Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

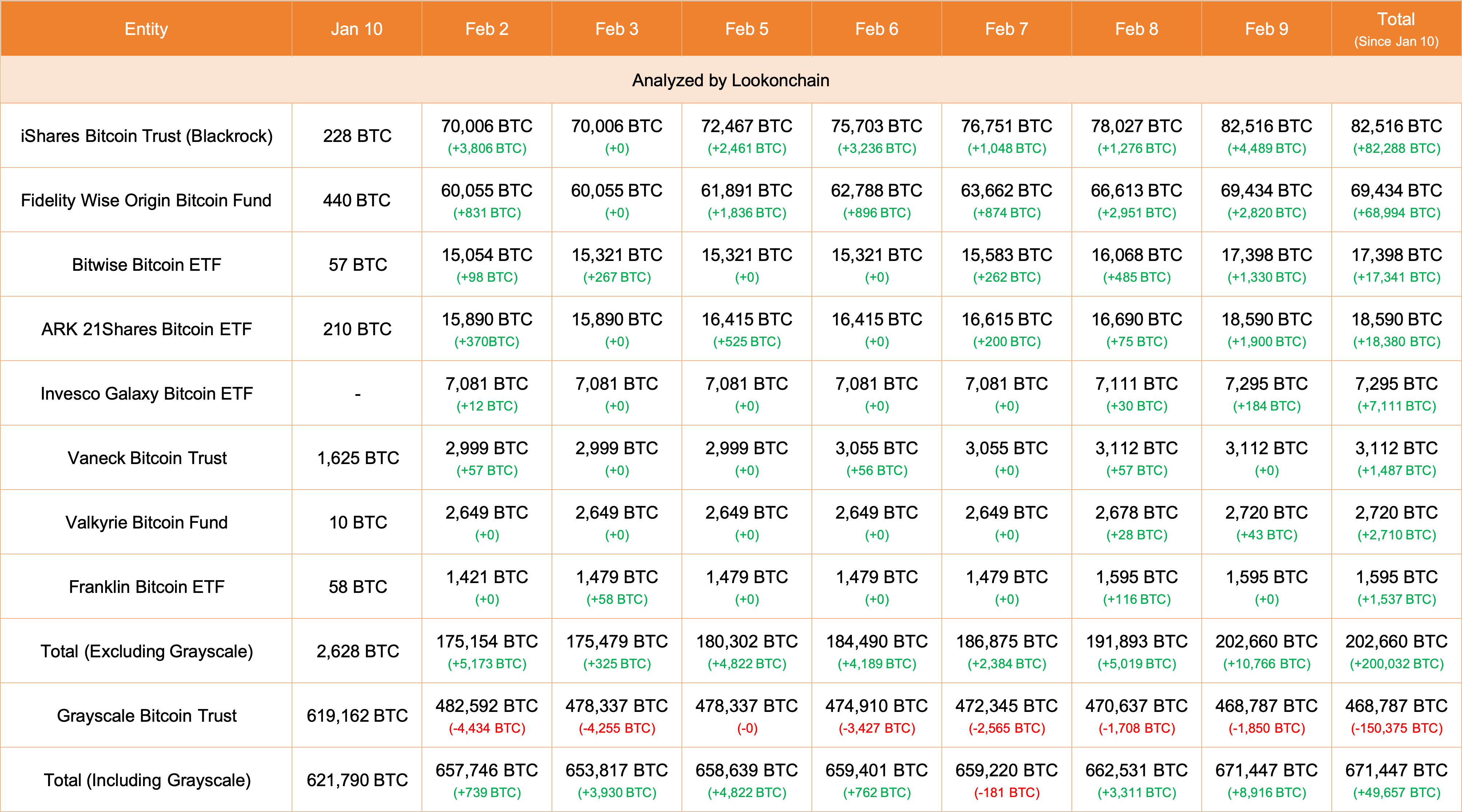

In a significant surge of investment activity, Bitcoin ETFs have witnessed a substantial influx of $500 million today. Lookonchain's latest update reveals that eight Bitcoin ETFs collectively accumulated 10,766 BTC, equivalent to a staggering $510.6 million. This influx comes alongside a notable decrease in holdings by Grayscale, which shed 1,850 BTC, amounting to $87.7 million.

Among the prominent contributors to this uptick, IBIT, the iShares Bitcoin Trust managed by BlackRock, secured a hefty addition of 4,489 BTC, translating to $212.9 million. Following suit, Fidelity made a significant addition of 2,820 BTC, worth $133.7 million.

The data further underscores the dominance of iShares Bitcoin Trust on the ETF landscape, now holding a commanding 82,516 Bitcoin. Fidelity's Wise Origin Bitcoin Fund trails behind with 69,434 BTC, while Bitwise Bitcoin ETF rounds up the top three with 17,398 BTC in its holdings. Cumulatively, including Grayscale, Bitcoin ETFs currently command a total of 671,447 Bitcoin, valuing at an impressive $31.76 billion.

Institutions want more Bitcoin

These developments occur amid a broader sentiment shift within the investment community, with BlackRock's chief investment officer hinting at a potential expansion of the firm's exposure to Bitcoin. Speaking with Wall Street Journal, he emphasized the evolving attitudes toward cryptocurrency, suggesting a growing comfort level with its integration into asset allocation frameworks.

Simultaneously, the market performance of BTC reflects this heightened investor interest, with prices surging by over 5.7% today, reaching local highs at $47,650.

The convergence of institutional investment influx and bullish market sentiment underscores Bitcoin's growing mainstream acceptance and reinforces its status as a formidable asset class in the global financial landscape.

Alex Dovbnya

Alex Dovbnya Caroline Amosun

Caroline Amosun Godfrey Benjamin

Godfrey Benjamin Tomiwabold Olajide

Tomiwabold Olajide Gamza Khanzadaev

Gamza Khanzadaev