John Waldron, the chief operating officer of Goldman Sachs, says that client demand for cryptocurrencies is rising in a recent interview with Reuters.

He notes that the pandemic has significantly accelerated the pace of cryptocurrency adoption, and he now expects an “explosion” in crypto:

The pandemic has been a significant accelerant. There is no question in our mind there will be more digital commerce … and (use of) digital money.

Crypto Market Review: Shiba Inu Price Momentum Returns In New Uptrend, Is Ethereum (ETH) Stuck in the Mud? Bitcoin Isn't Giving Up on $70,000 Ripple Secures Major Partnership With Deutsche Bank, XRP Price Breaks Key Support, Binance’s CZ Reveals His Role In UAE’s Bitcoin Mining Milestone — Crypto News Digest

One of the biggest Wall Street banks is now attempting to strike a balance between meeting this demand and following regulations:

We are regulated on what we can do. We continue to evaluate it ... and engage on it.

Waldron also reveals that Goldman is currently having discussions with regulatory bodies and central banks around the globe about how the nascent asset class should be approached.

Goldman has big plans for Bitcoin

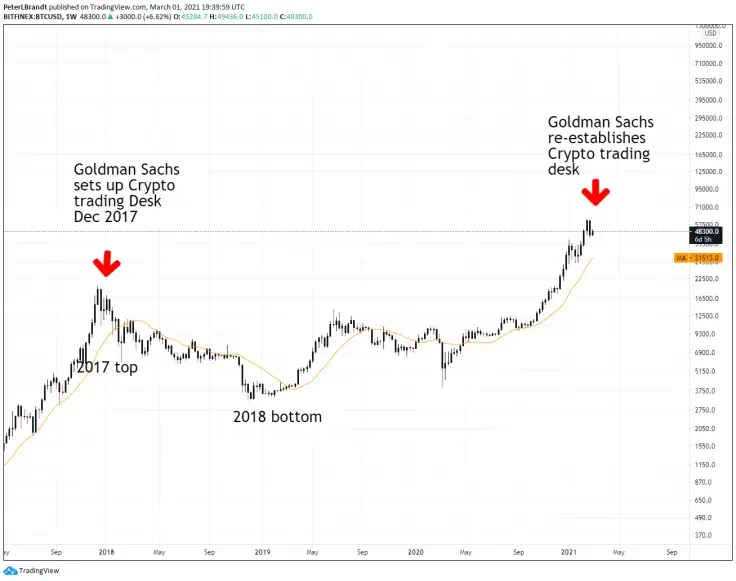

Goldman Sachs started trading Bitcoin futures earlier this week after reopening its cryptocurrency trading desk.

The banking institution is looking into an exchange-traded fund (ETF) tied to Bitcoin while also planning to offer cryptocurrency custody.

However, trader Peter Brandt recently warned that Goldman’s focus on crypto wasn’t necessarily bullish for the flagship coin.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin