Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

- Changing the narrative in DeFi development: What is ClearDAO?

- Roots of ClearDAO: When DeFi enters 3.0 phase

- ClearDAO: Multi-product ecosystem for open derivatives

- Out-of-the-box solutions for crypto businesses: Introducing ClearDAO templates

- ClearDAO’s token CLH goes live on top-tier CEXes KuCoin and Gate.io

- Bottom line

ClearDAO is an ecosystem of decentralized finance (DeFi) instruments designed to make derivatives building on multiple blockchains possible in a frictionless and seamless manner.

Changing the narrative in DeFi development: What is ClearDAO?

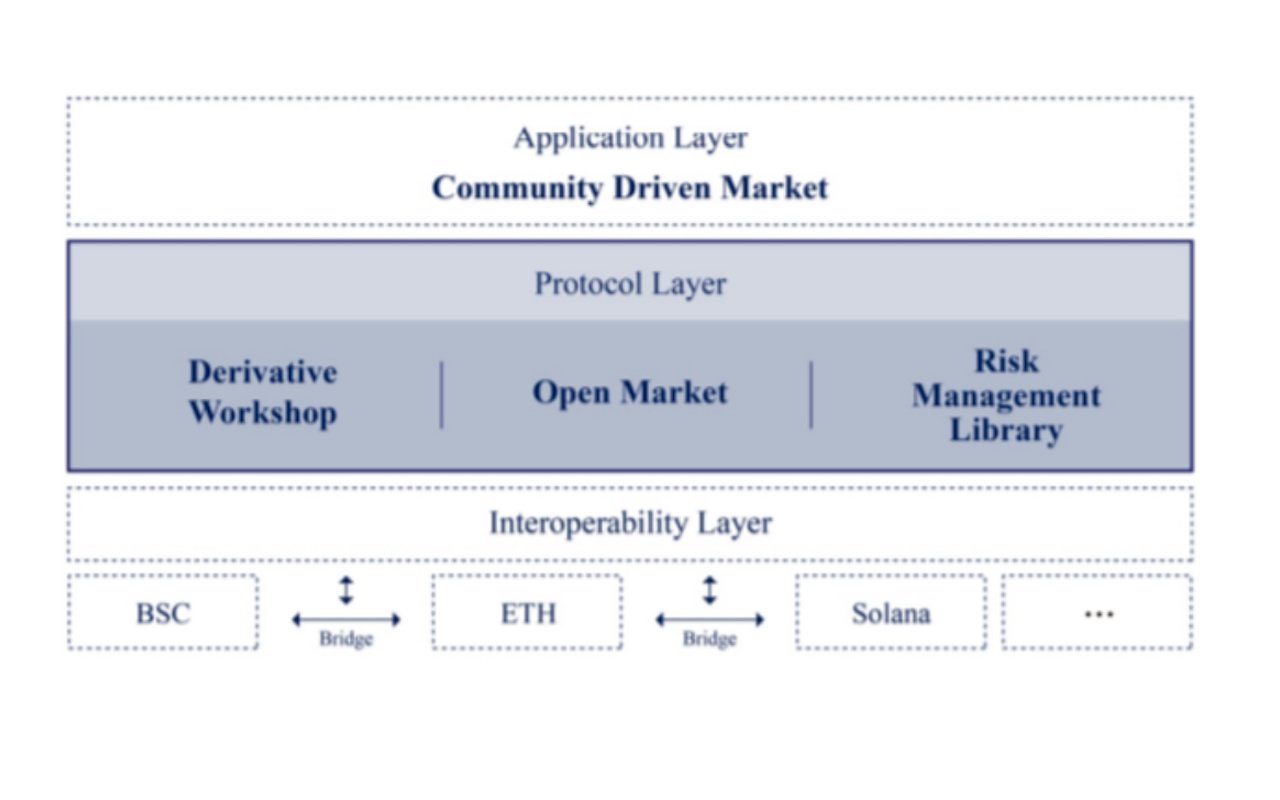

Leveraging modern distributed ledger technologies, ClearDAO promotes itself as an open protocol for DeFi derivatives. It also develops an instrument for effective risk management and a DeFi-centric software development kit (SDK).

What are the main components of ClearDAO?

- The Clear SDK is a one-of-the-kind product tailored to the deployment of customized derivatives products around various underlying assets;

- Community-driven market is an ecosystem of creators that harness ClearDAO as the technical basis for their protocols;

- Risk-management library is a toolkit that suits two-tier risk management across various DeFi products.

The mentioned stack of products makes ClearDAO an outstanding solution for on-chain businesses. It allows crypto entrepreneurs to launch their own customized products based on derivatives trading with advanced risk management.

Roots of ClearDAO: When DeFi enters 3.0 phase

ClearDAO cements itself as an ecosystem to implement cutting-edge decentralized finance (DeFi) principles. Its offering is a natural expansion of what the inception of blockchains brought to the world economic system.

With Bitcoin (BTC) and Ethereum (ETH), blockchain infrastructure became a reliable technical basis for cross-border money transfers and stores of value. Also, both currencies evolved into attractive investment products and changed the game in personal finances for millions of people all over the globe. Since the first cryptocurrencies had no centralized control over their networks, their adoption marked the dawn of DeFi 1.0.

Starting with Ethereum, smart contracts supercharged DeFi 2.0 with amazing economic designs both inherited from classic finance (lending/borrowing protocols) and completely novel (decentralized prediction markets, yield farming and so on). In 2021, major DeFi protocols Uniswap, Curve, Aave Finance and Sushiswap exploded and siphoned a significant share of liquidity from CEX services like Coinbase and Binance.

ClearDAO is the primary ecosystem of DeFi 3.0 that will follow completely different rules and principles. Sophisticated customizable derivatives systems with on-chain risk management tools will be the name of the game for this phase.

ClearDAO: Multi-product ecosystem for open derivatives

As a result of multi-year development and experiments, ClearDAO experts implemented a one-of-a-kind array of products for creators of DeFi-native derivatives primitives.

Decentralized derivatives workshop

With ClearDAO instruments, blockchain developers can create their own derivatives markets on various decentralized systems.

As a part of the Protocol Layer of ClearDAO infrastructure, the decentralized derivatives workshop interacts with a blockchain-agnostic Interoperability Layer. On this basis, applications can deploy and leverage derivatives-driven systems.

Community-driven markets on Clear SDK

Once this or that crypto entrepreneur develops his/her derivatives ecosystem, ClearDAO invites him/her to a closed community of market creators. Despite their products having different designs and front-ends, devs interested in building on ClearDAO work within a united ecosystem that pushes the frontiers of decentralization and its use cases.

The Clear Software Developers Kit (SDK) is a backbone element of ClearDAO practice and ideology. This toolkit of web development instruments is able to empower a multitude of DeFi primitives.

Risk management library by ClearDAO

Last but not least, ClearDAO has created a risk management library. This element of its development stack boasts modern flexible risk management instruments. As a result, all projects that work with ClearDAO are protected by a two-tier reserve pool system. Implementation of ClearDAO instruments makes risk management in DeFi resource-efficient and reliable as never before.

Out-of-the-box solutions for crypto businesses: Introducing ClearDAO templates

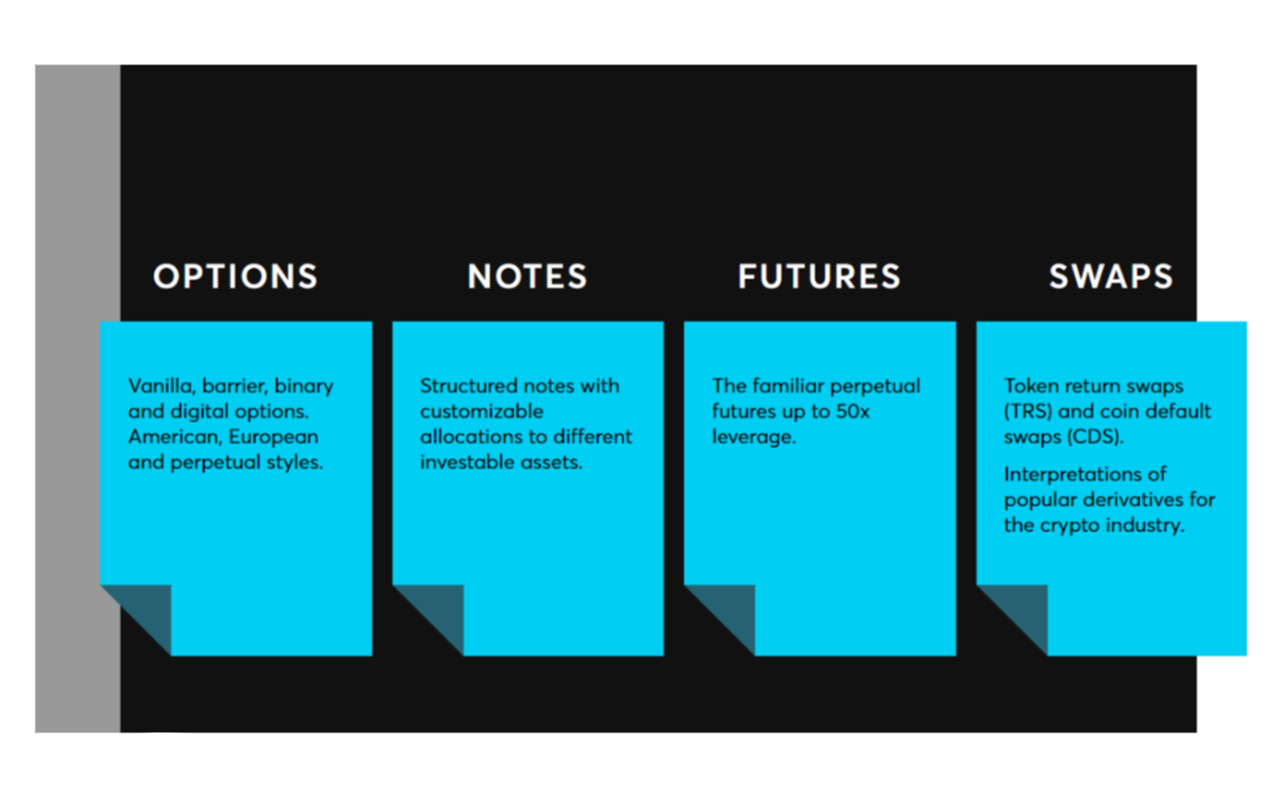

To ease the process of derivatives systems launch, ClearDAO offers a string of mainstream templates designed to cover the most popular use cases of the DeFi segment.

ClearDAO offers plenty of solutions for derivative products. Ready-made templates are available for vanilla, binary and barrier options, with American, European and perpetual exercise styles.

Fund managers within the ClearDAO ecosystem can launch structured notes with various underlying assets for retail investors to purchase.

Templates on futures are also available for developers to rapidly build futures contracts on fungible tokens and even NFTs.

Last but not least, multiple swap templates can be launched using the tools provided by ClearDAO. Both token return swaps (TRS) and coin default swaps (CDS) can be created, stress tested and deployed.

ClearDAO’s token CLH goes live on top-tier CEXes KuCoin and Gate.io

CLH token is a backbone element of ClearDAO’s tokenomics. With its dual nature, it serves as both a governance and utility asset for ClearDAO mechanisms. Under the ticker CLH, it is listed on a number of top-notch centralized cryptocurrency exchanges.

$CLH @clear_dao trading is now live!

— KUCOIN (@kucoincom) January 7, 2022

? Trade CLH/USDT: https://t.co/PD3r7770Rk?from=article-links #KuCoinSpotlight #KuCoinGems pic.twitter.com/dtJssV5Ulw

On Jan. 5, 2022, CLH token went live on KuCoin Spotlight, a launchpad for prospective early-stage products with native tokens. CLH tokensale for KCS holders was organized according to the proportional distribution model.

Also on Jan. 5, 2022, CLH was also released on Gate.io’s “Start-up Sale,” a closed IEO launchpad for VIP customers. A total of 56,000 USDT were raised in almost no time from 20,000 contributors.

Starting from Jan. 7, 2022, KuCoin is the first centralized exchange to enable CLH trading. On the same day, CLH token trading also commenced on Gate.io.

Bottom line

ClearDAO is an ecosystem for open derivatives markets designed to allow crypto entrepreneurs to launch customized DeFi products. Its offering includes SDK, a community management module and risk management tools.

ClearDAO’s tokenomics is supercharged with CLH token, which is available on heavyweight centralized exchanges and Uniswap.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin