Cathie Wood, the CEO of Ark Invest, has shared an epic Bitcoin price prediction.

She reaffirmed her optimistic outlook on Bitcoin, predicting a base price of $650,000 by 2030, with the possibility of reaching as high as $1.5 million under more favorable circumstances.

Wood, a prominent advocate for Bitcoin who began investing in the cryptocurrency in 2015, attributes her confidence to two primary factors driving its growth.

In an interview with CNBC on Friday, she emphasized that increasing regulatory clarity is a crucial development that could bolster the cryptocurrency market, easing concerns and paving the way for broader adoption.

She also pointed out the growing interest from institutional investors, who are beginning to appreciate Bitcoin's unique attributes compared to traditional assets. This distinction, according to Wood, is strengthening Bitcoin’s position as a valuable asset class and an essential tool for portfolio diversification.

Bitcoin outpaces historical averages in November

According to data provided by ARK Invest, Bitcoin's price as of Nov. 13, 2024, was 1.33 times higher than its previous cycle peak of $67,589 on Nov. 8, 2021.

Notably, Bitcoin's maximum drawdown during the 2022 bear market was 76.9%, which is a smaller decline compared to previous cycle drops of 86.3% in 2018, 85.1% in 2015 and 93.5% in 2011.

Since the last cycle low, Bitcoin's price has increased 5.72 times, closely mirroring the 5.18x and 5.93x growth seen at equivalent points in the 2015-2018 and 2018-2022 cycles, respectively.

If Bitcoin continues to follow the average trajectory of these two cycles, its price could potentially increase 15.4 times to around $243,000 during the next year, approximately 880 days after the November 2021 cycle low.

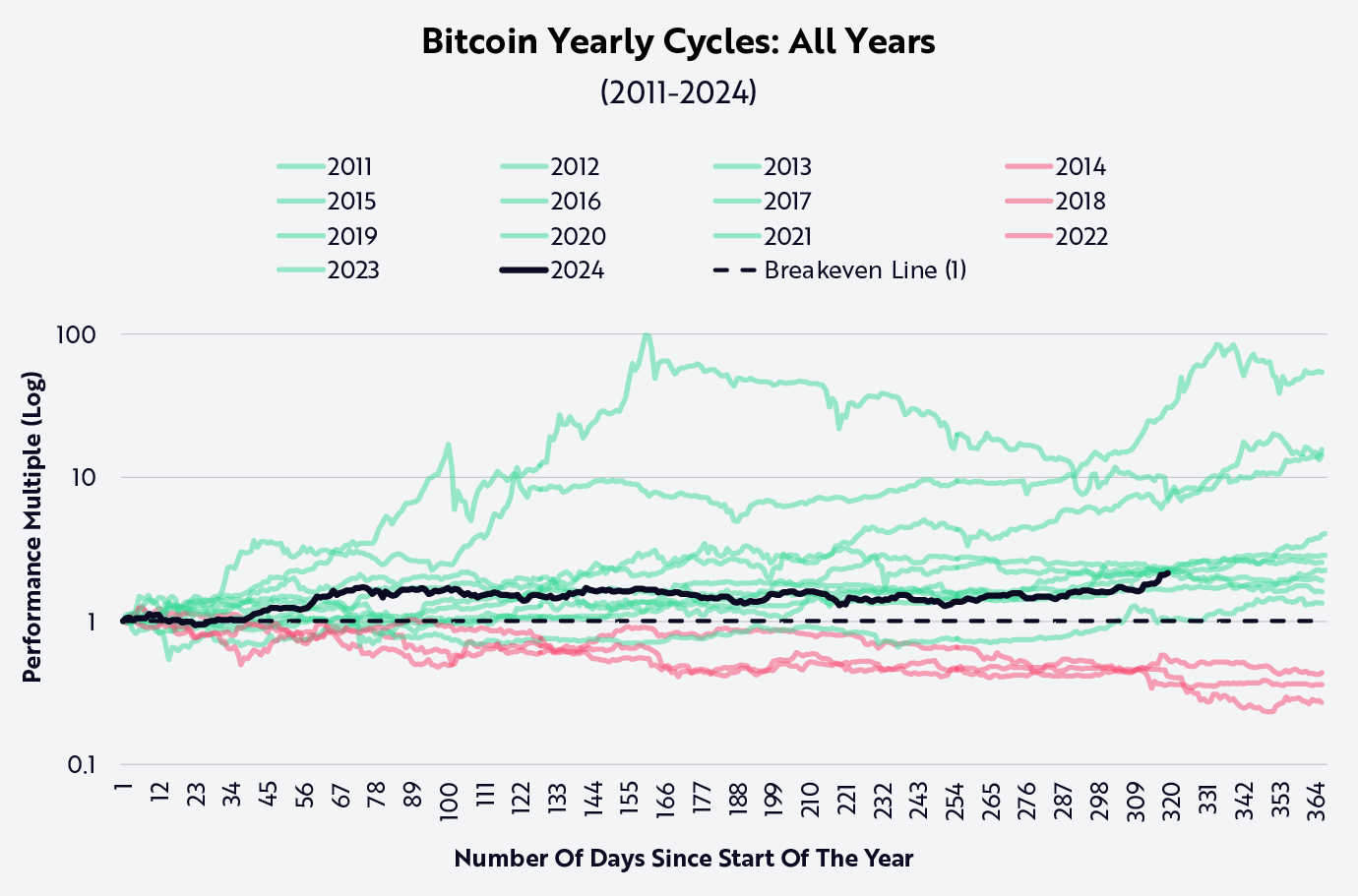

By November 2024, Bitcoin’s price had risen 114.1% year-to-date, or 2.14 times, marking strong growth compared to its average annual performance.

While this multiple exceeded the 2.06x average across all years sampled from 2011 to 2023 and the 2.04x average for halving years such as 2012, 2016 and 2020, it lagged behind some of the highest annual returns in prior cycles.

In 2024, Bitcoin experienced a notable overbought surge in the second quarter following the launch of U.S.-based spot Bitcoin ETFs. However, a prolonged oversold period ensued due to increased supply from government seizures and repayments to Mt. Gox creditors.

As of November, Bitcoin’s performance multiple outpaced historical averages, and projections suggest that if it aligns with past trends, its price could range between $104,000 and $124,000 by the end of 2024, resulting in performance multiples of 2.48x to 2.94x.

With institutional adoption gaining traction and discussions around the U.S. government potentially adding Bitcoin to its strategic reserves, a strong close to 2024 is anticipated, setting the stage for sustained momentum into 2025.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin