Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

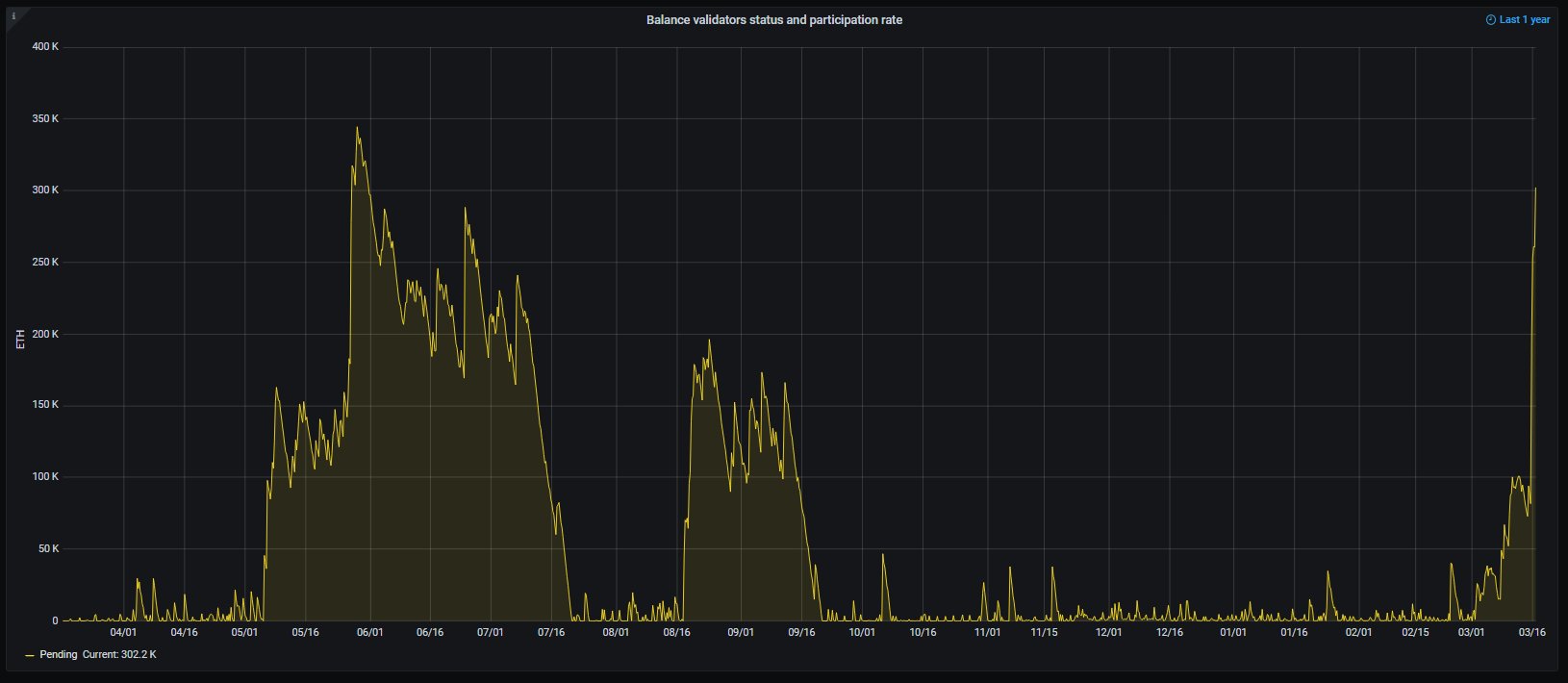

The Ethereum staking feature reached another milestone that shows that most of the cryptocurrency community is interested in the new feature that the second-largest cryptocurrency will bring to the table, as Balance Validators Status and Participation Rate suggest.

According to the metric, the number of coins in the staking queues now equals 302,000 ETH, or $800 million. The staking queue is the lineup of wallets suitable for the staking feature, which are waiting for activation. Such a rapid increase in the volume of funds in the queue has never taken place on the market before.

How does Ethereum staking affect the market?

Foremost, Ethereum staking locks a certain amount of Ether for a minimum of three months. With more funds locked into contracts, less selling pressure is going to hit the cryptocurrency market. Besides the decreased issuance of the coin, even the short-term lock of the coins will help Ethereum to become deflationary.

But while the first months or even years of Ethereum staking will play in favor of the currency and its ecosystem, the 12% APY rewards will create pressure on the market; when most funds get unlocked and in case of an unpleasant market performance, investors will decide to take profits to cover their losses.

Ethereum's market performance

After four months of trading after reaching the all-time high, Ethereum has lost over 40% of its value, creating a massive amount of pressure on investors that chose to stake over holding or trading the second-largest cryptocurrency.

Prior to the Merge, Ethereum's staking APY stays at approximately 5% and barely covers any losses from the devaluation of the asset. At press time, Ether trades at $2,757 and has lost 0.6% of its value in the last 24 hours.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov