Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Trading activity around the major meme cryptocurrency of the market, Dogecoin (DOGE), recently saw abnormal activity. In particular, as it became known thanks to data from CoinGlass, an epic imbalance emerged in liquidations of DOGE perpetual futures positions, when the amount of short liquidated overtook the figure for long positions by 400%.

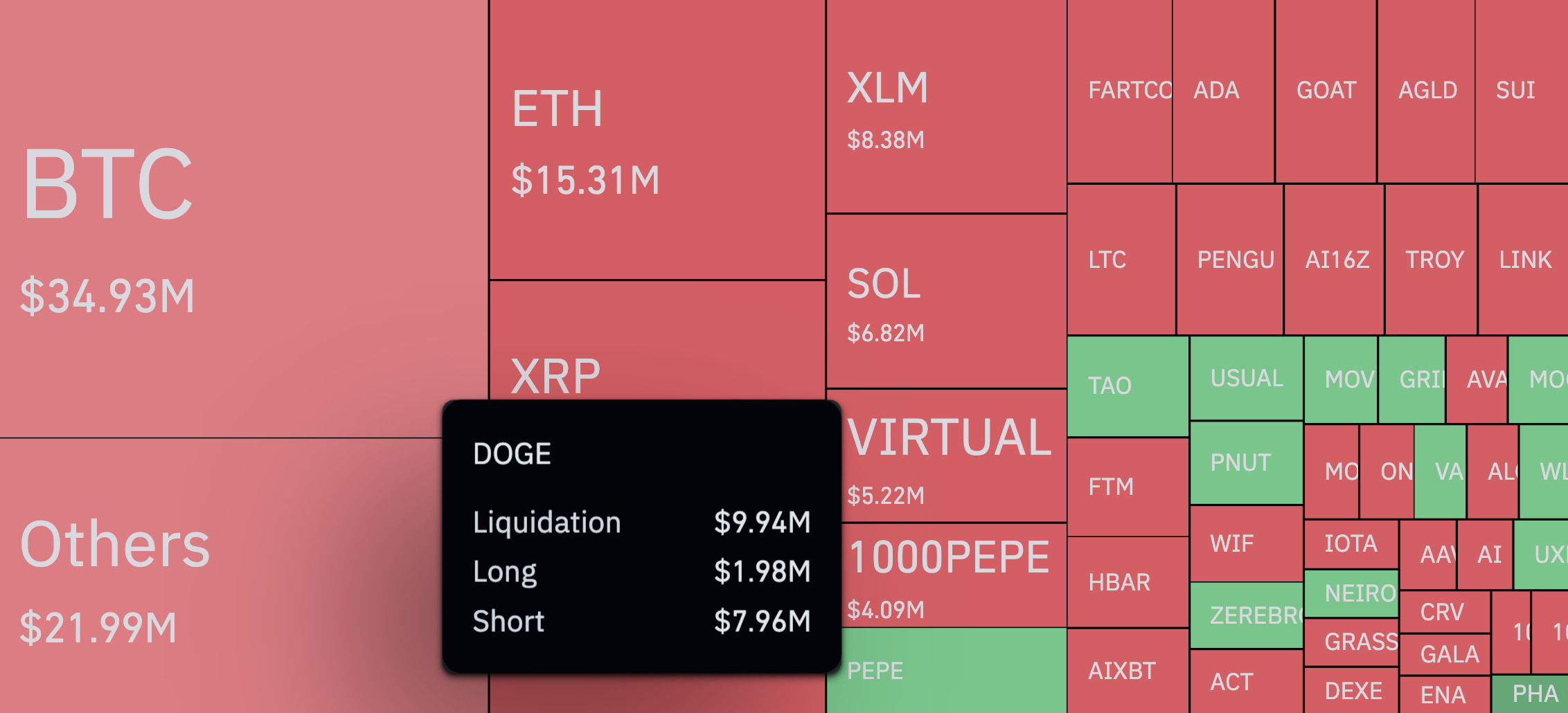

Thus, if the total amount of Dogecoin positions liquidated amounted to $9.94 million, $1.98 million out of it were longs, and $7.96 million shorts. Such an imbalance is explained by the 6% price surge demonstrated by Dogecoin over the course of 24 hours.

As it turns out not many believed the popular meme coin could pull such a powerful move and placed their bets on the bearish side.

The tendency of shorts getting more pain than longs is not limited to DOGE only and seen as a broader market trend with out of $201.55 million liquidated in 24 hours, $139.74 million are short positions and $61.81 million are longs.

Bulls in control

This is probably due to price rebounds and spikes that no one saw coming and shows that trading cryptocurrencies, especially perpetual futures, is risky right now. Traders should be cautious at the beginning of the new year as the market can suddenly change and lead to big financial losses.

The fact is that it is still a thin market with many people enjoying their weekend and not watching digital asset charts.

From the other point of view, it is clear that at least right now the vision of most market participants leans toward bull market continuation. After what happened in November, it seems logical many anticipate the same for January as round two.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov