NEO is a Chinese Blockchain platform released in 2014. It was designed as a scalable and stable decentralized network for smart contracts and development. The main feature of NEO is decentralized applications, which can be made on different programming languages, including Javascript, C#?from=article-links, Python, Java, and Go. The core of NEO is written on C#?from=article-links.

An interesting fact about NEO is that the platform still works in China, where almost all cryptocurrencies and exchanges are forbidden. The Chinese government does not approve independent Blockchain technologies. That is why NEO cannot provide anonymous transactions. The team of developers is doing their best to comply with the Chinese jurisdiction, and this makes sense because China is a huge, not available for most competitors market.

NEO and Ethereum: what do they have in common?

As for technology, NEO is very similar to Ethereum. Both networks have smart contracts and decentralized apps as their main features. Ethereum was released in 2013, a year earlier than NEO. That is why many independent experts and journalists call NEO a Chinese clone of Ethereum.

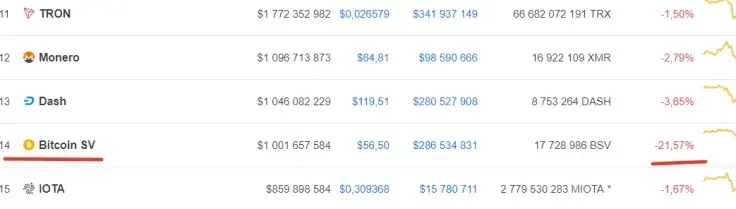

However, it did not stop the NEO’s fast rise. It paid off a hundred times for the first investors. The price grew from less than $1 to $160 in 2017. Unfortunately, now it is only $16 because of a total reduction of the market.

One more thing that Neo and Ethereum have in common is a special accessory coin for implementing transactions. In both platforms, it is called GAS.

What is the purpose of GAS?

A counting power of any network is restricted. It is not rational to provide free transactions in decentralized platforms as it will not bring any revenue. Every transaction must be paid for.

What is a transaction in NEO? Obviously, there are regular transactions which imply just sending money from one user to another. Things are getting more complicated when we are talking about decentralized apps.

DApps are literally bunches of code that any user can request. They are stored in Blockchain, and every time when the user requests it, the data is transmitted as a regular transaction.

The more complicated program the user requests, the more code has to be transmitted. Actually, anyone can design their own application and call it every time they need. Therefore, some issues have appeared.

If transactions were free, users would not think about rationality in their apps. For instance, someone could waste the network power just by writing such a code (it is pseudocode):

If you are not familiar with programming at all, just believe that this code has no end and the program can be stopped only by special platform restrictions.

In order to prevent such situations, every line of code you call should be paid for. It is not a big price, but it is necessary to make users design both powerful and rational code. The currency used for transactions is called NEO. The currency used to pay for transactions is called GAS.

How is GAS produced?

The algorithm for producing GAS is very simple. NEO tokens generate a certain number of the GAS coins depending on how many of them there are in the wallet. It is actually another way of mining. Here your success depends on the number of coins you keep, not on the computing power you have.

To put it simply, the more NEO tokens you keep in your wallet, the more GAS you will get as a reward. The method is based on Proof-of-Stake technology implemented in NEO for verifying transactions.

The amount of GAS is restricted as well as the number of NEO tokens. In 2018, the total GAS supply is about 17 mln coins. The maximum supply is fixed and comprises 100 mln coins. According to NEO documentations, the limit will be reached in the next 22 years.

How to claim free GAS?

Finally, the main part of the article. How can we get free GAS? Actually, as it has been said before, GAS is always free because it is generated automatically. So, the question is where should you keep NEO to get a passive income? Well, there are three most perspective ways below.

Exchanges

Some of the crypto exchanges allow their users to get GAS by keeping NEO. This is obviously the simplest way of earning GAS because it is quite easy to make an account on the exchange, and most importantly, it is free.

Talking about the disadvantages of this option, it should be mentioned that this is the most unsafe way of keeping coins. Exchanges are often being hacked, and even large platforms cannot ensure the 100% safety. The chance to be hacked is not that high to worry about it and rule out exchanges at all, but it is still there. I mention this because other methods in our top are 100% safe.

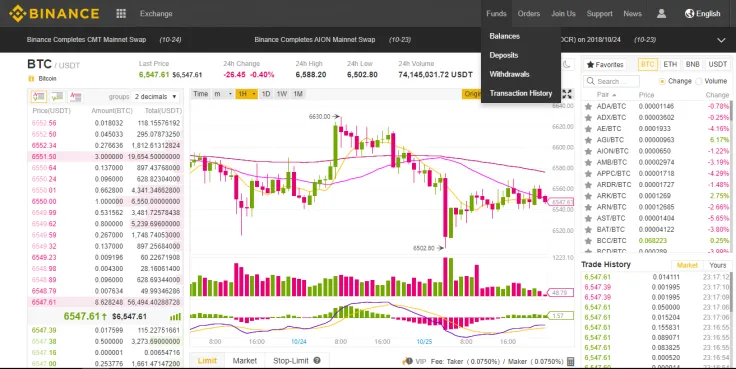

In 2018, you can claim GAS if you keep NEO on Binance or Kucoin. As it has been already mentioned, GAS is produced automatically from NEO tokens. So, what happens if the user decides to choose another exchange for keeping NEO? The answer is simple — other exchanges just keep your GAS rewards by themselves.

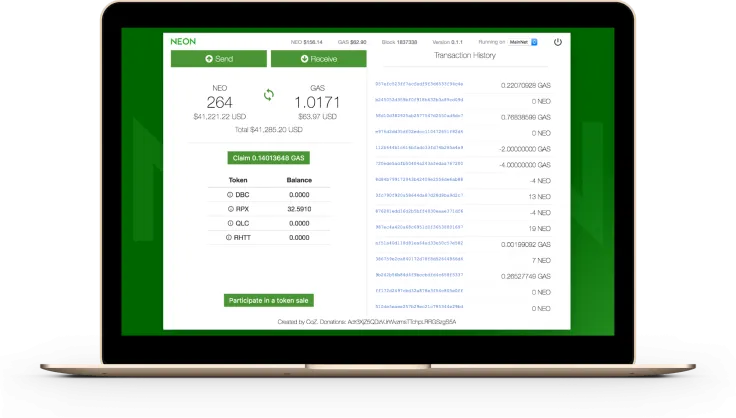

NEON wallet

The NEON wallet is a local wallet allowing users to keep NEO on their computers. It is the safest way of dealing with cryptocurrency because the user has an access to their private keys, so no one can steal it. At least, until you do not lose your computer.

There are many different local wallets which support NEO, but the NEON wallet boasts three killer features:

-

It is stable and safe.

-

It is free.

-

It allows users to get their GAS reward.

You can download the NEON wallet on GitHub. After installation, you will just need to send NEO tokens to the new address. Once the transaction is finished, you will start getting GAS automatically.

Ledger Nano S

Another 100% safe method of storing cryptocurrency is a physical hardware. The Ledger Nano S is one of the most popular models. It is much easier in usage than it seems.

Actually, the Ledger Nano S is a kind of minicomputer, but it has only one function — storing cryptocurrency. If you are not familiar with physical crypto-wallets, here are some instructions how to make it work.

It is important to note that the Ledger Nano S is just a hardware. You will also need to set up a local wallet to which the coins will be sent. I put exactly the Ledger Nano S in our top because it supports the NEON wallet.

In order to set up the wallet, you should install the Ledger Live software. It allows you to manage your devices and make transactions while all the data is stored in a physical wallet. After sending coins to the wallet, GAS will also start being produced automatically.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin