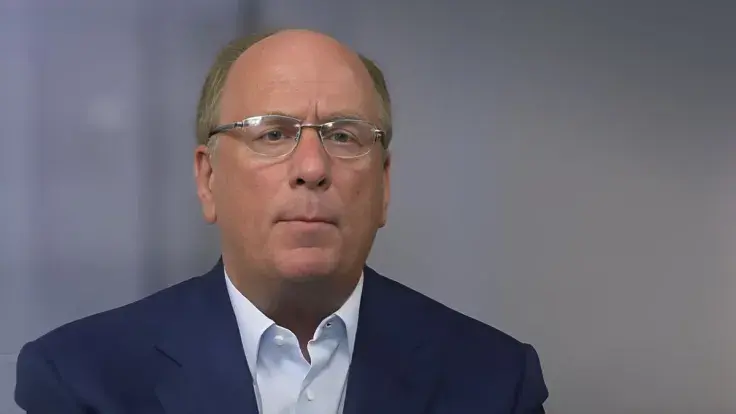

Larry Fink, CEO of the world's largest asset management conglomerate with $10 trillion under its belt, surprisingly sells 35,800 shares of his firm. Previously, such sell-offs were signals of major recession waves.

Larry Fink sells 7% of his BlackRock stake: Bulls should take care?

According to a securities filing released April 20, 2023, Larry Fink sold almost 7% of his stake in BLK, BlackRock's shares. With the average price of $694.36, this is equal to roughly $25 million.

$BLK BlackRock CEO Larry Fink & Senior Managing Director Richard Kushel sold a combined $27,000,000 in shares this week. 💰 pic.twitter.com/s16SXFsNVs

— TrendSpider (@TrendSpider) April 22, 2023

As noticed by the analytical software platform TrendSpider, Fink is not the only director of BlackRock to get rid of his shares. Senior management director Richard Kushel also sold 3,000 shares worth $2.08 million. In February 2023, Kushel sold four portions of his BLK shares: In total, he released 6,382 shares into the market.

Many analysts noticed that Fink typically sells his BLK before major recession events. Namely, the member of the WEF's Board of Trustees was aggressively selling in January-February 2020 before the global panic-driven stocks sell-off raged. In two events, he unloaded over 91,000 shares.

However, one week ago, Fink claimed that he was not expecting a big recession to come. He made such statements during his last appearance on CNBC's Squawk on the Street show.

"I am not expecting a big recession in the U.S.," BlackRock's Larry Fink has said. pic.twitter.com/pp78FZ9mti

— unusual_whales (@unusual_whales) April 15, 2023

As per Bloomberg, $25 million — the price of his latest unloading — is equal to Fink's yearly compensation in BlackRock.

BlackRock CEO skeptical on cryptocurrencies, but gives tokenization chance

Some commentators semi-ironically opined that Fink might be interested in buying cryptocurrencies at reduced prices. Typically, the BlackRock head shows little optimism about the digital assets segment.

As covered by U.Today previously, in November 2022, Larry Fink predicted that the majority of existing cryptocurrency companies would fail in the coming years.

He also repeatedly slammed Bitcoin (BTC) for being too overhyped. However, he claimed that tokenization can be the next big thing in the financial segment.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin