In an interview with CNBC, Fundstrat’s Tom Lee predicted that Bitcoin could triple in value in 2021:

I think, in rounder numbers, 2021 is gonna be a lot of like 2017, which means Bitcoin should do even better in 2021 than it did in 2020. So, something above 300 percent.

Lee added the interplay between the weaker dollar and stronger Bitcoin was part of his thesis, adding that younger generations now view the flagship cryptocurrency as an alternative to gold.

Prior to Lee, CNBC contributor and hedge fund manager Brian Kelly also mentioned the issue of dollar debasement:

This is the exact environment that Bitcoin was designed and created for. Every central bank in the world is printing money. No central bank wants a strong currency.

Advertisement

Bitcoin is gunning for $30,000

The cryptocurrency hit a new all-time high of $29,300 at 0:55 UTC on the Bitstamp exchange. In the meantime, CME’s futures are already trading at $29,700.

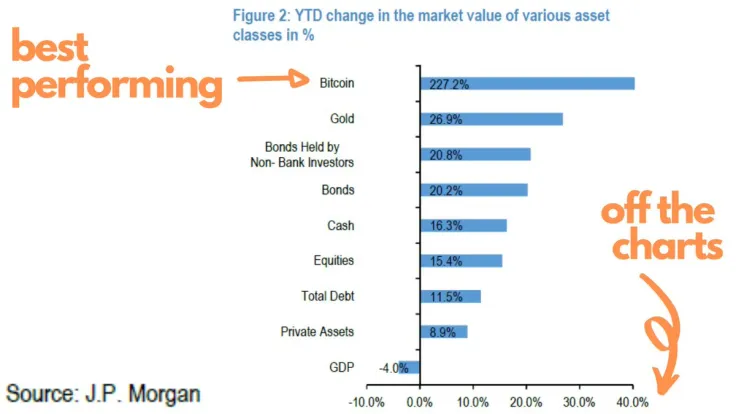

The cryptocurrency had such a massive rally in 2020 that JP Morgan will probably have to re-size its chart since Bitcoin has completely dwarfed every other asset.

Beware of a stock market correction

When asked about Bitcoin’s sharp corrections in the past three years, Lee noted that it was still a very tiny asset:

We have to keep in mind that Bitcoin’s holder basis is still tiny. I don’t think there are nearly a million people that own Bitcoin.

Lee continues to stick to his view that Bitcoin tends to act as a risk-on asset that is positively correlated to the U.S. stock market:

So, I think if we have a correction in stocks, then Bitcoin’s gonna fall.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin