Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

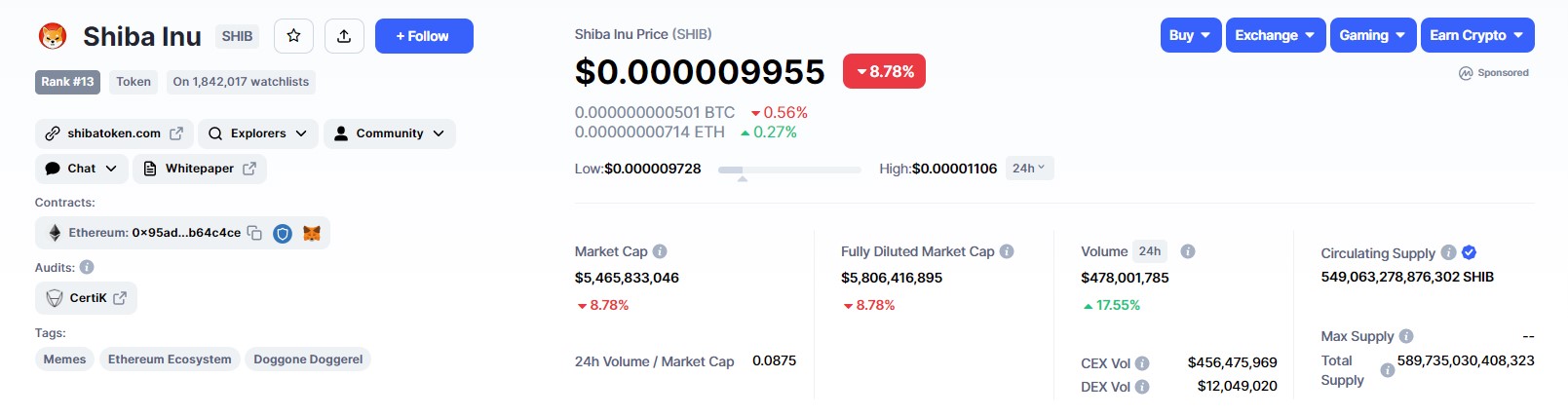

After a week of impressive price action, Shiba Inu (SHIB) has bowed to the pouncing pressures of the bears as it is experiencing a massive sell-off at the time of writing. The meme coin is priced at $0.000009954, down 8.78% over the past 24 hours. With the current selling pressure, the token has shed as much as 12.72% in the past week.

Despite this, Shiba Inu is still maintaining positivity in terms of its trading volume over the past 24 hours.

Per data from CoinMarketCap, a total of $478,001,785 worth of SHIB has been traded within this time frame, a figure representing growth of 16.23%. This data is an indication that there is ongoing buying activity on exchanges even though this is not translating into price growth.

Shiba Inu has its own niche and its own community, and the meme coin has been pushing its ecosystem to serve as a one-stop shop for everything in Web3.0. From the integration of Shiba Inu as a payment on merchant platforms to its pivot into the fast food business through investment in Welly, a fast food start-up that is planning to expand to Dubai, SHIB's utility is growing across the board.

Shibarium Effect

Shibarium, the Layer 2 protocol that is highly anticipated by members of the Shiba Inu community, is set to experience its beta test mode anytime now. The hype surrounding the Shibarium launch and the fear of missing out on growth that may trail SHIB and the other ecosystem tokens could account for why the transaction volume is growing at this time.

Shiba Inu is known for extreme volatility, and with its core metrics, including its burn rate, still flashing positive, we may get to see a price retracement in the near future.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov