Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Cardano's blockchain has seen a drastic reduction in the activity of large transaction volumes, traditionally associated with whale movements. The sudden and massive drop has led to a near standstill in the network's activity.

The on-chain metrics indicate a stark decrease in the number of large transactions, which are typically indicative of whale behavior. Such a precipitous fall often portends a shift in network dynamics, but in this case, the reasoning is not transparent. The motives – whether they be accumulation, redistribution or another factor – are currently speculative at best, leaving much room for interpretation and concern.

Long-term observation of Cardano's on-chain activity suggests a gradual decrease in whale activity. This trend could imply various strategic movements by significant holders, such as quiet accumulation phases or strategic asset redistribution. Nevertheless, the lack of clarity and transparency makes it challenging to ascertain the precise motives or implications for Cardano's ecosystem and its holders.

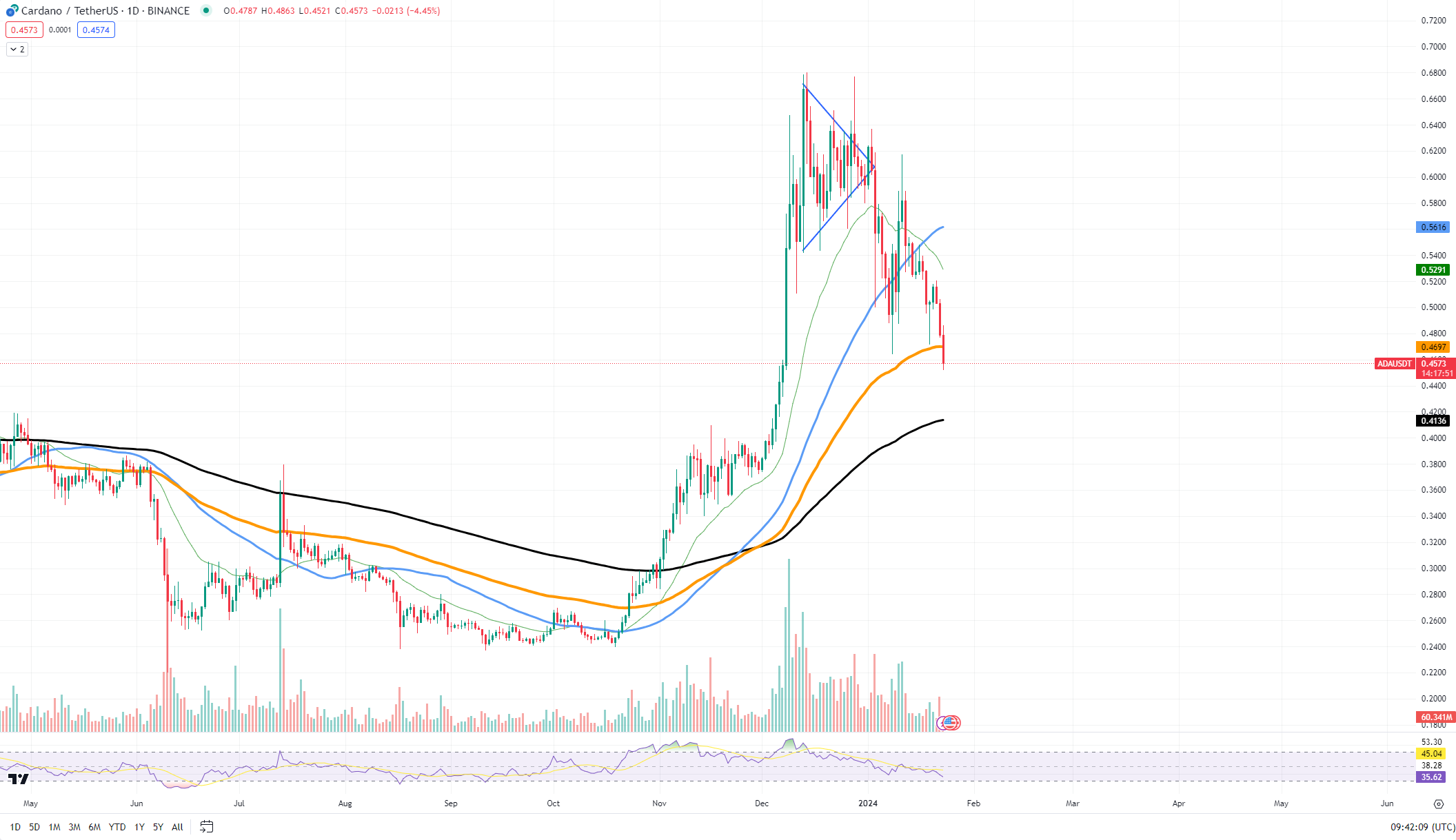

Cardano price analysis

Turning to the price chart of ADA, the technical analysis presents a concerning picture. ADA's price hovers around the $0.46 mark, a level that has historically served as support, having been tested thrice before, particularly in October. However, the absence of substantial buying power and the current descent in volume suggest a weakened defense at this support level.

The prevailing market sentiment, coupled with Cardano's specific fundamental issues, such as the lack of widespread utility beyond transactions and payments, and its ongoing legal challenges, contribute to a bearish outlook for the asset. The confluence of these factors may well lead to a further slide in price.

If the $0.46 support level fails to hold, the next significant support lies at $0.4136. A breach below this threshold could see ADA's value plummeting further, potentially seeking lower support levels that have yet to be established.

Tomiwabold Olajide

Tomiwabold Olajide Gamza Khanzadaev

Gamza Khanzadaev Arman Shirinyan

Arman Shirinyan Yuri Molchan

Yuri Molchan Godfrey Benjamin

Godfrey Benjamin