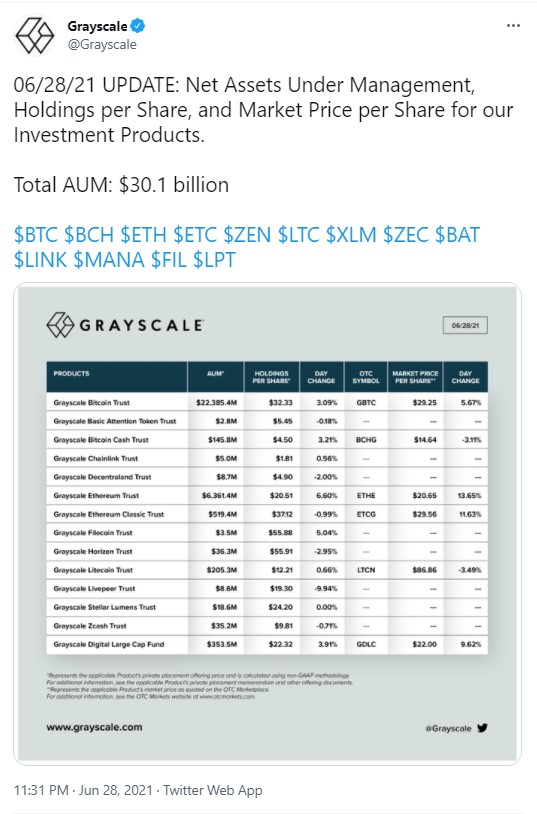

Major cryptocurrency asset manager Grayscale Investments, a subsidiary of Barry Silbert’s Digital Currency Group, announced that as of Monday, June 28, its digital currency holdings have added $1.1 billion.

The growth had taken place over the weekend when Bitcoin started recovering and on Monday 28, it rallied back to the $34,000 level.

Grayscale’s crypto holdings growing along with the market

On Monday, Grayscale’s team tweeted that over the weekend the total worth of the crypto assets they hold had risen by a whopping $1.1 billion and now constitutes $30.1 billion compared to $29 billion on Friday.

Earlier today, the flagship cryptocurrency, Bitcoin, recovered to the $35,000 level and Ethereum keeps holding above $2,000 after the rise on Monday.

Therefore, Grayscale’s crypto holdings also rose in value, adding $1.1 billion.

“Institutional investors buying GBTC”: CryptoQuant

Crypto data vendor CryptoQuant has tweeted that financial institutions are purchasing Grayscale’s Bitcoin Trust’s GBTC at a discount which over the weekend has declined by approximately 2 percent from 11% to 9%.

At the time of writing, Grayscale holds a total of 651,420 Bitcoin, 3.15 million ETH and millions or hundred of thousands of altcoins in its crypto trusts.

Still, outflows from them continue as investors are selling their Grayscale shares. GBTC outflows as of today total 107, as per the data provided by the Bybt analytics website.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin