Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

In a recent observation, prominent analyst Ali Martinez shared a sobering prediction about the price of Ethereum (ETH). Martinez believes that Ethereum's value could potentially decline to $1,200 unless certain conditions change. The expert's prediction is based on data from blockchain analytics provider IntoTheBlock, specifically focusing on the distribution of profit and loss among Ethereum token holders.

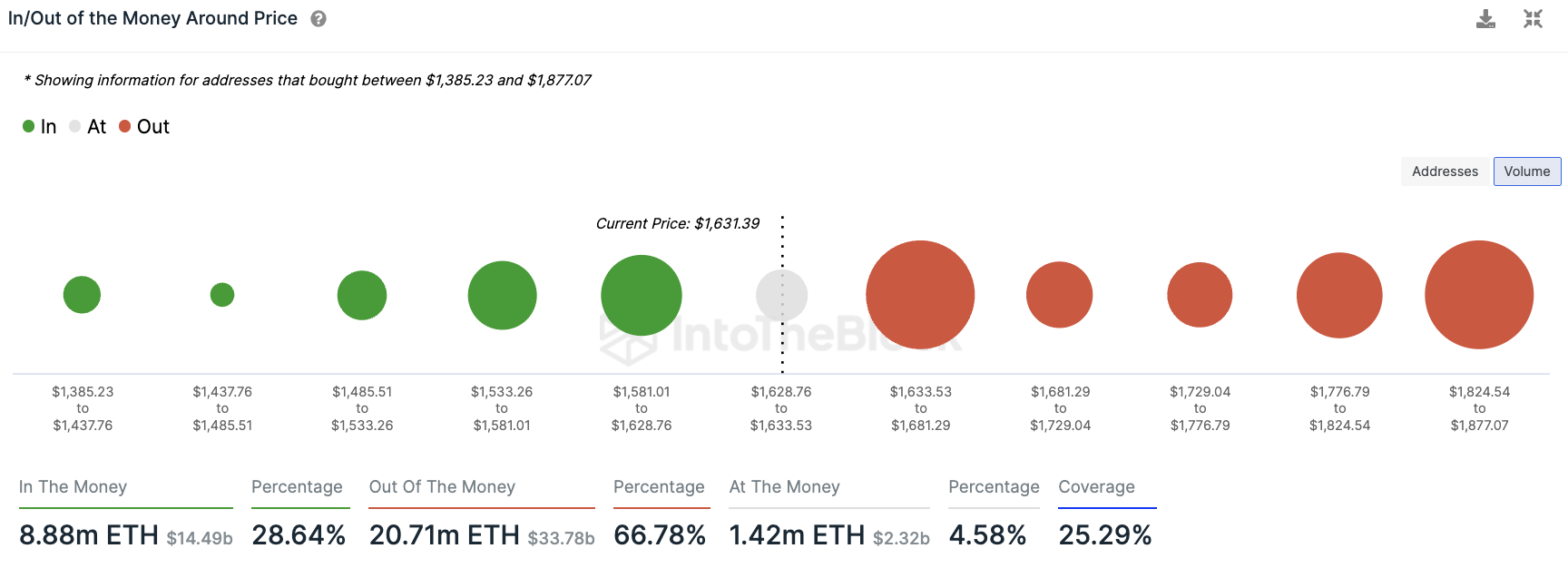

According to this data, a significant number of ETH holders are currently experiencing losses, particularly in the price range of $1,633 to $1,681, where approximately 6.39 million tokens are in the red. Below this range, down to a minimum of $1,385 per ETH, buying support appears weaker, as indicated by the size of the corresponding green circles on the infographic.

This combination of a substantial number of Ethereum tokens incurring losses for their holders and weaker buying support at lower price levels raises concerns about the cryptocurrency's stability. Martinez suggests that unless there are catalysts for growth in the near future, Ethereum may be vulnerable to what experts refer to as "time capitulation." In this scenario, the worst-case scenario could be a flash crash, for sure leading to a significant increase in unprofitable addresses among ETH holders.

The crypto community is now hoping for positive developments that could prevent the potential crash and push the ETH price up to $1,681 and higher. As Ethereum faces a critical juncture, crypto investors should be paying close attention to market trends in anticipation of potential changes within the space.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov