Banker and financial expert Peter Schiff, a well-known critic of digital assets, took to social media to highlight that gold is trading near a record high, just shy of $2,760. However, he noted that Bitcoin (BTC) has surpassed $71,000, implying that gold’s performance may be overlooked in light of Bitcoin's resurgence.

In response, Sean Ono Lennon, son of Beatles' icon John Lennon and Yoko Ono, expressed his support for Schiff, though with a bit of irony. While many recognize Ono Lennon primarily as a musician, he is also an enthusiastic participant in the crypto space. He has been involved in various SocialFi innovations, such as friend.tech, and has previously shared positive views about Bitcoin.

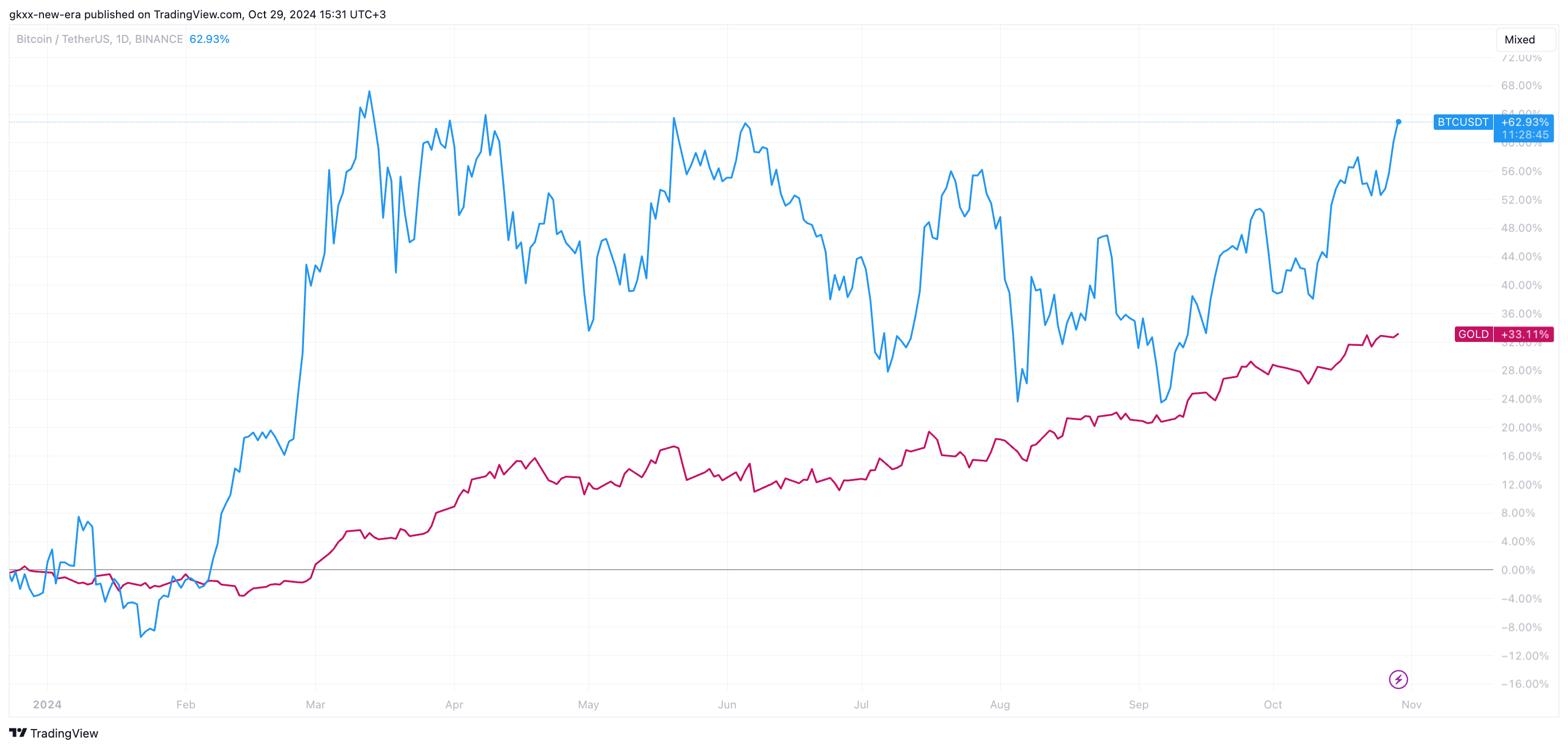

Schiff's commentary comes during a period when both gold and Bitcoin are vying for record prices. Gold is currently at an all-time high, while BTC approaches its previous peak. BlackRock CEO Larry Fink recently commented on this competition, stating that the cryptocurrency essentially “digitizes” gold, reinforcing the notion of Bitcoin as “digital gold” or “gold 2.0."

Bitcoin and gold, or versus?

Even though Schiff is not a fan of cryptocurrencies, particularly Bitcoin, others, including Fink, see similarities between the two assets not only in terms of price movement but also in their fundamental characteristics.

Bitcoin recently broke through the $69,000 mark, surpassing significant resistance levels and generating renewed momentum. This surge marks its highest point since early June, positioning it just 4.2% below its all-time high of $74,000. With a noticeable shift in investor sentiment, current market dynamics suggest that Bitcoin could soon reach new highs.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov