Santiment analytics company says that, over the past three weeks, Bitcoin whales have been pretty active with transactions.

Meanwhile, as per Glassnode data, the number of long-term BTC investors is rising, despite the recent 10 percent BTC decline, signifying that users are grabbing the dip.

Whales make 23,478 transfers worth $100,000

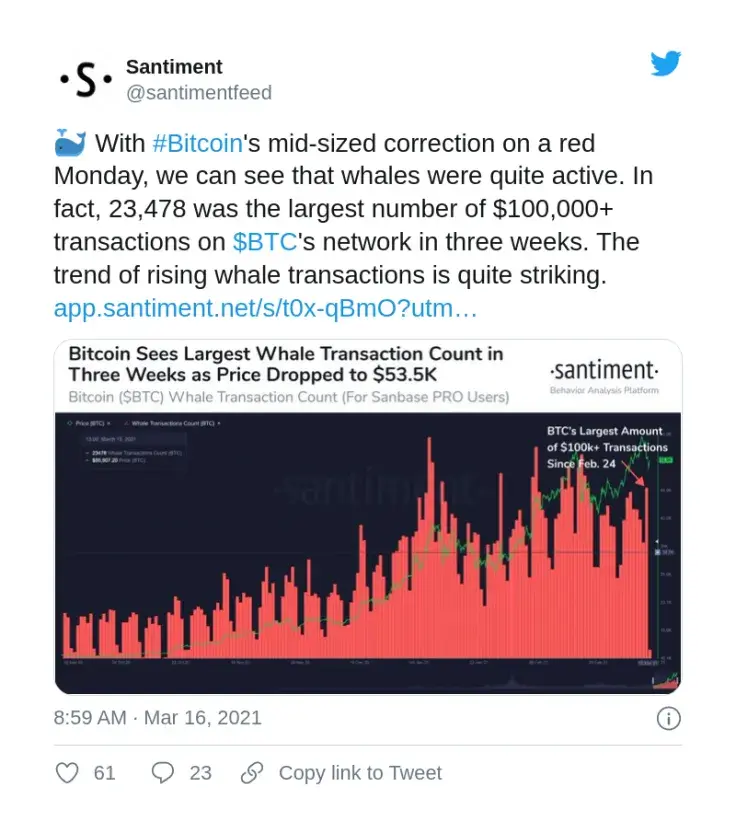

Santiment has shown that, as of March 15, whales have conducted almost 23,500 transfers of approximately $100,000 each over the past three weeks.

These massive whale transactions have turned into a trend, the tweet states, emphasizing that this is "quite striking."

On Monday, Bitcoin saw a 10 percent correction, which pulled the flagship cryptocurrency down from the $60,000 level to the $55,600 zone.

Over the weekend, a transaction of over 18,000 BTC (worth approximately $1 billion) was made to the Gemini exchange which, apparently, was a possible reason for the massive BTC sell-off that followed, bringing the Bitcoin exchange rate down to the $55,600 zone.

CryptoQuant analytics provider believes it was made from BlockFi, although Glassnode does not agree, believing it was an internal transaction on Gemini.

Number of long-term BTC investors is growing

Blockchain journalist Colin Wu has shared a chart by Glassnode analytics company that shows that more long-term investors are stocking up on Bitcoin and moving it to cold storage.

Despite the 10 percent fall of Bitcoin, the illiquid BTC supply is still high and has even grown as investors are buying BTC even as it tanked on Monday.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin