Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

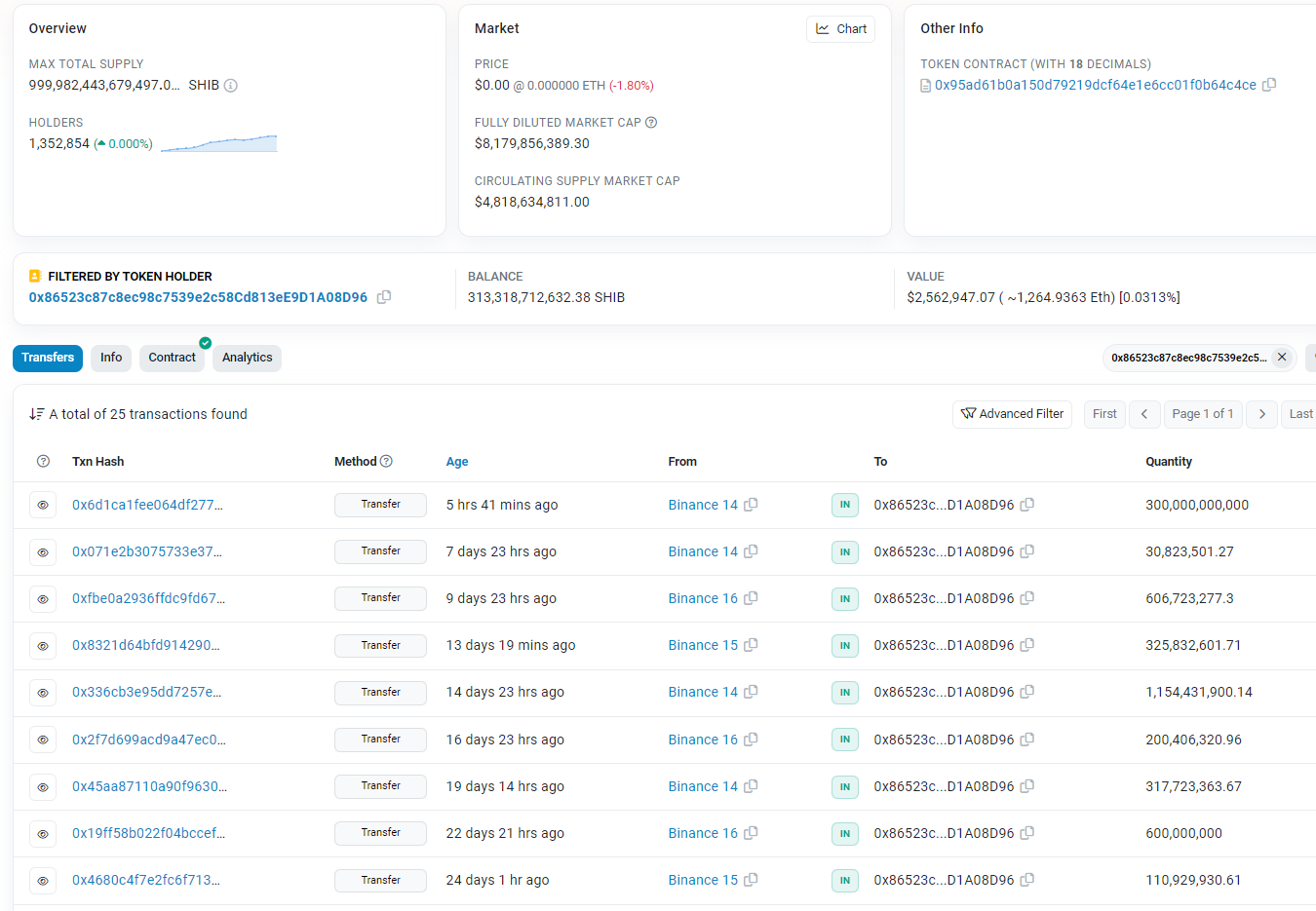

A staggering 300 billion SHIB tokens have been transferred to an anonymous wallet. The transaction, originating from cryptocurrency exchange Binance, raises the question: Who is behind this whale-sized movement?

The transaction hash, viewable in the blockchain's immutable ledger, confirms the transfer's success. With a transaction fee of a mere $3.73, the move has been economically executed, and yet it represents a significant shift in SHIB's token distribution.

Given the magnitude of the transfer, the recipient could be an entity with substantial market influence, perhaps an institutional investor or a large-scale crypto entity positioning itself on the meme coin market.

The wallet in question, now loaded with an influx of SHIB, has been active, with a pattern of large-scale acquisitions from Binance over the past few weeks. This pattern suggests strategic accumulation, possibly for liquidity provisioning, investment or even preparation for further token burns, which could impact the coin's value.

In addition to the transactional activity, the technical analysis of SHIB's price chart offers insights into potential market movements. The chart displays a descending triangle formation, with the price recently breaking below the lower trendline, indicating a bearish outlook. This technical breakdown could lead to further price depreciation if the pattern follows through.

However, it is worth noting that the price is hovering above a crucial support level, with the 50-day moving average acting as a potential springboard for a price rebound. Should the anonymous wallet's activities influence market sentiment, we could see an upward price correction as part of a broader response to the wallet's accumulation strategy.

It is also possible that the anonymous wallet is tied directly to Binance and could be used for internal operations and liquidity management, which means that such a large transfer will not have any effect on the Shiba Inu market.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov