Bitcoin (BTC) difficulty is a metric that demonstrates how it is difficult for Bitcoin (BTC) miners to find the target hash, or, simply put, how difficult it is to add the next block to the main network.

Bitcoin (BTC) mining difficulty prints new record, hashrate also targets ATH

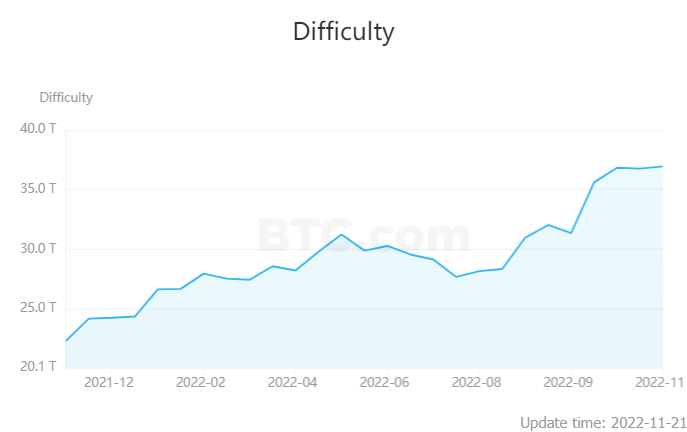

Today, on Nov. 21, 2022, Bitcoin (BTC) difficulty, the most crucial indicator of BTC network performance, prints a new historical high. According to public trackers, it spiked to 36,950,494,067,222 T after a surprising +0.51% adjustment.

It is the smallest positive adjustment of Bitcoin (BTC) network difficulty in the last 10 months. It should be noted that Bitcoin (BTC) mining difficulty is adjusted once every two weeks to keep the block time stable (about 10 minutes).

A year ago, Bitcoin (BTC) mining was sitting at 22.5 T. Another crucial metric of the Bitcoin (BTC) network, its hashrate (aggregated number of hashes unveiled by all active mining computers) is also going through the roof.

On Nov. 12, 2022, it jumped over 298 quintillions hashes per second (Ehash/s). By press time, this metric is at the 274 Ehash/s level, up 4% in the last 24 hours.

Bitcoin (BTC) price tumbles below $16,000

Normally, surging metrics indicated the increased interest of miners in securing the network. Despite falling prices and increased mining costs, miners are not quiting, and that might hint at bullish reversal expectations.

Meanwhile, on Monday, the Bitcoin (BTC) price dropped to the lowest levels since the FTX/Alameda collapse. Briefly, it touched the $16,000 level and is now struggling to stay above it.

As covered by U.Today previously, triggered by the collapse of fourth largest centralized exchange FTX and a cascade of liquidations, crypto capitalization dropped to two-year lows.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin