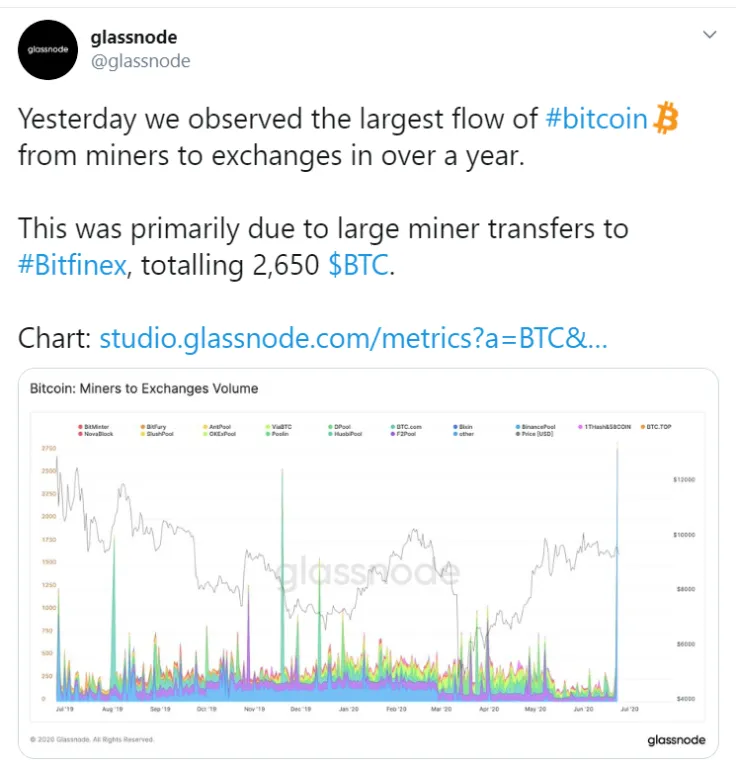

On June 23, miner outflows of Bitcoin spiked to their highest level in more than a year, according to Glassnode data.

The Bitfinex exchange alone received 2,650 Bitcoin (around $25 mln at press time) from multiple miner addresses.

The two reasons behind Bitcoin's drop to $9,200

CryptoQuant, another on-chain analytics firm, also spotted big outflows from Chinese mining pools HaoBT and Pooling that took place yesterday.

However, these coins didn’t go to exchanges, which is why they cannot be directly linked to the latest Bitcoin price drop.

The top cryptocurrency plunged to an intraday low of $9,260 at 10:38 UTC before recovering to its current price of $9,385.

This bearishness can also be attributed to the ongoing stock market sell-off (the Dow is down one percent at press time).

A double-edged sword

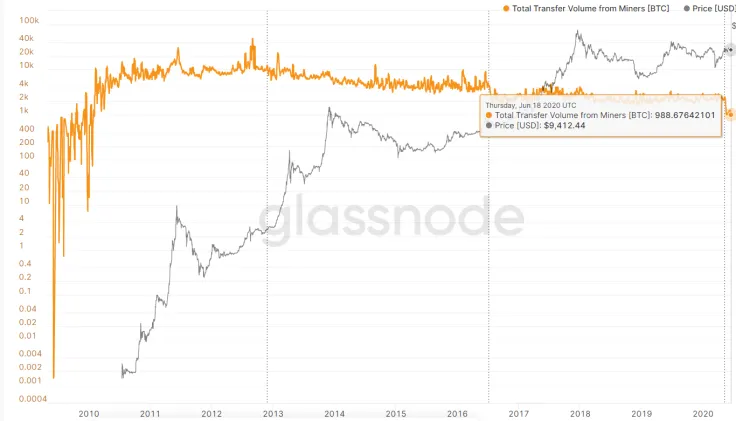

The recent surge of miner outflows comes five days after they reached their lowest level in ten years.

From a bullish perspective, they could be waiting for higher prices to liquidate their holdings.

However, miners dumping a higher-than-expected amount of coins when the BTC price does move higher could inflict a lot of selling pressure.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin