According to statistics provided by industry-level on-chain Coinmetrics analysts, miners have enough momentum to mitigate the losses caused by Black Thursday.

Bitcoin (BTC) Death Spiral Postponed

According to the Coinmetrics announcement, the second largest drop in Bitcoin (BTC) history isn't far from adjusting as miners strengthen their efforts.

#Bitcoin miners have shrugged off the second largest difficulty drop in its 11 year history, with hash rate comfortably returning to the range it has spent most of 2020 in and difficulty bouncing back 6% pic.twitter.com/2fRf3Tj9tA

— CoinMetrics.io (@coinmetrics) April 12, 2020

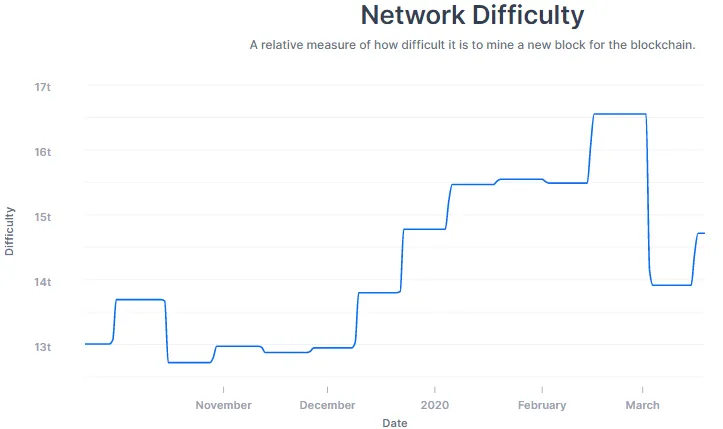

The Bitcoin (BTC) hash rate, the estimated number of terahashes per second produced by all Bitcoin (BTC) mining rigs, has already recovered to the ranges it was in before the market crash. The network difficulty, which is an indicator of how difficult it is to mine a new Bitcoin (BTC) block, is also doing well and has bounced back 6%. At press time, Bitcoin (BTC) network difficulty was near its January level, sitting at 14.715 TH/s.

Such positive statistics can provide confidence for a community that believe it's too early to bury Bitcoin (BTC). A 'death spiral', which is a hypothetical scenario for the overall mining capitulation, has been postponed one more time.

Will Bitcoin (BTC) Price also Recover?

Trader and analyst PlanB has already demonstrated the data on his 'stock-to-flow' model chart. According to this model, a crypto king may reach $100,000 this year.

#Bitcoin halving ETA: May 11

— PlanB (@100trillionUSD) April 11, 2020

Miners are really pumping up hashrate

Next difficulty adjustment will be uphttps://t.co/zMdxlteR6Z?from=article-links pic.twitter.com/XeN5NcfwLP

However, as U.Today previously reported, some analysts are sure that Bitcoin (BTC) is unaffected by the hash rate movements.

Jason Deane of Quantum Economics announced that it is driven only by adoption, usage, and classic supply/demand laws rather than by some miner statistics.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin