Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

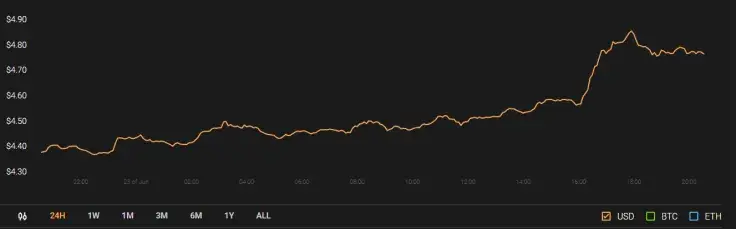

The price of Chainlink (LINK) has rallied by more than 11 percent over the last 24 hours, occupying 13th place by market capitalization.

The token surged to $4.87 but fell short of surpassing its current all-time high of roughly $4.93 that was set on March 4.

China adds more fuel to the fire

The most recent spike came after China’s Blockchain Services Network (BSN) made an announcement about integrating Chainlink’s oracle network.

With the help of this collaboration, the government-backed blockchain platform, which was launched back in October 2019, wants to implement its ambitious plan to create the internet of blockchains.

According to BSN co-founder Yifan He, they will introduce a working demo of its cross-chain services powered by Chainlink this September:

This collaboration with Chainlink, IRITA, and SNZ Pool will help us achieve this goal and ensure that BSN users reach new levels of security, reliability, and interconnectivity.

Beware of a Compound-style plunge

From March 6 to March 13, the price of Chainlink collapsed by 72 percent amid a broader cryptocurrency market sell-off.

After fully recovering from the ‘Black Thursday’ plunge by mid-May together with other top coins, LINK extended its gains in July.

However, given the enormous 40 percent crash of the Compound (COMP) token, it is unlikely that another altcoin rally is going to have legs (even with China’s endorsement).

As reported by U.Today, blockchain analytics firm AnChain.AI accused the token of being a coordinated pump-and-dump scheme after its wild price action in Q2 2019.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin