Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Cardano (ADA) is setting up its growth pace on the broader market. Despite the turbulence of the past week, it has printed a 19% rally thus far this month. Cardano has faced both heat and boom this month as conflicting trends shape investor sentiment. However, the historical outlook indicates that Cardano is ready to rewrite its history this month.

Cardano and possible growth height

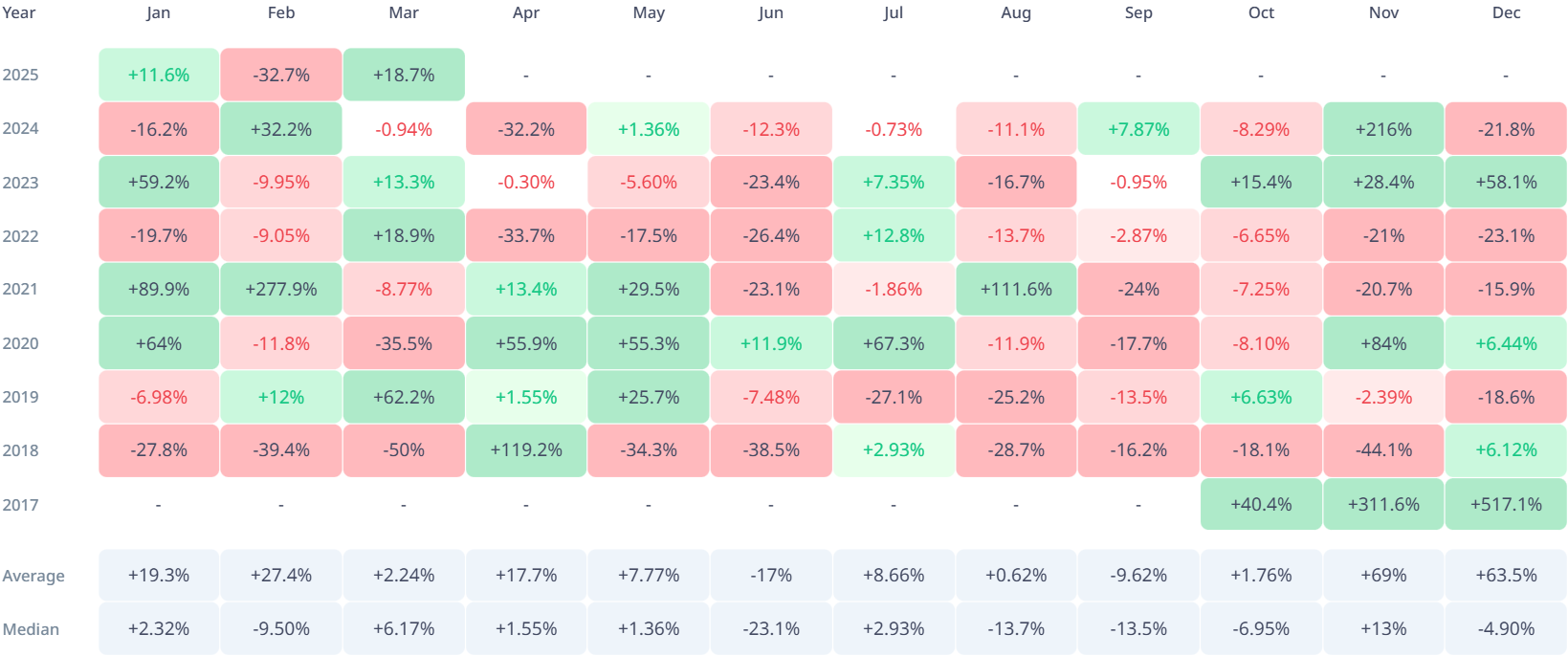

According to data from Cryptorank, Cardano has recorded an average growth rate of 2.32% in March since its inception. March is a relatively positive month for ADA, which has recorded a split win-lose trend since 2018.

The inaugural March 2018 performance outlook saw a negative growth trend of 50%. The trend shifted the next year as the ADA price rallied 62.2% before correcting by 35.5% and 8.77%, respectively.

More recently, Cardano has showcased a bullish outlook despite a recent monthly decline, with an 18.9% close in 2019 and a 13.3% uptick in the next year. Overall, Cardano has given investors a very mild return on investment, as the 0.94% loss in March 2024 is considered negligible.

The current 19% monthly rally has positioned ADA on track as the second-best March since its debut. If the rare uptick continues, it might fuel a surge beyond the 2019 growth rate of over 62%.

Cardano deserves it

The proof-of-stake blockchain has the fundamentals to justify its projected growth trend in the coming weeks. Like some top altcoins, asset managers are now filing for a Cardano ETF product with the U.S. Securities and Exchange Commission (SEC).

Besides this ADA ETF, the Cardano protocol drives an impressive chain upgrade to enhance the decentralization push. Ultimately, the network remains among the most promising to lead the next altcoin season.

Other secondary factors to watch include the general volume revival, open interest and Cardano whale activities that can shift investor sentiment in the short term.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov