Today, a seasoned analyst and strategist made a tweet storm. In 109 tweets he gave probably the most reasonable explanation why being bullish on Ethereum (ETH) may be the right bet.

ETH isn't whale-dominated

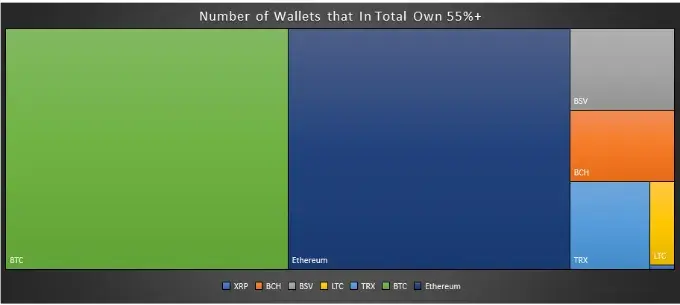

Mr. Cochran's latest report addresses the status and behavior of Ethereum (ETH) whales, i.e. the 10,000 richest wallets of the whole network. First of all, the analyst highlighted that the distribution of wealth in the Ethereum (ETH) network is fairer than in Bitcoin's (BTC), let alone other crypto behemoths. Bitcoin's (BTC) top 10,000 holders account for 57.44% of tokens while Ethereum (ETH) fat cats own 56.7% of Ethers.

In contrast, a similar share of XRP and Litecoin (LTC) is held by 16 and 300 addresses respectively.

Very soon, Ethereum (ETH) whales may be able to benefit greatly from their earnings. Mr. Cochran visualized the chasm of adoption for Ethereum (ETH) 2.0 and predicted how fast the staking process will be. He concluded that during Phase 0 the early birds may enjoy very high annual yields of 17-20%.

Hungry HODLers

Mr. Cochran noticed a very large influx of wealth into Ethereum (ETH) whale pockets. The top 10,000 Ethereum (ETH) accounts accumulated $550M in the last 6 months. And they are not ready to sell their riches. Only 19.5M ETH are listed on exchanges for sale out of 33.6M deposited.

The analyst also identified wallets associated with real-world moguls, namely JPMorgan Chase, Reddit, IBM, Microsoft, Amazon and Walmart. All of these wallets are accumulating Ethereum (ETH).

Finally, Mr. Cocran highlighted that patience is a real virtue for Ethereum (ETH) whales:

The individuals on the top whale list who grew their net worth the most over the past 3 years were those who were patient.

Godfrey Benjamin

Godfrey Benjamin Yuri Molchan

Yuri Molchan Gamza Khanzadaev

Gamza Khanzadaev Arman Shirinyan

Arman Shirinyan Alex Dovbnya

Alex Dovbnya