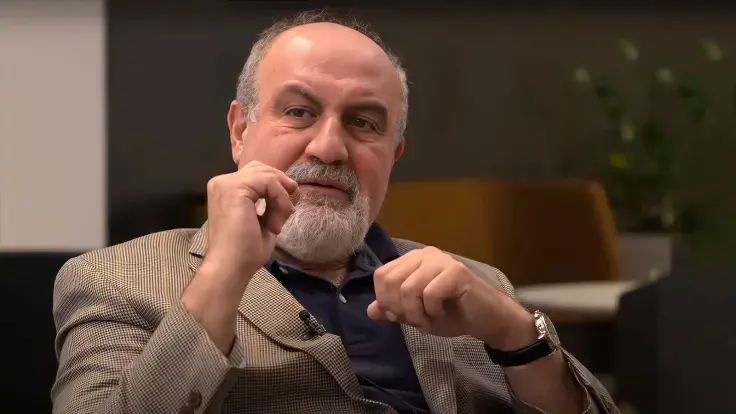

Nassim Nicholas Taleb, author of the bestseller "The Black Swan," has taken to Twitter to challenge the legitimacy of Bitcoin as an antifragile asset.

Taleb points out the incoherence of the crypto concept, stating, "Bitcoin price drops because of ... UNCERTAINTY," which conflicts with the claims that it is an antifragile asset.

He noted noted that the cryptocurrency is supposedly "antifragile," yet its price dropped due to uncertainty. The price of Bitcoin plunged below the $20,000 threshold for the first time since January, recording its worst performance since late 2022.

Taleb defines antifragility as the property of systems that increases resilience and adaptability in response to stressors and shocks.

The mathematician argues that the opposite of fragility is not resilience or robustness, but antifragility. According to Taleb, a system that is merely resilient or robust can withstand stressors and shocks but doesn't necessarily improve in response to them. In contrast, an antifragile system is one that not only survives but thrives under stress.

Taleb applies his concept of antifragility to various domains, from finance to medicine, to society as a whole.

The "Black Swan" author has previously expressed his skepticism toward Bitcoin's ability to serve as a decentralized currency and store of value.

He previously criticized Bitcoin, saying that it cannot protect against black swan events and is vulnerable to inflation.

According to Taleb, the crypto industry's craze can be attributed to near-zero interest rates, pushing people towards speculation instead of "real finance."

In a recent interview, he described Bitcoin as "the detector of imbeciles."

As reported by U.Today, Bitcoin's recent decline below $20,000 has been attributed to the regulatory clampdown in the U.S., the underperformance of U.S. equities, concerns over higher interest rates, and the proposed tax on electricity used in crypto mining.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov