Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Buyers remain more powerful than sellers to a certain extent as the prices of most of the coins are rising.

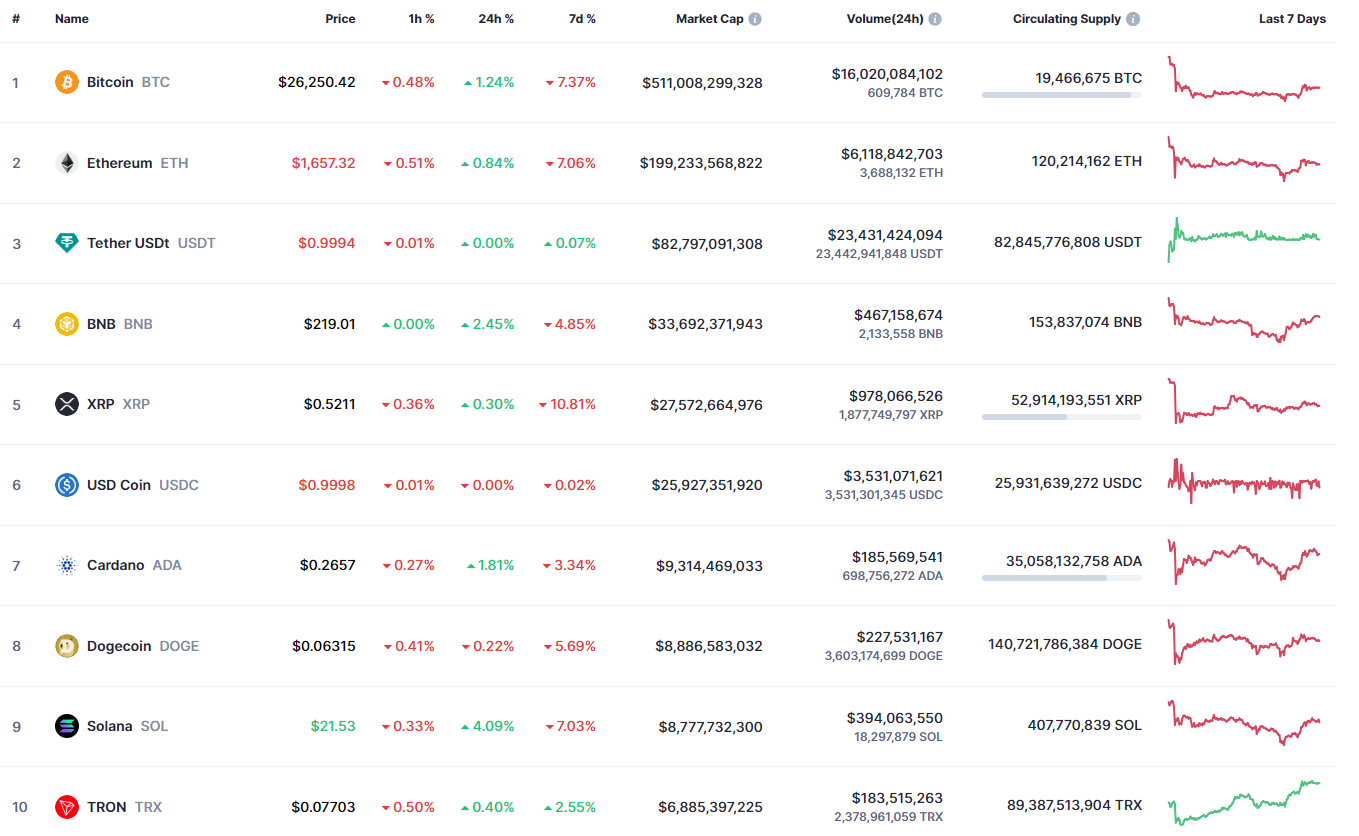

Top coins by CoinMarketCap

ETH/USD

The price of Ethereum (ETH) has increased by 0.84% over the past 24 hours.

Image by TradingView

On the short-term chart, traders should keep an eye on the immediate resistance level at $1,650.9. Should a false breakout occur, the price could potentially climb to the range of $1,660 to $1,670 in the near future.

Image by TradingView

Conversely, the daily chart presents a different scenario. The bullish momentum was unable to sustain yesterday's gains.

If the situation remains unchanged by the end of the day, sellers could potentially take control, causing the price to drop toward the crucial $1,600 level.

Image by TradingView

Over a weekly timeframe, it is crucial to monitor the closing price of the candlestick. If selling pressure persists and the candlestick closes near the support level of $1,571, we could witness a sharp decline to the $1,450 to $1,500 range.

Ethereum is trading at $1,648 at press time.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin