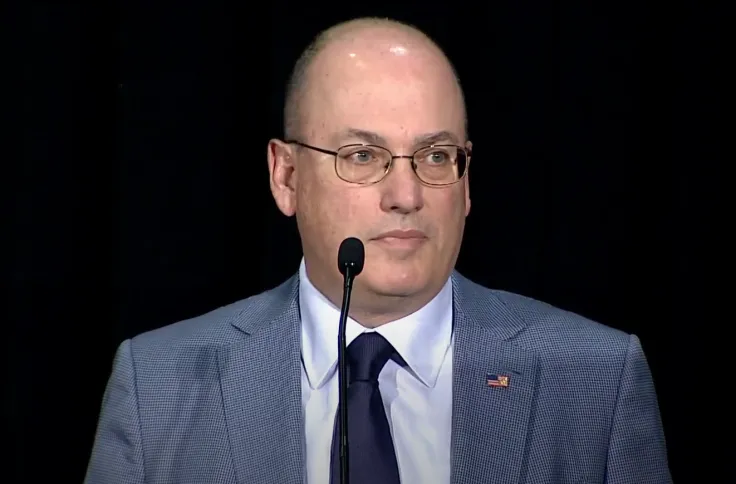

According to a recent report by Forbes, Point72 Ventures, an early-stage venture capital firm that was launched by billionaire Steven Cohen, is ditching fintech and cryptocurrencies in order to focus on artificial intelligence.

Several investors from fintech and crypto teams have been fired, according to anonymous sources cited by the outlet.

Apart from AI, Cohen's VC firm has also prioritized defense industry startups.

Point72 told Forbes that it keeps "optimizing" its strategy based on emerging market opportunities.

As reported by U.Today, Cohen, whose net worth is estimated to be $19.8 billion, revealed that he owned "a little bit" of Bitcoin during a CNBC interview. He said that he had dipped his toes into the largest cryptocurrency because of his son who showed him how to perform transactions on a crypto exchange.

During the aforementioned interview, the billionaire admitted that Bitcoin was "interesting," but he also stated that he did not have a strong opinion on the leading cryptocurrency.

At the same time, Cohen expressed a bullish sentiment toward AI, arguing that the current craze reminded him of the internet boom in the 90s that managed to produce some of the best companies of today.

Back in 2021, the Point72 Asset Management boss said that he was "fully converted" to crypto, adding that he was still early.

Now, it seems like the billionaire has soured on cryptocurrencies due to the recent focus on AI.

He's not the only one. Last year, for instance, Chinese fintech behemoth Ant Group abandoned the crypto market in order to invest in AI.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov