Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

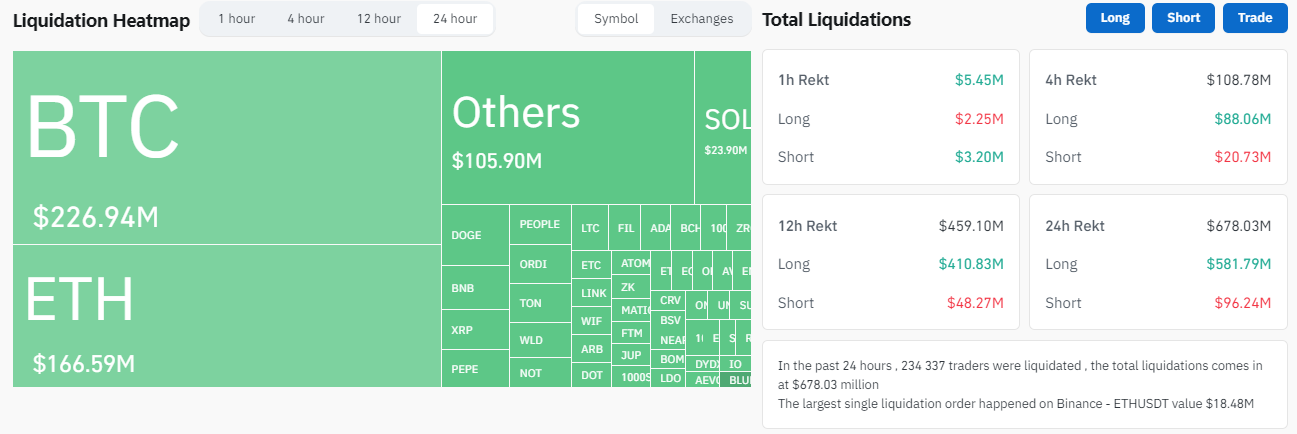

The second largest liquidation event in the history of the cryptocurrency market is here. Almost $700 million worth of long orders were destroyed overnight after Bitcoin plummeted below $55,000. Unfortunately, we will not see as quick of a recovery as in the past.

A cascade effect is observed on the cryptocurrency market due to large liquidations. When large positions are liquidated, it not only further lowers the price but also incites investor panic.

The downturn may be made worse by these panic sales, which would result in more liquidations and a steeper price decline. This also applies to the current market, with dire consequences. Considerable selling pressure has been applied to the market as a result of the transfer of funds from the now-defunct Mt. Gox exchange.

The movement and possible sale of these funds raises the total quantity of Bitcoin available for purchase, which lowers prices. Another significant factor has been the recent selling pressure from ETFs. Exchange-traded funds (ETFs) have instead become a major source of selling pressure, despite piling up BTC prior to the sell-off.

The market price of Bitcoin is adversely affected when these funds sell off substantial quantities of the cryptocurrency. The governments of the U.S. and Germany have been liquidating their cryptocurrency holdings. The market's problems are exacerbated by this government liquidation, which raises supply and lowers prices.

The enormous selling volume we are currently seeing is beyond the capacity of the market's liquidity. Due to the lack of liquidity, even modest sales volumes may have a significant effect on the price.

It will be a difficult journey to recovery. It is unlikely that there will be a rapid recovery because of the large liquidations, large sell-offs from institutional and governmental sources and negative market sentiment overall. Preparing for a midterm bearish market might be a wise decision here.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov