Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Bears are back in the game after slight recent growth.

ETH/USD

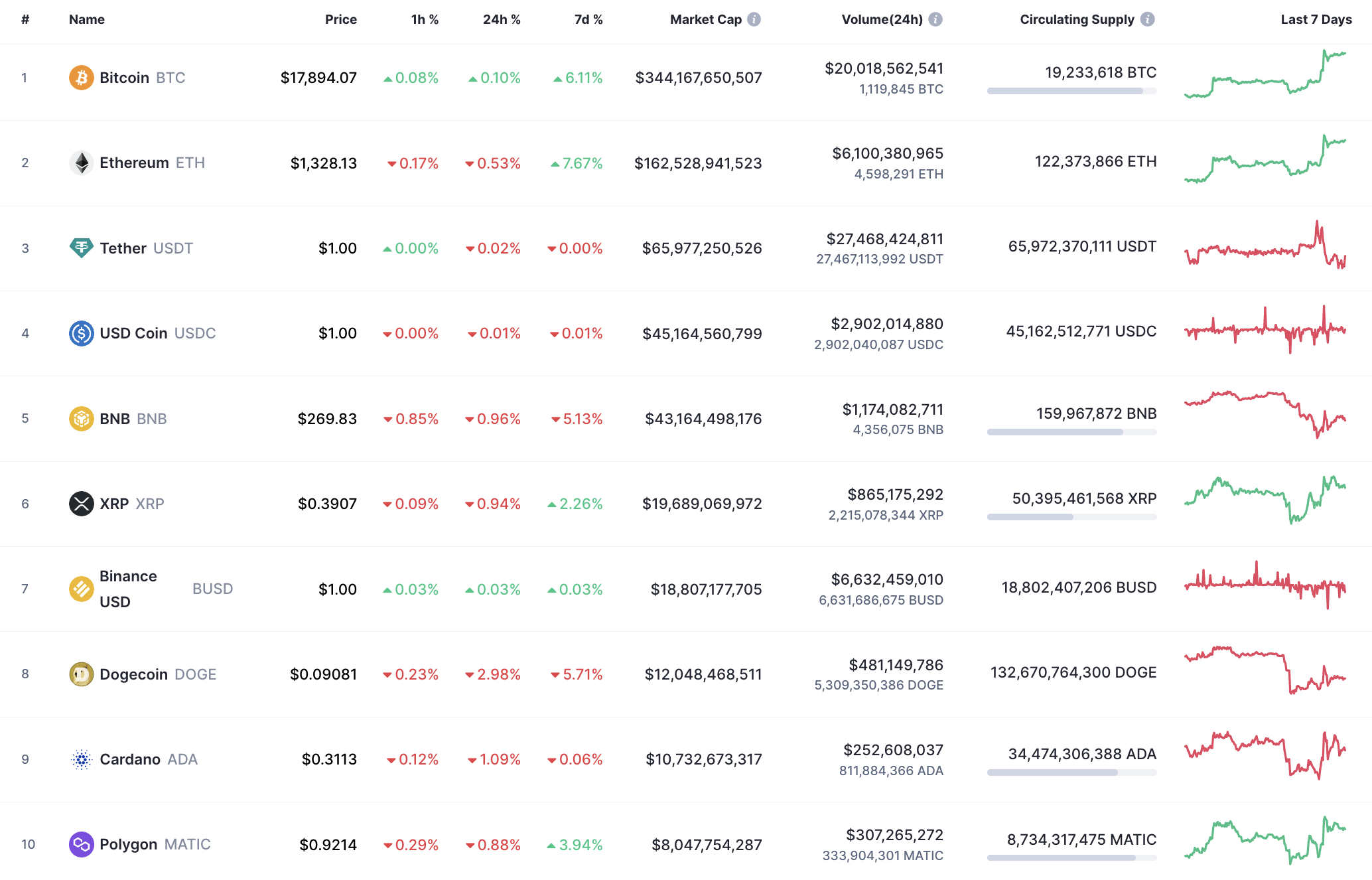

Ethereum (ETH) could not follow the slight growth of Bitcoin (BTC), falling by 0.53%.

Despite the fall, the price of Ethereum (ETH) has made a false breakout of the support level at $1,317.10. However, the rise has been stopped at the local resistance level of $1,332.80.

If the daily candle closes near that mark, the upward move might continue tomorrow.

On the daily time frame, Ethereum (ETH) confirmed the test of the $1,350 level yesterday. At the moment, traders should pay attention to it, as its possible breakout might be the start of a midterm rise as enough energy has been accumulated for such a move.

The volatility keeps declining on the chart against Bitcoin (BTC), as the price has not decided yet which way to go. The resistance at 0.076133 remains a level of great importance; however, buyers need more time to get stronger if they want to seize the initiative.

Ethereum is trading at $1,328 at press time.

Arman Shirinyan

Arman Shirinyan Alex Dovbnya

Alex Dovbnya Dan Burgin

Dan Burgin Denys Serhiichuk

Denys Serhiichuk