Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

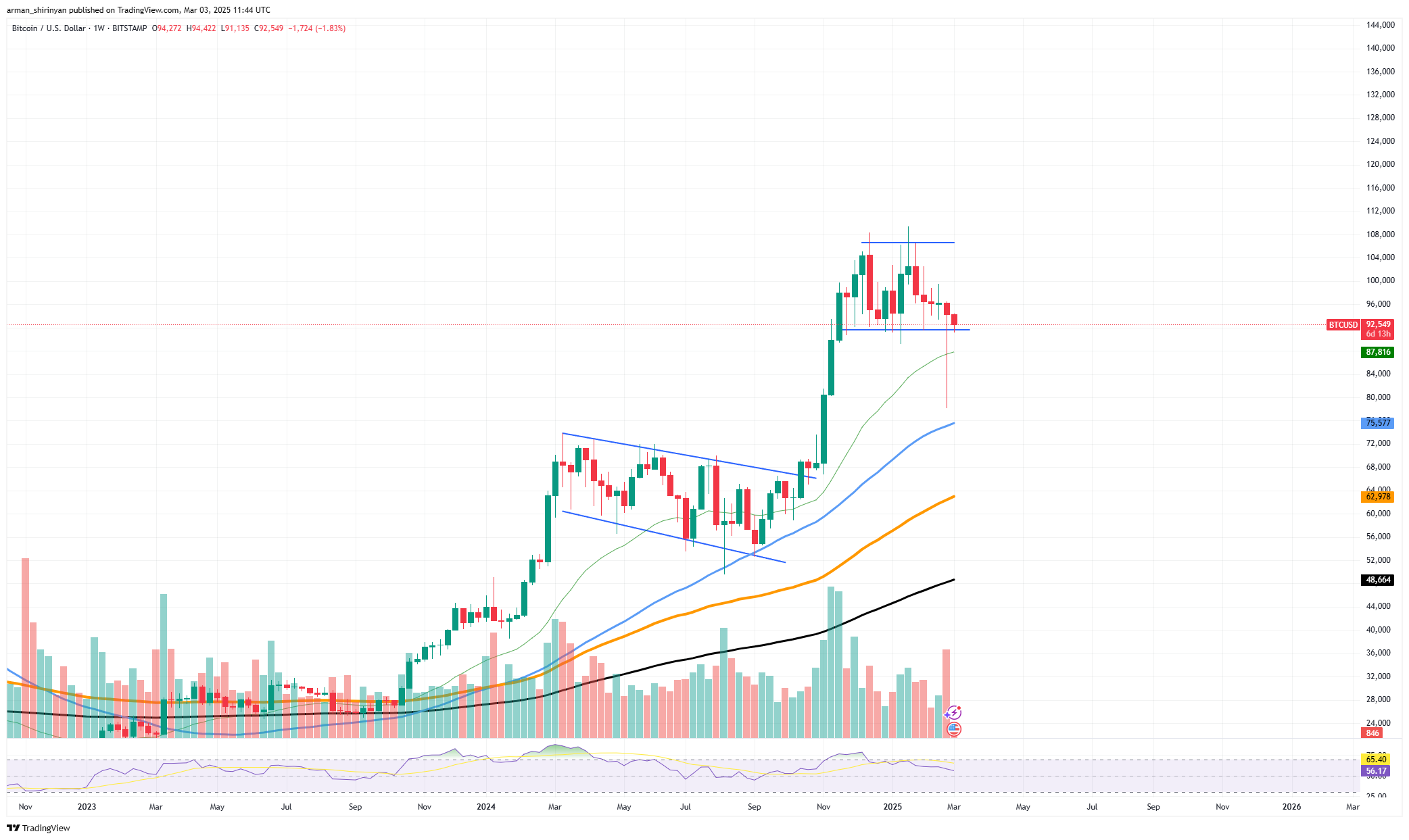

Bitcoin's market momentum might finally change thanks to a strong and rapid comeback above an important support level. The sideways channel formed previously was not breached, which leaves the possibility for a substantial price reversal open for the future.

Although Bitcoin experienced a significant decline that momentarily breached this channel, it was unable to gain traction below it, suggesting that bearish pressure may be waning. Bitcoin recently saw a large sell-off falling below the main trendline of its range of sideways trading. At first, the move seemed to be a bearish breakout, but the inability of sellers to hold levels below $92,000 suggests that they lacked the strength to maintain control of the market.

Rather, Bitcoin has recovered above this pivotal level and is now trading at about $92,616. The next hurdle for bulls is $100,000, which is the upper limit of the consolidation range. A break above this mark might lead to a new round of buying interest, which could push Bitcoin closer to $110,000 or even reach all-time highs. The next crucial area to keep an eye on if Bitcoin drops below $92,000 once more is the $87,800 support.

The recovery could be rendered invalid by a confirmed breakdown below this level, which would pave the way toward a more significant decline toward $80,000 or less. Bears may be finding it difficult to sustain pressure, as indicated by the failed breakdown below the trendline.

Even though there was a brief spike in selling, the market swiftly recovered from the decline, keeping Bitcoin from going into a long-term downward trend. This might mean that the selling momentum is slowing down, which would allow for a bullish comeback. A further indication of renewed buying interest is the rising trading volume on the recovery move, which supports the argument for further upward movement.

Since Bitcoin has recovered its main support level, the market structure is still in place for the time being. A significant rally may occur if bulls can keep control and push above $100,000. But if it does not stay above $92,000, more bearish pressure might be applied. Whether Bitcoin is poised for a breakout or another round of sideways consolidation will be determined in the coming days.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov