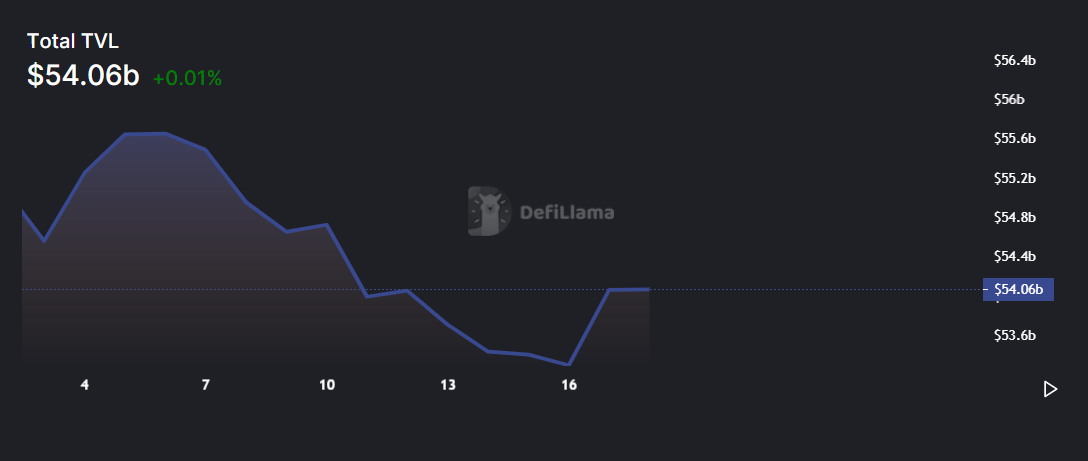

According to data provided by the leading decentralized finance (DeFi) total value locked (TVL) aggregator DeFi Llama, the TVL in DeFi protocols has rebounded to the $54 billion mark.

Per the data, the total TVL was down — between $53.7 and $53.29 billion — since Oct. 12. It’s important to note that in September, the TVL was down to $52.22 billion, the lowest since March 2021.

Currently, the largest DeFi protocol across all chains remains the Ethereum-based MakerDAO with a market dominance of 14.48% and $7.83 billion TVL.

Algorand hits new all-time highs

The young proof-of-stake (PoS) blockchain Algorand — initially released in 2019 — just hit an all-time high (ATH) of $275.15 million, according to DeFi Llama data.

Furthermore, the top DeFi protocol in Algorand, called Algofi, saw a nearly 33% increase in its TVL in the past 30 days. According to DeFi Llama data, Algofi has a 48% market dominance with a TVL of roughly $133 million.

The new milestone has also affected Algorand’s native utility token ALGO, giving it a roughly 3% push to the upside. ALGO is trading at $0.33 at the time of writing, according to CoinMarketCap Data.

Last week, Solana’s (SOL) TVL dropped 12.5% to $1.1 billion due to the Mango hack, according to a U.Today report. The numbers are still declining. Solana’s TVL has now plunged to $928 million, per DeFi Llama data.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin