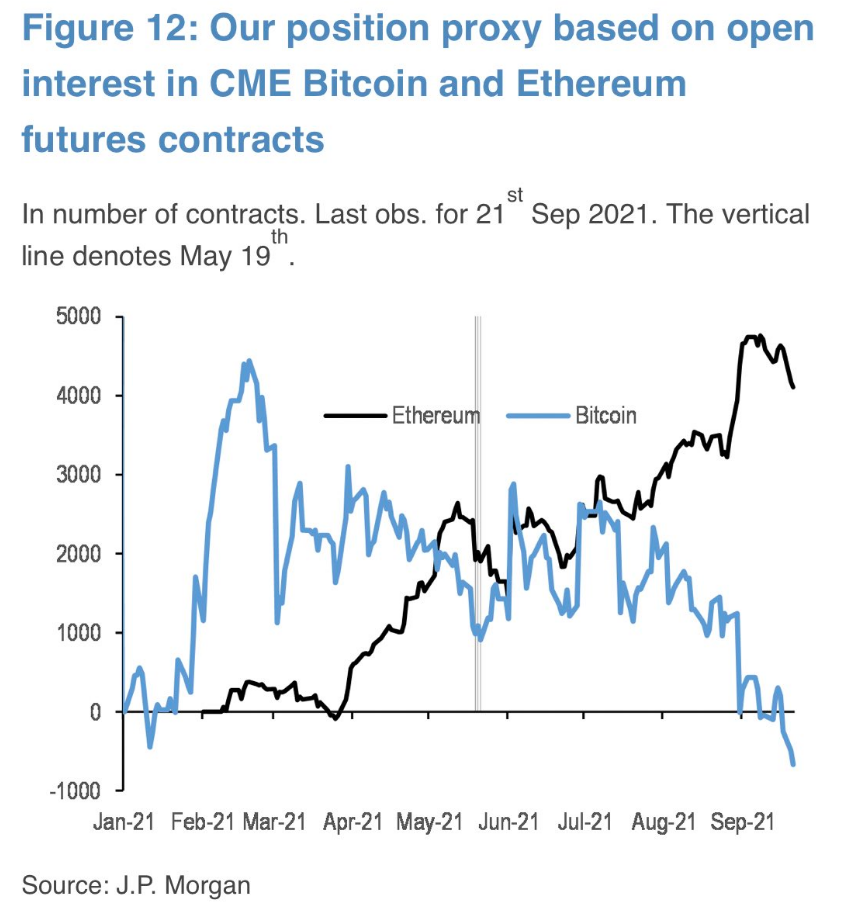

There has been a steady decline in the number of Bitcoin futures contracts traded on CME since August.

On the other hand, Ether has seen a sharp increase in open interest over the same period of time.

Still, JPMorgan’s Nikolaos Panigirtzoglou recently told Business Insider that the second-largest cryptocurrency was grossly overvalued:

We look at the hashrate and the number of unique addresses to try to understand the value for Ethereum. We're struggling to go above $1,500.

Panigirtzoglou believes that the growing competition in the smart contract sector threatens Ethereum’s dominance in spite of its first-mover advantage.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov